Earnings season continues its rapid pace, with a wide variety of companies on the reporting docket for this week. Among the bunch is a similar pair – Lyft LYFT and Uber Technologies UBER.

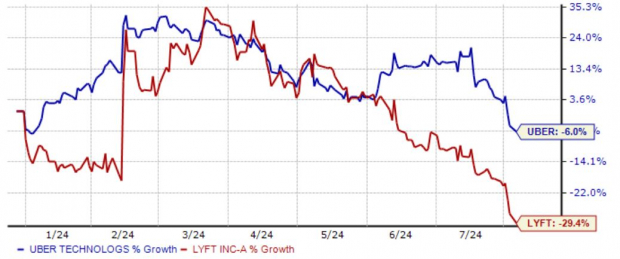

Both stocks have risen in popularity considerably over the years as consumers continuously flock to the platform, leaving taxis in the dust. Concerning performances, LYFT shares have faced notably more pressure in 2024 relative to UBER, as shown below.

Image Source: Zacks Investment Research

But will the performance disparity continue? Let’s take a closer look at how expectations stack up heading into their respective releases.

Are Analysts Bullish?

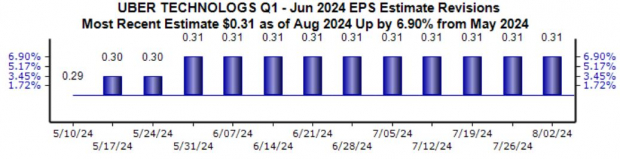

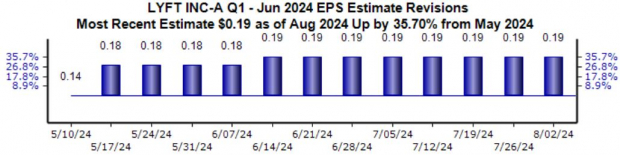

Both Uber and Lyft have seen their earnings outlook for the upcoming release tick higher, though it’s worth noting that the trend has been more pronounced within Lyft. They’re expected to post big growth, with Uber’s earnings expected to be up 70% and Lyft forecasted to see a 27% climb higher.

Uber Revisions –

Image Source: Zacks Investment Research

Lyft Revisions –

Image Source: Zacks Investment Research

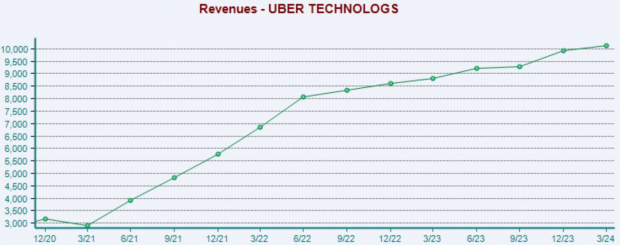

It’s also worth noting that Uber’s sales expectations have remained unchanged, whereas Lyft has seen positive revisions concerning the top line over recent months. Both companies have enjoyed supercharged sales growth over the years, as shown below.

Uber’s Quarterly Revenue –

Image Source: Zacks Investment Research

Lyft’s Quarterly Revenue –

Image Source: Zacks Investment Research

Key Metrics to Watch

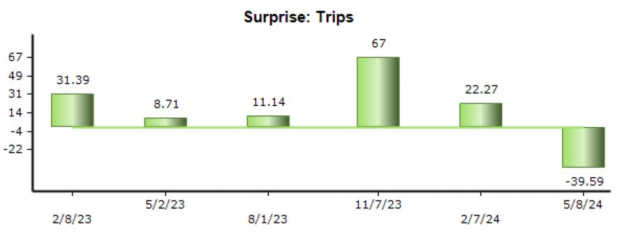

Uber reports its results a bit differently than Lyft, using Trips as a key metric in quarterly releases. The company’s Trips have regularly exceeded our expectations but fell modestly short in its latest release, as shown below.

Despite missing expectations, Trips did pencil in strong Y/Y growth, reflecting solid momentum. For the quarter to be released, the Zacks Consensus Estimate for Trips stands at 2.7 billion vs. 2.3 billion in the year-ago period.

Image Source: Zacks Investment Research

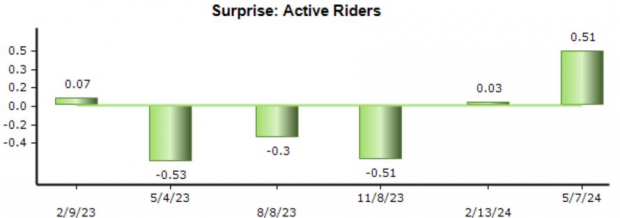

Concerning Lyft, the company reports several key metrics, including Active Riders. As shown below, the company broke a long streak of negative surprises on the metric in its latest quarter, with Active Riders of 21.9 million up 12% Y/Y.

Our consensus expectation for Active Riders stands at 23.8 million, reflecting a slight uptick from the year-ago mark of 21.5 million.

Image Source: Zacks Investment Research

Bottom Line

Both Uber Technologies UBER and Lyft LYFT have seen adverse price action over the last month, down 21% and 19%, respectively. And soon, they’ll reveal their Q2 results.

Given the current weak sentiment, positivity within the releases concerning rider momentum will likely perk shares back up, with analysts also taking a bullish stance over the last several months.

Profitability and cash flows will also be heavily in focus, which have both been trending higher for both companies over recent periods.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

See Stocks Now >>Lyft, Inc. (LYFT) : Free Stock Analysis Report

Uber Technologies, Inc. (UBER) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.