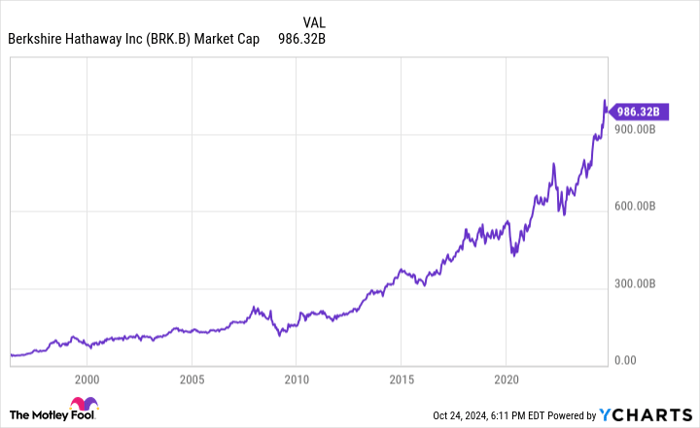

Few investors need an introduction to Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B). The company's shares have been one of the best long-term investments of all time. But Berkshire is no longer the company it used to be. Now valued at nearly $1 trillion, it's reasonable to be skeptical about whether Berkshire can replicate its past success.

Is Berkshire still a buy as it hovers around a $1 trillion market cap? The answer might surprise you.

Listen to what Warren Buffett has been trying to tell investors

Want proof that Berkshire won't deliver the same historical results into the future? Just ask Warren Buffett. In his latest letter to investors, Buffett cautioned that while Berkshire "should do a bit better" than the average American corporation, there is now "no possibility of eye-popping performance." The reason he cites for this impossibility is simple: Berkshire has gotten too big. "There remain only a handful of companies in this country capable of truly moving the needle at Berkshire, and they have been endlessly picked over by us and by others," Buffett explained.

It's not hard to see what Buffett is getting at here. In the past, a single investment could propel Berkshire's stock price higher, allowing it to beat the market with a handful of savvy bets per year. But now valued at $1 trillion, the list of companies that can generate this type of outperformance is very small, relegated mostly to other trillion-dollar businesses. And the challenge is doubled considering those trillion-dollar businesses also face their own scaling challenges. At a certain size, these gargantuan businesses often find that there simply isn't anywhere else to grow.

But don't think Berkshire is dead just yet. As Buffett added in his letter, "Berkshire is built to last."

BRK.B Market Cap data by YCharts

Berkshire stock can still beat the market for one reason

Sure, Berkshire stock isn't likely to rise in value by 20% per year over the next several decades, similar to the incredible performance it's posted in the past. But that doesn't mean shares aren't a buy today. That's because while Berkshire will struggle with its large size, it has a superpower that few companies or investment funds have: consistent access to capital.

At the core of Berkshire's business empire sits a portfolio of insurance companies. These businesses are largely unswayed by economic turmoil because an insurance policy is typically a necessity, not a luxury expense. Because insurers collect cash when a payment is made, and only pay that cash out at a later date when a claim is filed, these businesses generate consistent levels of investable cash uncorrelated with market volatility. So when asset prices fall, Berkshire has excess cash that can be put to work -- an advantage few investors can brag about. During the financial crisis, for instance, Berkshire put tens of billions of dollars to work even as competing capital dried up.

But it's not just its insurance arm that generates regular cash. Berkshire owns dozens of businesses spanning nearly every continent and industry. Because it owns many of these businesses outright, it can divert free cash flow from one business to invest in another. This is yet another reason why Berkshire is able to lock in fantastic valuations at the nadir of bear markets.

In his latest investor letter, Buffett noted: "Berkshire does not currently pay dividends, and its share repurchases are 100% discretionary. Annual debt maturities are never material." He further added that Berkshire holds a cash position far in excess of what conventional wisdom deems necessary. "During the 2008 panic," he stressed, "Berkshire generated cash from operations and did not rely in any manner on commercial paper, bank lines or debt markets. We did not predict the time of an economic paralysis but we were always prepared for one."

These structural capital advantages are the main reason why Buffett described Berkshire as "built to last." Perhaps shares will struggle to match the market during a strong upswing. But Berkshire is built to strike just when most investors are incapable of taking advantage, granting it attractive entry points that it can sit on for decades to come.

Will Berkshire outperform the overall market by huge margins in the years to come? Likely not. But its structural capital advantages still make it a buy for patient investors willing to bet on Berkshire's enduring patience and savvy investment strategy.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $867,372!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 21, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.