Fintel reports that on October 1, 2024, Guggenheim upgraded their outlook for TTEC Holdings (NasdaqGS:TTEC) from Sell to Neutral.

Analyst Price Forecast Suggests 27.71% Upside

As of September 25, 2024, the average one-year price target for TTEC Holdings is $7.65/share. The forecasts range from a low of $4.04 to a high of $16.80. The average price target represents an increase of 27.71% from its latest reported closing price of $5.99 / share.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for TTEC Holdings is 2,784MM, an increase of 18.98%. The projected annual non-GAAP EPS is 4.34.

What is the Fund Sentiment?

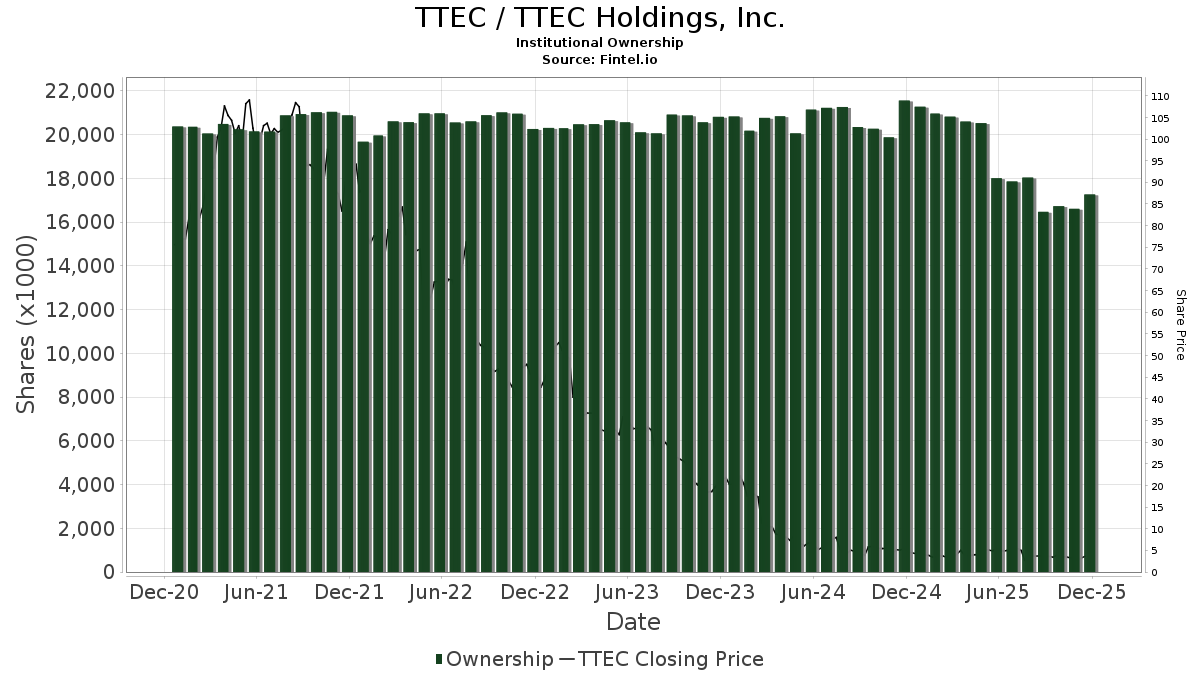

There are 350 funds or institutions reporting positions in TTEC Holdings. This is an decrease of 46 owner(s) or 11.62% in the last quarter. Average portfolio weight of all funds dedicated to TTEC is 0.03%, an increase of 39.46%. Total shares owned by institutions decreased in the last three months by 4.51% to 20,272K shares.  The put/call ratio of TTEC is 0.41, indicating a bullish outlook.

The put/call ratio of TTEC is 0.41, indicating a bullish outlook.

What are Other Shareholders Doing?

Federated Hermes holds 1,180K shares representing 2.47% ownership of the company. In its prior filing, the firm reported owning 278K shares , representing an increase of 76.43%. The firm increased its portfolio allocation in TTEC by 36.64% over the last quarter.

D. E. Shaw holds 836K shares representing 1.75% ownership of the company. In its prior filing, the firm reported owning 480K shares , representing an increase of 42.62%. The firm increased its portfolio allocation in TTEC by 7.99% over the last quarter.

QASCX - Federated MDT Small Cap Core Fund Shares holds 832K shares representing 1.74% ownership of the company. In its prior filing, the firm reported owning 356K shares , representing an increase of 57.26%. The firm increased its portfolio allocation in TTEC by 124.15% over the last quarter.

Goldman Sachs Group holds 667K shares representing 1.40% ownership of the company. In its prior filing, the firm reported owning 319K shares , representing an increase of 52.16%. The firm decreased its portfolio allocation in TTEC by 72.27% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 645K shares representing 1.35% ownership of the company. In its prior filing, the firm reported owning 568K shares , representing an increase of 11.94%. The firm decreased its portfolio allocation in TTEC by 37.39% over the last quarter.

TTEC Holdings Background Information

(This description is provided by the company.)

TTEC Holdings, Inc. is one of the largest global CX (customer experience) technology and services innovators for end-to-end, digital CX solutions. The Company delivers leading CX technology and operational CX orchestration at scale through its proprietary cloud-based CXaaS (Customer Experience-as-a-Service) platform. Serving iconic and disruptive brands, TTEC's outcome-based solutions span the entire enterprise, touch every virtual interaction channel, and improve each step along the customer journey. Leveraging next-gen digital and cognitive technology, the Company's Digital business designs, builds, and operates omnichannel contact center technology, conversational messaging, CRM, automation (AI / ML and RPA), and analytics solutions. The Company's Engage business delivers digital customer engagement, customer acquisition & growth, content moderation, fraud prevention, and data annotation solutions. Founded in 1982, the Company's singular obsession with CX excellence has earned it leading client NPS scores across the globe. The Company's nearly 61,000 employees operate on six continents and bring technology and humanity together to deliver happy customers and differentiated business results.

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers the world, and includes fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, our exclusive stock picks are powered by advanced, backtested quantitative models for improved profits.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.