AMN Healthcare Services, Inc. AMN still can’t find the bottom in the healthcare staffing market. This Zacks Rank #5 (Strong Sell) is expected to see earnings fall 62.4% this year with no rebound expected in 2025.

AMN Healthcare provides total talent solutions for healthcare organizations across the United States. Its services include direct staffing, vendor-neutral and managed services programs, clinical and interim healthcare leaders, temporary staffing, permanent placement, executive search, vendor management systems, recruitment process outsourcing, predictive modeling, language services, revenue cycle solutions and other services.

Clients include acute-care hospitals, community health centers and clinics, physician practice groups, retail and urgent care centers, home health facilities, schools and other healthcare settings.

AMN Healthcare Beat Again for the Third Quarter 2024

On Nov 7, 2024, AMN Healthcare Services reported its third quarter 2024 results and beat on the Zacks Consensus Estimate by $0.03. Earnings were $0.61 versus the Consensus of $0.58.

It is especially impressive because AMN Healthcare Services has a perfect 5-year earnings surprise track record. Few companies made it through the COVID pandemic unscathed in the earnings beat category, especially one so intricately involved in healthcare.

But even thought it beat; the company still has not seen the bottom yet in the post-COVID correction. Demand for medical professionals, especially nurses, was at all time highs during the pandemic. But industry conditions remain challenging.

Revenue fell 19% to $687.5 million and was also down 7% compared to the prior quarter, but the company said this was better than expected.

A big hit came in the Nurse and Allied Solutions segment which fell 30% year-over-year to $399 million. It was also down 10% just from the prior quarter.

Travel nurse staffing, which boomed during the pandemic, fell 37% year-over-year and 12% sequentially. Allied division revenue also declined 16% year-over-year.

AMN Healthcare has $31 million in cash and cash equivalents as of Sep 30, 2024. It also had total debt of $1.135 billion.

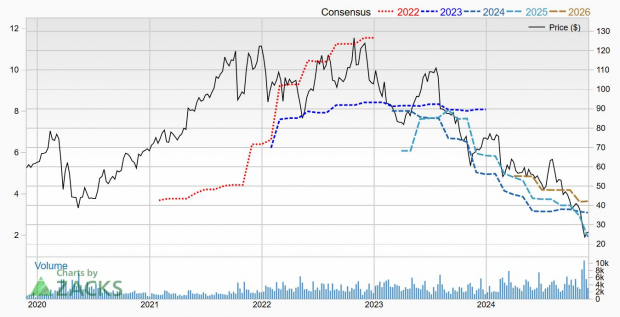

Analysts Cut AMN Healthcare’s Earnings Estimates Again

The company’s fourth quarter guidance was not encouraging that a bottom was coming soon.

The analysts are bearish. 3 have cut for 2024 and 4 have cut their earnings estimates for 2025 in the last 30 days.

The 2024 Zacks Consensus Estimate has fallen to $3.09 from $3.15 in that period. That’s a decline of 62.4% as the company made $8.21 last year.

2025 is grim as well. The Zacks Consensus has fallen to $1.92 from $2.93 in the last month. That’s another earnings decline of 38.1%.

This is what it looks like on the price and consensus chart.

Image Source: Zacks Investment Research

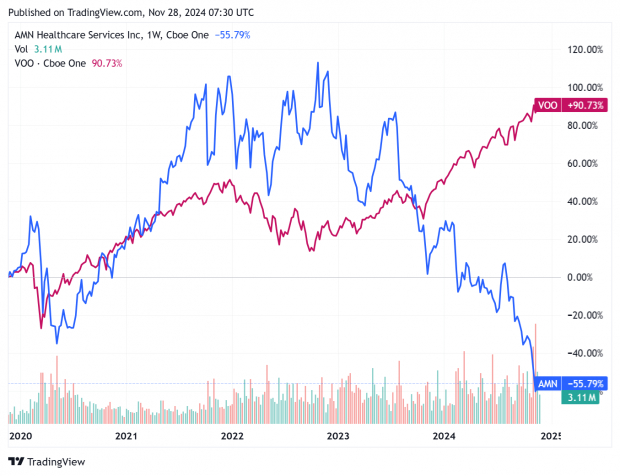

AMN Healthcare Services at 5-Year Lows: Value or Trap?

Shares of AMN Healthcare Services rallied big during the pandemic when the company was seeing record revenue. But they have plunged over the last few years and are now at new 5-year lows.

Image Source: Zacks Investment Research

For the year, shares are down 66%.

AMN Healthcare Services appears to be cheap, with a forward price-to-earnings (P/E) ratio of 8.5.

But with those earnings estimates still being slashed, even for next year, and earnings growth still expected to take a dive, AMN Healthcare is not a value, but a trap.

For those investors interested in the staffing companies, it might be best to still be on the sidelines.

Free Today: Profiting from The Future’s Brightest Energy Source

The demand for electricity is growing exponentially. At the same time, we’re working to reduce our dependence on fossil fuels like oil and natural gas. Nuclear energy is an ideal replacement.

Leaders from the US and 21 other countries recently committed to TRIPLING the world’s nuclear energy capacities. This aggressive transition could mean tremendous profits for nuclear-related stocks – and investors who get in on the action early enough.

Our urgent report, Atomic Opportunity: Nuclear Energy's Comeback, explores the key players and technologies driving this opportunity, including 3 standout stocks poised to benefit the most.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.