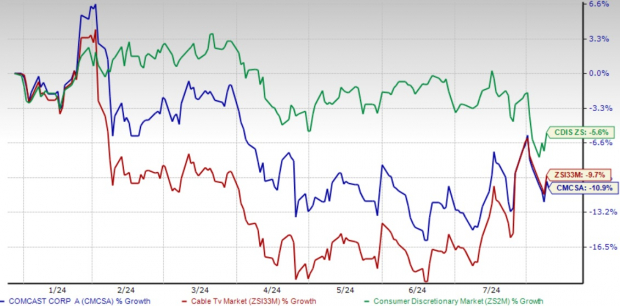

Comcast Corporation CMCSA, a leading media and technology company, has seen its stock price decline 10.9% year to date (YTD) compared with a 5.3% decline in the broader Zacks Consumer Discretionary sector, prompting investors to question whether to maintain their positions or consider selling their shares. The drop comes amid broader market volatility and specific challenges facing the telecommunications and media sectors.

Investors should carefully weigh the company's growth prospects against the challenges it faces. The ongoing shift in the media consumption landscape, potential regulatory hurdles and the significant capital expenditures required to stay competitive in both content and infrastructure are all factors to consider.

Year-to-Date Performance

Image Source: Zacks Investment Research

Xfinity to Universal: Assessing Comcast's Investment Potential

In the Connectivity & Platforms segment, Comcast's Xfinity brand remains a powerhouse in broadband Internet services. The domestic broadband average rate per customer increased 3.6% and drove domestic broadband revenue growth of 3% to $6.6 billion in the second quarter.

As hybrid work and digital connectivity continue to be essential, this division provides a stable revenue stream. The company's ongoing investment in its broadband infrastructure, including the expansion of its fiber-optic network, positions it well for future growth. In the second quarter, Comcast Business announced new and cost-effective mobile plans aimed at enhancing value and performance for small business customers. Moreover, the company launched a new 5-Year Price Lock Guarantee promotion, offering long-term pricing stability for qualifying new customers.

Additionally, Comcast's foray into the wireless market with Xfinity Mobile has shown promising results, adding another layer of service to its connectivity offerings. Domestic wireless customer lines increased 20% year over year to 7.2 million, including net additions of 322K in the second quarter.

The Content & Experiences segment, which includes NBCUniversal and Sky, presents compelling growth opportunities. Last month, Comcast launched NOW TV Latino, a new service targeting Spanish-speaking audiences, which is priced at $10 per month with no contract or additional fees.

NBCUniversal's Peacock streaming service, while facing stiff competition, has been gaining traction. The platform's unique blend of live sports, news and original content differentiates it in the crowded streaming market.

As Peacock continues to grow its subscriber base, it could become a significant contributor to Comcast's revenues. In the second quarter, Peacock’s paid subscribers rallied nearly 38% year over year to 33 million. Peacock’s revenues jumped 28% to $1 billion, driven by the launch of Xfinity StreamSaver, a streaming bundle of Peacock, Netflix and Apple TV+ for new and existing Xfinity Internet and TV customers.

Universal theme parks, another key component of the Content & Experiences segment, are poised for recovery as global tourism rebounds post-pandemic. The rising popularity of the latest Universal Beijing Resort and ongoing expansions at other locations demonstrate the company's commitment to this high-margin business.

Comcast's film and television studios continue to produce popular content, which not only generates box office revenues but also feeds into the company's streaming and traditional broadcast channels. This vertical integration allows Comcast to maximize the value of its intellectual property across multiple platforms.

The synergies between Comcast's two main segments provide a competitive advantage. The company can leverage its connectivity services to promote its content offerings and vice versa, creating a more cohesive and attractive package for consumers.

The Zacks Consensus Estimate for CMCSA 2024 revenues is pegged at $123.02 billion, indicating growth of 1.2% from the year-ago quarter’s reported figure. The consensus mark for 2024 earnings has moved north by 0.5% to $4.23 per share in the past 30 days, suggesting a rise of 6.28% from the figure reported in the year-ago quarter.

Image Source: Zacks Investment Research

Valuation is another key consideration for potential investors. CMCSA is trading at 1.23X forward 12 months sales, below its five-year median and the Zacks Cable Television industry’s forward earnings multiple, which sits at 1.34X, indicating potential undervaluation based on revenue generation.

Price-to-Sales (Forward 12 Months)

Image Source: Zacks Investment Research

Cord-Cutting and Streaming Pressure Weigh on Stock

The persistent trend of cord-cutting continues to erode its traditional cable subscriber base, threatening a once-stable revenue stream. As consumers flock to streaming alternatives like Netflix NFLX, Amazon AMZN Prime Video services and Disney DIS-owned Disney+, Comcast's cable TV business faces mounting pressure.

The company's foray into streaming with Peacock, while necessary, comes with substantial costs for content production and infrastructure. These investments, coupled with intense competition in the streaming space, strain profitability and raise concerns about return on investment.

Moreover, the slowing growth in broadband subscriptions — a key driver of Comcast's recent success — has alarmed investors. This deceleration, combined with the high costs of maintaining and upgrading network infrastructure, casts doubt on the company's growth prospects.

These factors collectively contribute to investor hesitation despite Comcast's efforts to adapt to the changing media consumption landscape.

Conclusion

Comcast's 10.9% YTD dip presents a complex investment opportunity. While the company's strong market position, diverse business model and attractive valuation metrics suggest potential upside, ongoing challenges in the media landscape cannot be ignored. Investors should carefully weigh these factors against their risk tolerance and long-term investment goals before making a decision. While it may be premature to abandon the stock for those who have already invested in it, new investors should wait for a better entry point. Comcast currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Comcast Corporation (CMCSA) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.