NetApp, Inc. NTAP has partnered with Amazon Web Services (“AWS”) to drive growth and innovation by leveraging artificial intelligence (AI). The recently signed strategic collaboration agreement reflects the dedication of both companies to improve customer experiences through accelerated generative AI initiatives, simplified processes and valuable CloudOps solutions.

The enhanced alliance will facilitate smoother workload migrations and new application deployments on AWS. It will also simplify transactions by facilitating more AWS Marketplace purchases, particularly for NetApp CloudOps solutions and make conducting technical proofs of concept easier.

The partnership solidifies NetApp’s reputation as a reliable provider of CloudOps solutions. With the backing of AWS, customers can benefit from optimized cost and performance solutions that integrate seamlessly into their cloud environments, enhancing the efficiency, scalability and reliability of their workloads.

NetApp Strengthens Ties With AWS

NetApp and AWS have partnered for over a decade, driving innovation for thousands of global customers. During this time, NetApp has achieved more than a dozen AWS competencies, including those in Manufacturing, Financial Services and Cloud Operations. It stands out as the only enterprise storage vendor with a first-party data storage service natively built on AWS through Amazon FSx for NetApp ONTAP.

In July 2024, NetApp launched the BlueXP workload factory, enabling customers to connect ONTAP with foundation models via Amazon Bedrock, thus extending their on-premises data for generative AI applications. Additionally, AWS and NetApp have released reference architecture guidance to help customers integrate their proprietary data on FSx for ONTAP into generative AI pipelines using retrieval-augmented generation (RAG). This partnership simplifies and accelerates the process for customers to harness the value of their data.

NetApp, Inc. Price and Consensus

NetApp, Inc. price-consensus-chart | NetApp, Inc. Quote

NTAP Gains From AI Momentum and Cloud Storage Solutions

Strengthening demand for its solutions in cloud storage and AI is driving NTAP’s performance. In the fiscal first quarter, the company won more than 50 AI and data lake modernization deals.

In partnership with Lenovo, the company announced a full-stack OVX system optimized for GenAI and designed to support RAG. Additionally, NTAP introduced new capabilities designed for cloud AI workloads. The integration of the NetApp GenAI toolkit with Microsoft Azure NetApp Files allows customers to combine their proprietary data with pre-trained foundational models, enabling them to generate unique, high-quality and highly relevant outcomes from their generative AI projects.

The Public Cloud segment generated $159 million in revenues, reflecting a 3% increase year over year. Strong performance in both the Hybrid Cloud and Public Cloud segments, particularly a 40% rise in revenues from first-party and marketplace cloud storage services, contributed significantly to the top-line growth in the last reported quarter. The expanded partnership with AWS is further expected to generate incremental revenues for NTAP in the near future, likely propelling the stock upward.

NTAP’s Zacks Rank & Stock Price Performance

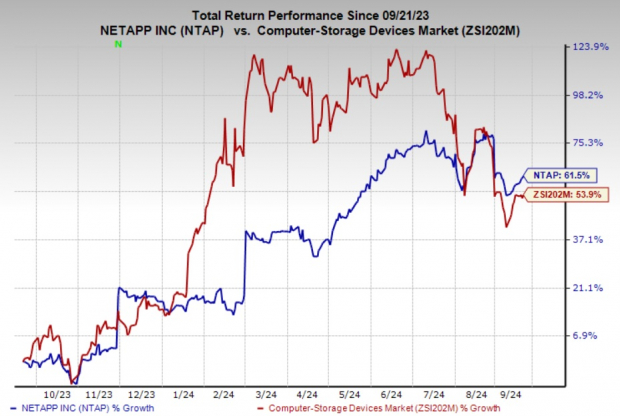

NTAP currently carries a Zacks Rank #2 (Buy). Shares of the company have gained 61.5% in the past year compared with the sub-industry's growth of 53.9%.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks from the broader technology space are Manhattan Associates, Inc. MANH, ANSYS, Inc. ANSS and American Software, Inc. AMSWA. MANH presently sports a Zacks Rank #1 (Strong Buy), whereas ANSS & AMSWA carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Manhattan Associates delivered an earnings surprise of 26.6%, on average, in the trailing four quarters. In the last reported quarter, MANH pulled off an earnings surprise of 22.9%. The Zacks Consensus Estimate for MANH has increased 9.2% to $4.26 in the past 60 days.

ANSYS delivered an earnings surprise of 4.8%, on average, in three of the trailing four quarters. In the last reported quarter, ANSS pulled off an earnings surprise of 28.9%. It has a long-term earnings growth expectation of 6.4%.

American Software delivered an earnings surprise of 84.5%, on average, in the trailing four quarters. In the last reported quarter, AMSWA pulled off an earnings surprise of 71.4%. The Zacks Consensus Estimate for AMSWA has increased 8.6% to 38 cents in the past 60 days.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>NetApp, Inc. (NTAP) : Free Stock Analysis Report

Manhattan Associates, Inc. (MANH) : Free Stock Analysis Report

ANSYS, Inc. (ANSS) : Free Stock Analysis Report

American Software, Inc. (AMSWA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.