Four Corners Property Trust FCPT has announced the purchase of five Outback Steakhouse properties for $19.7 million, continuing its spree of strategic acquisitions. This move strengthens FCPT's portfolio and provides a steady income stream, benefiting the business and stockholders.

Located in strong retail corridors across Texas, Florida and Missouri, the properties are operated under long-term net leases. Priced at a cap rate in range with prior FCPT transactions, the properties add a reliable stream of income to the company’s already impressive portfolio.

Recently, Four Corners announced the buyout of a Raising Cane's property, a Dollar General property and a Jiffy Lube property for $6.6 million. The sites are situated in strong retail corridors in Texas and Florida. The properties are secured under long-term, triple-net leases with a weighted average term of eight years remaining. The Raising Cane’s and Dollar General properties are operated by corporates, while Jiffy Lube is a franchisee-operated property. The transaction was executed at a capitalization rate of 7.3% on rent net of transaction costs.

Early in November, Four Corners announced the acquisition of Miller's Ale House property in a strong retail corridor in Georgia for $3.8 million. The property is corporate-operated under a long-term, net lease with around 11 years of term remaining.

Image Source: Four Corners Property Trust, Inc.

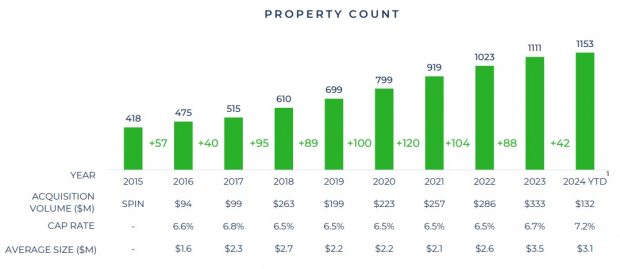

As per the company’s latest investor presentation, from the beginning of 2024 through Oct. 30, Four Corners acquired 42 properties worth $132 million at a capitalization rate of 7.2%.

These strategic moves not only broaden FCPT's footprint in various states but also ensure portfolio diversification. Such efforts benefit the company and its investors as they gain exposure to growing industries and establish long-term lease agreements with strong tenants.

Over the past six months, shares of this Zacks Rank #3 (Hold) company have risen 24.3% compared with the industry's growth of 21.3%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the REIT sector are Welltower Inc. WELL and Cousins Properties CUZ, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Welltower’s 2024 FFO per share has been raised 1.7% over the past month to $4.26.

The Zacks Consensus Estimate for Cousins Properties’ current-year FFO per share has moved marginally north in the past month to $2.68.

Note: Anything related to earnings presented in this write-up represents FFO, a widely used metric to gauge the performance of REITs.

Free: 5 Stocks to Buy As Infrastructure Spending Soars

Trillions of dollars in Federal funds have been earmarked to repair and upgrade America’s infrastructure. In addition to roads and bridges, this flood of cash will pour into AI data centers, renewable energy sources and more.

In, you’ll discover 5 surprising stocks positioned to profit the most from the spending spree that’s just getting started in this space.

Download How to Profit from the Trillion-Dollar Infrastructure Boom absolutely free today.Cousins Properties Incorporated (CUZ) : Free Stock Analysis Report

Four Corners Property Trust, Inc. (FCPT) : Free Stock Analysis Report

Welltower Inc. (WELL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.