$200 billion. That's how much revenue Apple (NASDAQ: AAPL) generated last year from iPhone sales.

Most people think that is why Apple is the most valuable company in the world. And they're not entirely wrong. But it is more complicated than that.

Let's dive into how Apple makes its money, and why the company is spending so much cash on a business you -- and many other investors -- probably don't give all that much consideration.

Image source: Getty Images.

Products vs. services

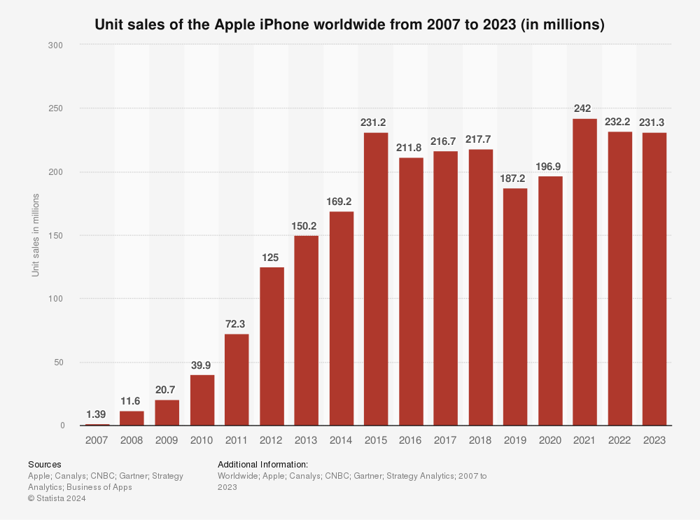

When it comes to Apple, most people think one thing -- iPhones. And, as noted earlier, the company does generate a ton of revenue from its smartphones. But here's the thing: Apple's iPhone sales haven't really budged in almost a decade:

Image source: Getty Images.

In short, the iPhone is old news -- at least for Apple. The same goes for its other hardware products -- the iPad, Macs, even wearables. Sure, they've boosted the company's revenue over the last decade, but nowhere even close to what the iPhone did from 2007 to 2015.

No, the real growth driver for Apple in recent years is its services segment. This unit gets sales from the App store, iTunes, AppleCare+, advertising, and subscriptions to apps like iCloud+, Apple Fitness, and AppleTV+.

Best of all, at least for Apple and its shareholders, the company's services segment is far more profitable than its product segment. Overall, Apple generates roughly 33% gross profit from its products (iPhones, iPads, and Macs). Its services unit has an overall gross profit margin of 75%.

What this means is that Apple is laser-focused on growing its services revenue and profit -- as that unit is the value engine for the company right now.

So why has Apple spent $20 billion on content almost no one sees?

Apple has spent $20 billion on Apple TV+ productions

Since Apple doesn't publicly break down the revenue and costs of its services unit at a granular level, investors have to rely on estimates. Reporting from Bloomberg indicates Apple has spent more than $20 billion on Apple TV+ in an attempt to compete with Netflix, Amazon, Disney, and others. Clearly, the so-called "streaming wars" have been costly, even for Apple.

What's worse, however, is that all that spending appears to have been largely in vain. Sure, Apple netted a Best Picture win in 2022 for Coda, but many other big-budget projects failed to boost Apple TV's viewership. According to one report, Apple TV gets roughly the same number of viewers in a month that Netflix gets in a day.

Reports suggest Apple management is tightening the belt and cutting budgets for its streaming projects. And perhaps for good reason. The company is now focusing on new artificial intelligence (AI) tools that could boost its services revenue even higher. Investments in AI are costly, and, as a result, Apple TV's big spending days may be over.

Apple dipped its toe into the streaming wars, which cost billions that could have been spent on AI. However, it now looks like the company recognized this misallocation of resources and is working to tighten its big spending on streaming. As a result, Apple management can focus its resources on building up its services and AI business -- the former being the company's current growth engine and the latter being its future.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Jake Lerch has positions in Amazon and Walt Disney. The Motley Fool has positions in and recommends Amazon, Apple, Netflix, and Walt Disney. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.