Chipotle Mexican Grill, Inc. CMG is slated to release results for second-quarter 2024 on Jul 24, after the market close.

In the last reported quarter, the company’s earnings surpassed the Zacks Consensus Estimate by 15%. The company’s top and the bottom line increased 14.1% and 27.3% year over year, respectively. Chipotle enhanced throughput and effective marketing initiatives like Braised Beef Barbacoa and Chicken Al Pastor, leading to strong sales and transaction growth.

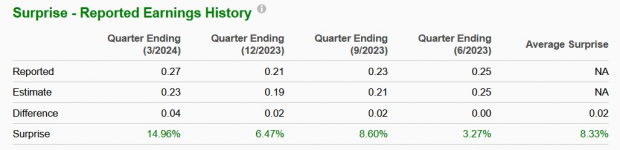

CMG has an impressive track record of surpassing earnings expectations, exceeding the consensus mark in each of the last four quarters. The average surprise over this period is 8.3%, as shown in the chart below.

Image Source: Zacks Investment Research

Trend in Estimate Revision

The Zacks Consensus Estimate for second-quarter earnings per share (EPS) has remained unchanged at 31 cents in the past 60 days. The estimated figure indicates a 24% increase from the year-ago EPS of 25 cents. Also, the consensus mark for revenues is pegged at $2.93 billion, indicating 16.6% year-over-year growth.

Image Source: Zacks Investment Research

What the Zacks Model Unveils

Our proven model predicts an earnings beat for Chipotle this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat.

Earnings ESP: Chipotle has an Earnings ESP of +0.83%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company carries a Zacks Rank #3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Factors Influencing Q2 Performance

Chipotle's second-quarter performance is anticipated to show year-over-year growth, driven by its digital initiatives, the addition of Chipotlane drive-thrus and new restaurant openings. CMG’s focus on advertising effectively boosted brand visibility, relevance and popularity, contributing positively to its performance.

Strong comparable sales growth, fueled by higher transaction volumes and increased average checks, is another key factor in the company’s success. This, combined with robust digital sales, is bolstering its overall performance. Our model projects an 8.9% year-over-year increase in comparable sales for second-quarter 2024.

The introduction of new menu items is likely to have spurred transactions during the second quarter. Our model estimates a 16.2% year-over-year rise in food and beverage revenues, reaching $2.9 billion. Delivery service revenues are projected to increase 11.5% year over year, totaling $19.3 million.

However, rising costs are expected to have impacted the company's margins. Inflation in beef and produce prices, along with challenges in the protein mix due to the Braised Beef Barbacoa promotion, likely increased costs in the second quarter of 2024.

Our model predicts food, beverage, and packaging costs to rise 16.5% year over year to $860.3 million. Labor costs are also expected to increase 17.2% year over year, reaching $716.9 million. Despite these higher costs, we anticipate a restaurant-level margin of 28.1%.

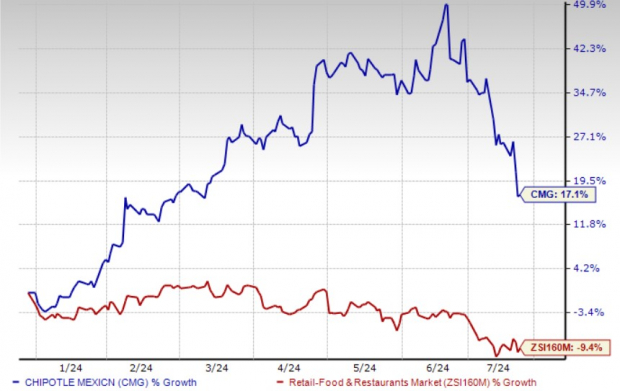

Price Performance & Valuation

Chipotle has shown resilience despite market volatility, delivering significant returns to investors. The stock has notably outperformed its industry peers and the broader S&P 500 index. Year to date, the stock has increased 17.1% against the industry’s 9.4% decline. The company also outperformed other industry players like Darden Restaurants, Inc. DRI, down 13%, Domino's Pizza, Inc. DPZ, down 2%, and Restaurant Brands International Inc. QSR, down 6.9%.

Image Source: Zacks Investment Research

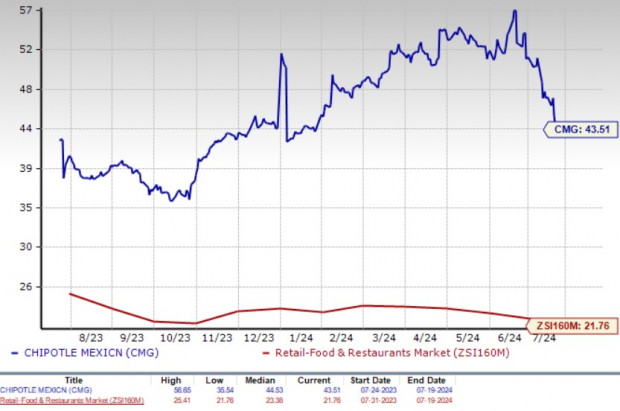

Let's assess the value CMG offers to investors at its current levels.

From the valuation point of view, the stock is trading at a premium. Chipotle’s forward 12-month price-to-earnings ratio stands at 43.51, significantly higher than the industry’s ratio of 21.76 and the S&P 500's ratio of 21.48. This suggests that investors may be paying a high price relative to the company's expected earnings growth.

Image Source: Zacks Investment Research

Investment Thoughts

CMG is well-positioned for long-term growth, supported by robust digitalization, strategic initiatives and strong financial fundamentals. Recently, the company executed a 50-1 stock split, which, while not affecting its market valuation, made its shares more affordable and accessible to investors who previously found them too expensive.

Despite the stock split, Chipotle's shares have pulled back in the past month, declining 16.2%. This drop is primarily due to an online customer backlash over claims that the company reduced portion sizes while increasing prices. Although management denies reducing portions, they have acknowledged raising prices to offset inflation and higher input costs.

Current shareholders should hold onto their positions, while prospective investors might consider waiting for a more favorable entry point, given the stock's high valuation. The lack of positive EPS estimate revisions over the past 60 days suggests that analysts are currently not very optimistic about the stock at the moment.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Free Report – 3 Stocks Sneaking Into Hydrogen Energy

Demand for clean hydrogen energy is projected to reach $500 billion by 2030 and grow 5-FOLD by 2050. No guarantees, but three companies are quietly getting the jump on their competition.

Zacks Investment Research is temporarily offering an urgent Special Report naming and explaining these emerging powerhouses primed to boom. Click below for Hydrogen Energy: 3 Industrial Giants to Ride the Next Renewable Energy Wave.

See Stocks Now >>Chipotle Mexican Grill, Inc. (CMG) : Free Stock Analysis Report

Domino's Pizza Inc (DPZ) : Free Stock Analysis Report

Darden Restaurants, Inc. (DRI) : Free Stock Analysis Report

Restaurant Brands International Inc. (QSR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.