Nvidia (NASDAQ: NVDA) is one of the biggest wealth-creating machines investors have seen for some time. An investment of $10,000 in Nvidia five years ago is now worth more than $275,000, vastly accelerating many investors' paths to becoming millionaires.

However, we can't go back in the past and buy shares to capitalize on that movement. Instead, we're only left with the future, which begs the question: Could investing in Nvidia stock today help you become a millionaire?

Nvidia's amazing rise is thanks to AI

Nvidia's rise has been directly related to the boom in artificial intelligence (AI). Nvidia's primary product is the graphics processing unit (GPU), which is the piece of hardware most often used in training AI models. GPUs have a unique ability to process multiple calculations in parallel. They can also be connected in clusters to further increase their computing power. When thousands of GPUs are connected, their computing power reaches levels where training top-tier AI models efficiently is possible.

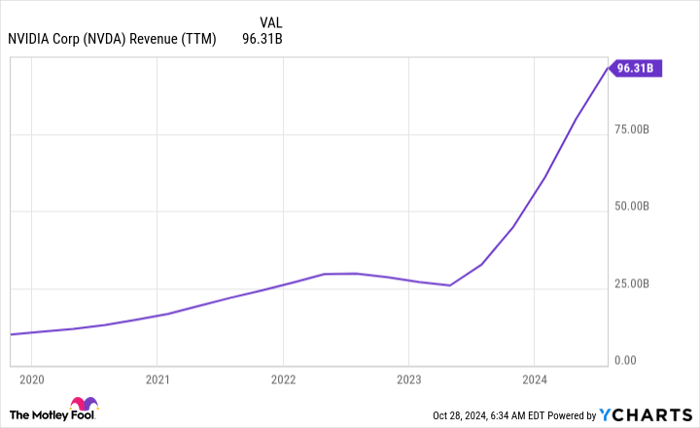

As companies race to build up their computing power to present consumers and businesses with the best models possible, Nvidia is benefiting from all of the GPUs it's selling. This has caused its revenue to ramp up incredibly quickly.

NVDA Revenue (TTM) data by YCharts

With this strong growth came impressive stock returns, which is why Nvidia has been one of the top stocks to own over the past few years.

We've already established that Nvidia has been amazing, but what will it be able to do going forward?

Nvidia's stock is expensive, but the market opportunity is there

Unfortunately, if you're expecting Nvidia to repeat its performance over the next five years, you're likely going to be disappointed. During its run, Nvidia has risen to become the second-largest company in the world and is quickly approaching Apple to overtake it in the top spot.

So, for the stock to double (or triple), it would need to reach heights that no company has ever come close to. As a result, investors need to adjust their expectations.

As an individual investor, a worthy goal is to beat the market by a percentage point or two each year. Over a long-term investing horizon, that percentage point or two can be a huge difference. For example, if an investor starts with $100,000 and doesn't add any money to it over the course of 30 years, the final returns at different levels of performance look like this:

| Return Level | Final Value |

|---|---|

| 10% | $1.7 Million |

| 11% | $2.3 Million |

| 12% | $3 Million |

Not everyone has $100,000 to start investing 30 years away from retirement, but the principle still stands: A few percentage points of outperformance makes a huge difference. Another way to look at this is a higher rate of return decreases the amount of time needed to attain a certain dollar figure, thus accelerating your path to becoming a millionaire.

With the long-term average return of the S&P 500 being about 10% per year, that's the bar Nvidia must clear.

So, could Nvidia return 12% annually from here? I think that's a fair bet. The demand for Nvidia GPUs hasn't been close to being fulfilled. Global Market Insights pegs the GPU market value at $456 billion by 2032. Nvidia has a fairly strong hold in the GPU market yet has produced just shy of $100 billion in revenue over the past 12 months. This means there's still plenty of opportunity out there.

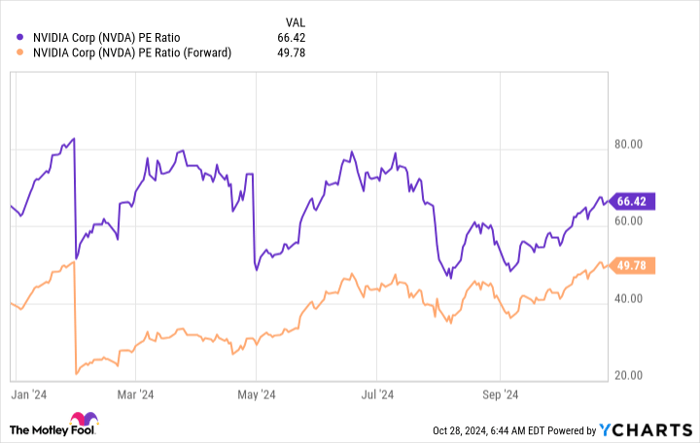

However, investors need to be aware of Nvidia's price tag. On a price-to-earnings (P/E) basis, this is by far the most expensive Nvidia's stock has been for most of the year.

NVDA PE Ratio data by YCharts

So, now may not be the best time to get into the stock. However, if you're patient, the stock tends to dip from time to time, and scooping up shares at discounts can be a smart strategy.

Nvidia may not be able to make you a millionaire by itself moving forward, but as part of a diversified portfolio, it can accelerate your path to becoming one.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,706!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,529!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $406,486!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 28, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.