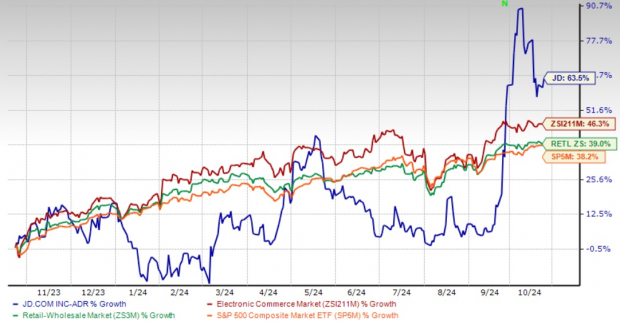

JD.com's JD remarkable 60% stock surge over the past year has caught investors' attention. This Chinese e-commerce giant appears well-positioned to maintain its momentum heading into the crucial holiday season. The company's strong performance comes amid improving retail conditions, as evidenced by September's Commerce Department report. Per the report, September retail sales rose 0.4%, surpassing analysts' expectations of 0.3%.

The broader retail landscape has shifted favorably since the challenges of 2023, particularly with the Federal Reserve's recent 50-basis point rate cut — its first since March 2020. This marks a significant change from the previous tightening cycle that saw rates climb 525 basis points to a 23-year high. Lower interest rates, combined with declining gasoline prices, are enabling consumers to spend more freely on discretionary items, creating an optimal environment for retailers like JD.com.

Looking ahead to the holiday season, the outlook appears particularly promising for JD.com. Adobe Analytics forecasts online sales to reach $240.8 billion this holiday season, representing an 8.4% year-over-year increase. Mobile shopping is expected to hit a record $128.1 billion, up 12.8% from the previous year, aligning perfectly with JD.com's robust digital infrastructure and innovative technology solutions.

1-Year Performance

Image Source: Zacks Investment Research

JD Redefines Retail With AI & Omnichannel Strategy

The company's comprehensive e-commerce business model continues to be a major strength, featuring a diverse product range from electronics to home appliances. JD.com's strategic partnerships with premium international brands like French luxury fashion group SMCP (featuring brands like SANDRO, MAJE, and CLAUDIE PIERLOT) demonstrate its ability to attract and retain high-end retailers on its platform. This expansion of flagship stores has significantly enhanced the JD Retail segment's performance.

JD has a strong e-commerce relationship with Walmart WMT. It supports Walmart and Sam’s Club Flagship Stores on its platform and provides them with fulfillment solutions.

A key differentiator for JD.com is its sophisticated supply chain and logistics network, powered by cutting-edge technology in three crucial areas, including AI, big data analytics and cloud computing. This technological advancement has enabled the company to build a smart supply-chain platform that manages everything from upstream manufacturing and procurement to last-mile delivery. The company's majority-owned subsidiary, Dada, in cooperation with JD Logistics, provides efficient on-demand and last-mile delivery services, particularly for grocery and fresh products through JD Daojia.

JD.com's omnichannel strategy sets it apart from competitors like Alibaba BABA and PDD Holdings PDD. The launch of JD MALL, an offline store offering over 200,000 items from more than 200 brands, represents a significant step in blending online and offline retail experiences. The company's expansion into the offline fresh food market through 7FRESH further demonstrates its commitment to providing comprehensive shopping solutions. These initiatives are particularly relevant as Cyber Week sales are projected to grow 7% year over year, reaching $40.6 billion and accounting for 16.9% of overall holiday season sales.

Upward Estimate Revision Bodes Well for JD

The company's strong relationships with suppliers, brands and partners position it well for continued growth. JD.com's nationwide fulfillment infrastructure ensures speedy, efficient and reliable delivery services, enhancing the overall shopping experience for customers.

The Zacks Consensus Estimate for 2024 revenues is pegged at $159.34 billion, indicating year-over-year growth of 4.7%. The consensus mark for 2024 earnings is pegged at $3.97 per share, suggesting year-over-year growth of 27.2%.

Image Source: Zacks Investment Research

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

JD Stock: An Undervalued Gem in E-commerce Space

JD is trading at a discount with a forward 12-month Price/Sales of 0.38X compared with the Zacks Internet - Commerce industry’s 1.72X, which suggests that the stock is significantly undervalued and may present an attractive buying opportunity for investors seeking value in the e-commerce sector. This substantial valuation gap indicates that the market may not be fully recognizing JD.com's robust fundamentals, strong logistics infrastructure and growth potential, particularly ahead of the promising holiday season.

Price-to-Sales (Forward 12 Months)

Image Source: Zacks Investment Research

Conclusion

For investors considering JD.com, the combination of favorable macroeconomic conditions, strong e-commerce growth projections and the company's technological and operational excellence presents a compelling investment opportunity ahead of the holiday season. The company's comprehensive approach to retail, combining advanced technology, robust logistics, and strategic partnerships, suggests it is well-equipped to capitalize on the expected surge in holiday shopping while maintaining its competitive edge through continued innovation and service excellence.

With a Zacks Rank #1 (Strong Buy) and a Growth Score of A, JD offers solid investment potential. You can see the complete list of today’s Zacks #1 Rank stocks here.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Walmart Inc. (WMT) : Free Stock Analysis Report

JD.com, Inc. (JD) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

PDD Holdings Inc. Sponsored ADR (PDD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.