Jones Lang LaSalle JLL — popularly known as JLL — recently announced a joint venture with Slate Asset Management to launch a software-as-a-service (SaaS) technology platform, JLL Asset Beacon. This platform integrates data across asset management functions, offering a real-time, comprehensive view of performance for a single asset, a fund, or the entire portfolio.

JLL Asset Beacon provides commercial real estate (CRE) professionals with accurate and integrated data, facilitating them in making faster-informed decisions, improving portfolio performance, reducing risks and identifying value-creation opportunities. This platform gathers all financial, operational, and leasing data and documents, serving as a single source of truth with robust and customizable data visualization and reporting capabilities.

The recently launched JLL Falcon platform enhances JLL's generative AI capabilities, which include lease abstraction, entity resolution and natural language query functions. These features will be integrated into JLL Asset Beacon, enabling users to utilize AI to organize and extract insights from their proprietary data.

JLL Research reveals that over the past decade, there has been a notable increase in the diversification of CRE portfolios, which has intensified the challenges associated with active asset management. SaaS platforms like JLL Asset Beacon are essential for validating, consolidating, and reconciling large volumes of data, thereby assisting investors in maximizing value through strategic decision-making.

Per Amit Koren, CEO of Leasing and Capital Markets Technology Group at JLL, "Slate's powerful asset management hub, combined with JLL's domain expertise and advanced AI capabilities, sets a new standard for data-driven, proactive asset management for our clients. JLL Asset Beacon will empower asset and portfolio managers with unparalleled insights, agility and efficiency for more precise decision-making about investment strategies in an increasingly complex market landscape."

Is It Prudent to Invest in JLL Stock Now?

Through data-driven insights, JLL Asset Beacon is likely to assist clients in enhancing their investments throughout the asset management lifecycle, thereby facilitating improved decision-making that yields superior returns.

JLL has a broad range of real estate products, and services as well as an extensive knowledge of domestic and international real estate markets, thus enabling it to operate as a single-source provider of real estate solutions.

The company’s strategic investment in data-driven technology platforms is expected to help grow market share and lead to increased client engagements. In fact, strategic investments made on the technology front helped the company navigate during the challenging times.

Analysts seem bullish on this company, with the Zacks Consensus Estimate for its 2024 earnings per share revised 4.9% upward over the past month to $13.17.

Considering the growth scope, we conclude that the stock indicates a good investment opportunity for investors. Its Zacks Rank #2 (Buy) supports our thesis.

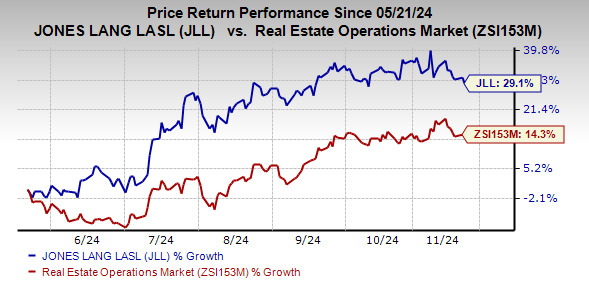

Over the past six months, shares of the company have rallied 29.1% compared with the industry’s upside of 14.3%.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks from the operations real estate industry are CBRE Group CBRE and Kennedy-Wilson KW, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for CBRE’s 2024 earnings per share is pinned at $4.93, suggesting year-over-year growth of 28.4%.

The Zacks Consensus Estimate for KW’s ongoing year’s earnings per share stands at $3.00, indicating a significant increase from the year-ago reported figure.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpJones Lang LaSalle Incorporated (JLL) : Free Stock Analysis Report

Kennedy-Wilson Holdings Inc. (KW) : Free Stock Analysis Report

CBRE Group, Inc. (CBRE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.