Value investors and income seekers will want to pay attention to several stocks that are standing out among the coveted Zacks Rank #1 (Strong Buy) list.

Edging toward new 52-week highs, here are three of these highly-ranked stocks that still stand out in terms of valuation while offering very generous dividends.

Finance Stocks: AB & AXAHY

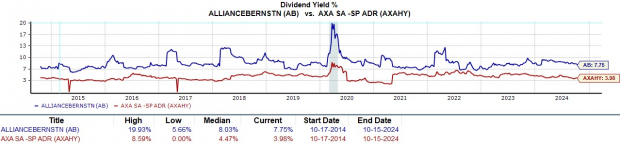

The financial sector has moved to new highs and two stocks mirroring this move are financial investment management firm AllianceBernstein AB and multi-line insurance provider Axa Group AXAHY.

Trading near their 52-week peaks of just under $40 a share, AllianceBernstein and Axa Group’s stock are still at attractive forward earnings multiples of 12.1X and 9.9X respectively. Notably, this is nicely beneath the broader Zacks Financial Market’s average of 18X forward earnings and the benchmark S&P 500’s 24.6X.

Image Source: Zacks Investment Research

Plus, AllianceBernstein is expecting 12% EPS growth in fiscal 2024 with Axa Group’s bottom line slated to increase 8%. Further suggesting they are undervalued is that high double-digit EPS growth is in the forecast for these finance stocks in FY25 and AllianceBernstein has a 7.75% annual dividend yield with Axa Group’s at 3.98%.

Image Source: Zacks Investment Research

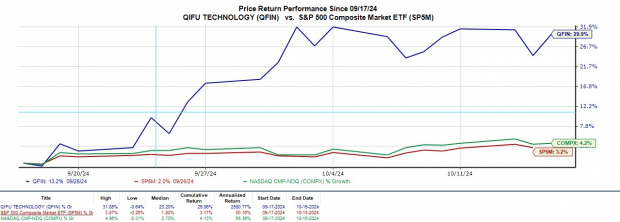

Technology Services Leader: QFIN

It’s a rarity to find a technology services stock that offers a significant dividend but Qifu Technology QFIN has a 3.77% annual payout. Operating a credit-tech platform in China, the Shanghai-based company provides a comprehensive suite of services to assist financial institutions and consumers in the loan lifecycle.

Image Source: Zacks Investment Research

Attributed to the recent announcement of China’s economic stimulus, Qifu’s stock has rallied nearly +30% in the last month and has now soared over +100% year to date.

Despite being one of the market’s top performers, QFIN trades at just 6.1X foward earnings. Trading near its one-year high of $33 a share, Qifu’s EPS is projected to increase 38% this year to $5.08 with annual earnings expected to expand another 6% in FY25.

Image Source: Zacks Investment Research

Bottom Line

These top-rated stocks could be in store for higher highs considering their attractive earnings outlook makes their P/E valuations look cheap. Furthermore, AllianceBernstein, Axa Group, and Qifu Technology should be viable long-term investments with their generous dividends making them more attractive in this regard.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>AllianceBernstein Holding L.P. (AB) : Free Stock Analysis Report

Axa Sa (AXAHY) : Free Stock Analysis Report

Qifu Technology, Inc. (QFIN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.