Market Overview

On May 31, the French Final Private Payrolls increased by 0.3%, above expectations, while German Import Prices rose by 0.7%, higher than the forecasted 0.5%. However, German Retail Sales fell by 1.2%, significantly below the expected -0.2%.

The Dollar Index rose to $104.845, up 0.08%, supported by positive market sentiment ahead of upcoming US economic data releases. The GBP/USD fell to $1.27177, down 0.09%, despite better-than-expected Nationwide HPI at 0.4% and higher mortgage approvals at 62K.

Events Ahead

Looking ahead to the EUR/USD, attention will be on the French Consumer Spending, expected to decrease by 0.8%, and the French Preliminary CPI, forecasted to remain flat at 0.0%. The Core CPI Flash Estimate is expected to hold steady at 2.7%, while the CPI Flash Estimate is anticipated to rise to 2.5%.

The GBP/USD will be influenced by the M4 Money Supply and Net Lending to Individuals, with forecasts of 0.4% and 2.0B, respectively.

For the Dollar Index, all eyes will be on the upcoming Core PCE Price Index, expected to increase by 0.3%, and Personal Spending data, also expected to rise by 0.3%. FOMC Member Bostic’s speech could provide insights into future monetary policy.

US Dollar Index (DXY)

Dollar – Chart

Dollar – Chart

The Dollar Index is currently priced at $104.845, up 0.08%. The pivot point is at $104.950. Immediate resistance levels are at $105.194, $105.458, and $105.657. On the downside, immediate support is at $104.595, with further support at $104.343 and $104.179.

The 50-day Exponential Moving Average (EMA) is $104.790, while the 200-day EMA is $104.951, indicating potential resistance.

The technical outlook for the Dollar Index remains bearish below the pivot point of $104.950. Conversely, staying below $104.950 may lead to testing lower support levels, suggesting continued downward pressure.

EUR/USD Technical Forecast

EUR/USD Price Chart – Source: Tradingview

EUR/USD Price Chart – Source: Tradingview

The EUR/USD is currently priced at $1.08191, down 0.11%. The pivot point is at $1.08341. Immediate resistance levels are at $1.08585, $1.08889, and $1.09137. On the downside, immediate support is at $1.07918, with further supports at $1.07671 and $1.07398.

The 50-day Exponential Moving Average (EMA) is $1.08352, indicating potential resistance, while the 200-day EMA is $1.08019. The technical outlook for EUR/USD remains bearish below the pivot point of $1.08341.

A break above this level could shift the bias to bullish, targeting higher resistance levels. Conversely, staying below $1.08341 may lead to testing lower support levels, suggesting continued downward pressure.

GBP/USD Technical Forecast

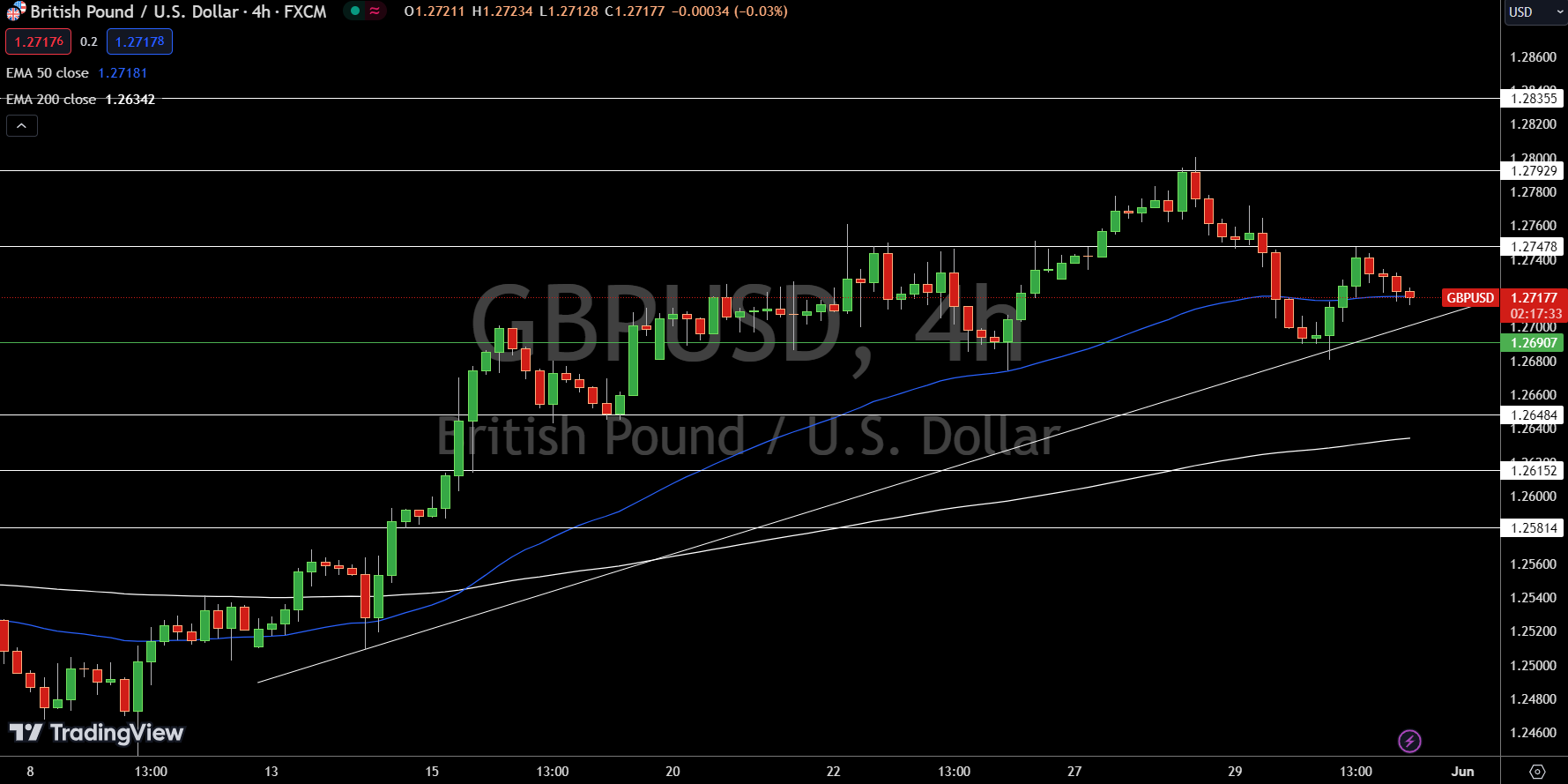

GBP/USD Price Chart – Source: TradingView

GBP/USD Price Chart – Source: TradingView

The GBP/USD is currently priced at $1.27177, down 0.09%. The pivot point is at $1.2691. Immediate resistance levels are at $1.2748, $1.2793, and $1.2836. On the downside, immediate support is at $1.2648, with further supports at $1.2615 and $1.2581.

The 50-day Exponential Moving Average (EMA) is $1.2718, indicating potential resistance, while the 200-day EMA is $1.2634. The technical outlook for GBP/USD remains bullish above the pivot point of $1.2691.

A break below this level could drive a sharp selling trend. Market participants should monitor these key levels and technical indicators for potential trading opportunities.

For a look at all of today’s economic events, check out our economic calendar.

This article was originally posted on FX Empire

More From FXEMPIRE:

- USD/JPY Forecast – US Dollar Continues to Bounce Around The Yen

- Crude Oil Weekly Price Forecast – Crude Oil Gets Pummeled

- Natural Gas Price Forecast – Natural Gas Continues to See Selling

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.