Medical Properties Trust, Inc. MPW — also known as MPT — recently concluded the disposition of 11 freestanding emergency department (FSED), primary care, imaging and urgent care facilities in Colorado to University of Colorado Health (“UCHealth”) for $86 million. The move is in line with the company’s capital-recycling strategy.

Reflecting positive sentiments, shares of MPW gained 5.34% on Aug 15 regular trading session on the NYSE.

The company plans to allocate the proceeds obtained from the transaction toward debt reduction and for general corporate purposes.

MPT follows a disciplined capital-recycling strategy, through which it disposes of non-core assets and redeploys the proceeds in premium asset acquisitions and accretive development projects.

In July 2024, MPT sold seven FSED facilities as well as one general acute hospital in Arizona to Dignity Health for approximately $160 million.

In April 2024, the company sold its 75% interest in five Utah hospitals to a new joint venture with an institutional investor for $886 million. This sale generated approximately $1.1 billion of total cash proceeds to MPT. During the same month, it closed on the sale of five facilities in California and New Jersey to Prime Healthcare for a total consideration of $350 million.

This healthcare real estate investment trust (REIT), engaged in the acquisition and development of healthcare facilities, has been making efforts to improve portfolio diversification with respect to the operator.

The company is focusing on the reduction of its exposure to troubled operators and enhancing its scope for stable cashflow generation. Moreover, the company’s successful execution of more than $2.5 billion in liquidity transactions since the beginning of the year through Aug 8, 2024, strengthens its balance sheet position and places it well to fund its short-term liquidity requirements.

Last week, this Birmingham, AL-based REIT reported better-than-expected second-quarter 2024 results. The company reported Normalized Funds from Operations of 23 cents per share, surpassing the Zacks Consensus Estimate of 20 cents.

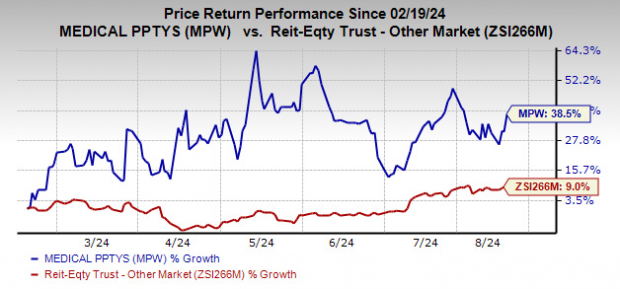

Over the past six months, shares of this Zacks Rank #1 (Strong Buy) company have gained 38.5% compared with the industry’s growth of 9%.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks from the healthcare REIT sector are CareTrust REIT CTRE and Sabra Healthcare REIT SBRA. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for CareTrust’s 2024 FFO per share stands at $1.47, indicating an increase of 4.3% from the year-ago reported figure. CTRE sports a Zacks Rank #1 at present.

Sabra currently carries a Zacks Rank #2 (Buy).The Zacks Consensus Estimate for SBRA’s 2024 FFO per share is pinned at $1.41, suggesting year-over-year growth of 6%.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Sabra Healthcare REIT, Inc. (SBRA) : Free Stock Analysis Report

Medical Properties Trust, Inc. (MPW) : Free Stock Analysis Report

CareTrust REIT, Inc. (CTRE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.