Heating, ventilation, air conditioning (HVAC), and building controls company Johnson Controls (NYSE: JCI) rose by 11% in November, according to data from S&P Global Market Intelligence. The catalyst for the move comes from the company's fourth-quarter earnings report, released early in the month. The earnings confirmed the powerful investment case for the stock and just why it's one of the most attractive stocks in the industrial sector.

Johnson Controls' excellent results and guidance

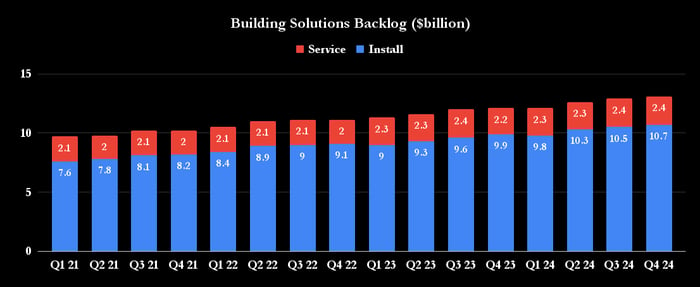

Not only did fourth-quarter revenue and earnings come in ahead of guidance, but the company's orders and building solutions backlog growth also set up Johnson Controls for another strong year. The former was up 8% organically from the same quarter last year; the latter rose 7%.

Data source: Johnson Controls presentations. Chart by author.

Looking into its financial 2025, management's guidance calls for mid-single-digit organic sales growth with profit margin expansion, resulting in adjusted earnings of $3.40-$3.50 per share. According to CFO Marc Vandiepenbeeck on theearnings call that implies "6% to 9% growth."

While this may seem disappointing, on a reported basis, in comparison with the full-year adjusted earnings per share of $3.71 just reported, note that Johnson Controls is in the process of selling its noncore residential and light commercial HVAC business to Bosch. Moreover, management plans to incur expenses of $400 million to cut annual expenses by some $500 million. With the costs coming ahead of the benefits, there's an element of upfront costs in its guidance for 2025.

Image source: Getty Images.

Johnson Controls growth potential

The sale of the residential and light commercial HVAC business and the cost-cutting measures are part of management's initiative to restructure the company. However, the company's growth story is far from relying on cost-cutting and portfolio restructuring.

Its top-line growth opportunity is significant. The company's HVAC solutions and building controls help its customers meet their net-zero ambitions as they improve building efficiency and reduce unnecessary emissions. Furthermore, its OpenBlue technology platform uses AI, advanced analytics, and Internet of Things (IoT) capabilities to manage building performance digitally in real time.

In addition, the company is seeing strong growth in demand for HVAC solutions in data centers, needing to support growth in demand from AI applications.

Image source: Getty Images.

A stock to buy

Johnson Controls has excellent long-term growth prospects, good order growth, a growing backlog, and cost-cutting measures to come, and management is restructuring its portfolio to create a more focused company. It all speaks to a company whose best days lie ahead.

Should you invest $1,000 in Johnson Controls International right now?

Before you buy stock in Johnson Controls International, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Johnson Controls International wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $849,539!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 2, 2024

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Johnson Controls International. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.