Powell’s Hawkish Comments Shake Equities

Ten days after the election, the sugar high and animal spirits appear to be finally wearing off. Tech stocks and the Nasdaq 100 Index ETF (QQQ) finally encountered some heavy selling pressure after comments from Federal Reserve Chairman Jerome Powell earlier in the week. Powell said, “The economy is not sending signals that U.S. central bank needs to be in a hurry to lower interest rates.” Investors must understand that markets are driven by liquidity, especially from the Federal Reserve. Nonetheless, considering the roaring rally since the presidential election, Powell taking the foot off the dovish gas pedal is not surprising. With stocks up 5% last week, some profit-taking is expected. Below are 5 more reasons stocks will likely to find support:

1. Technical Confluence Zone

The price action illustrates that QQQ is retreating to a high-probability buy zone, which includes a retest of the breakout and $500 round number, a daily price gap fill, and the rising 50-day moving average.

Image Source: Zacks Investment Research

2. OPEX

Friday is options expiration. Often, stocks trade funky on options expiration days as traders reposition.

3. Healthy Breadth Under the Hood

The major sometimes tell a partial story regarding market health. In order to get the full story, market participants must check breadth (participation). Though the major indices faded hard, only ~60% of stocks were lower for the session. Though markets were down, leading stocks like Tesla (TSLA), Coinbase (COIN), MicroStrategy (MSTR), and Root (ROOT) were up.

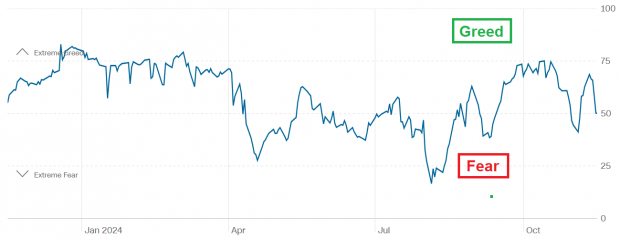

4. Dramatic Sentiment Shift

This week, the “CNN Fear & Greed” indicator showed that sentiment plunged from “Greed” to “Neutral” levels. Savvy investors use sentiment as a contrarian indicator.

Image Source: CNN

5. Seasonality

Historical seasonality suggests that markets tend to retreat into Thanksgiving week before rallying into year-end.

Bottom Line

Friday’s market swoon may seem intimidating on the surface. Nevertheless, several pieces of evidence, including the QQQ chart, sentiment, and seasonality suggest that the downside will be limited.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpTesla, Inc. (TSLA) : Free Stock Analysis Report

Invesco QQQ (QQQ): ETF Research Reports

MicroStrategy Incorporated (MSTR) : Free Stock Analysis Report

Root, Inc. (ROOT) : Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.