Bruker Corporation BRKR recently announced the release of its latest innovative neuroscience research solution, the OptoVolt module, at the Neuroscience 2024 conference. The module uniquely addresses the challenges of voltage imaging by providing scanner technology.

The latest release expands Bruker’s Ultima multiphoton microscope platform with advanced neuroscience research capabilities.

BRKR’s Likely Stock Trend Following the News

Subsequent to the news, the share price of BRKR moved south 1.6% to $65.95 on Monday. The company is continuously working on various collaborations and product launches to build the versatile Ultima 2Pplus platform as the ideal solution for all-optical neuroscience research. Henceforth, we expect the launch of OptoVolt to motivate market sentiment toward BRKR stock.

Bruker currently has a market capitalization of $9.98 billion. It has a trailing four-quarter average earnings surprise of 10.09%.

About Bruker’s OptoVolt

The OptoVolt module’s integration with the Ultima 2Pplus multiphoton microscope accelerates imaging speed beyond 1000 frames per second for the capture of millisecond dynamics of cell-to-cell neural communication. OptoVolt’s scanner technology is capable of operating at the ultrafast speeds and with the signal-to-noise ratio required to detect individual neural events.

Additionally, the latest module seamlessly integrates with Bruker’s NeuraLight 3D Ultra spatial light modulator (SLM), enabling researchers to visualize action potentials and sub-threshold membrane potentials across large neural networks.

Importance of Bruker’s OptoVolt

With the emergence of fluorescent voltage indicators, researchers are excited to measure neural activity with higher temporal resolution than traditional fluorescent calcium indicators have allowed. In line with this, voltage imaging is becoming a key tool for investigating neural circuits and systems neuroscience in the near future.

News instruments such as OptoVolt expand the possibilities for optically interrogating cellular and subcellular signaling at the temporal resolution of individual action potentials.

With such direct collaboration, the company aims to build the versatile Ultima 2Pplus platform as the ideal solution for all-optical neuroscience research.

Recent Development by Bruker

Bruker recently announced the acquisition of Dynamic Biosensors GmbH, or DBS, a pioneering company known for its development in biosensors. The acquisition is aimed at boosting Bruker’s biophysical portfolio, which is used for analyzing molecular interactions and kinetics. Financial details of the transaction were not disclosed.

Image Source: Zacks Investment Research

Industry Prospects Favor Bruker

Per a Verified Market Research report, the neuroscience market is projected to reach $39.59 billion by 2031 at a compound annual growth rate of 4.22% from 2024 to 2031. Key factors responsible for the market growth are the rising incidence of brain disorders, breakthroughs in neuroscience and technology, and growing geriatric population.

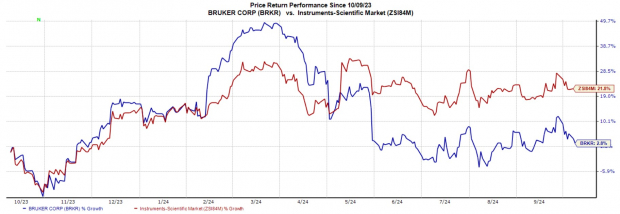

BRKR’s Price Performance

In the past year, BRKR’s shares have risen 2.8% compared with the industry’s 21.8% growth.

Zacks Rank and Key Picks

BRKR currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space are TransMedics Group TMDX, AxoGen AXGN and OrthoPediatrics KIDS. While TransMedics sports a Zacks Rank #1 (Strong Buy) at present, AxoGen and OrthoPediatrics carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for TransMedics’ 2024 earnings per share (EPS) have moved up 0.8% to $1.22 in the past 30 days. Shares of the company have soared 187.4% in the past year compared with the industry’s 18.9% growth. TMDX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 287.50%. In the last reported quarter, it delivered an earnings surprise of 66.67%.

Estimates for AxoGen’s 2024 loss per share have remained constant at 1 cent in the past 30 days. Shares of the company have surged 210.3% in the past year compared with the industry’s 18.8% growth. AXGN’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 96.5%. In the last reported quarter, it delivered an earnings surprise of 200%.

Estimates for OrthoPediatrics’ 2024 loss per share have declined to 92 cents from 96 cents in the past 30 days. In the past year, KIDS’ shares have lost 10.8% against the industry’s 18.8% growth. In the last reported quarter, it delivered an earnings surprise of 25.81%. Its earnings surpassed estimates in each of the trailing four quarters, the average surprise being 26.81%.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>AxoGen, Inc. (AXGN) : Free Stock Analysis Report

Bruker Corporation (BRKR) : Free Stock Analysis Report

OrthoPediatrics Corp. (KIDS) : Free Stock Analysis Report

TransMedics Group, Inc. (TMDX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.