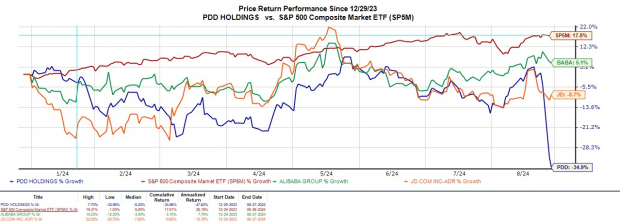

PDD Holdings PDD had been one of the better-performing stocks in recent years but has now dropped 30% since reporting Q2 results on Monday. The sharp selloff comes as the multinational e-commerce firm reiterated that a decline in its profitability is inevitable and expects the trend to start during Q3.

Stiffer competition and broader economic concerns in China are anticipated despite PDD’s discounted merchandise allowing the company to take market share from other e-commerce titans such as Alibaba BABA and JD.com JD.

Image Source: Zacks Investment Research

PDD’s Q2 Results

PDD posted Q2 sales of $13.35 billion which missed estimates by 2% although this was an 85% spike from $7.2 billion in the comparative quarter. On the bottom line, Q2 EPS of $3.20 came in 10% better than expected and soared 122% from $1.44 per share a year ago.

Notably, PDD has exceeded the Zacks EPS Consensus for 14 consecutive quarters posting an average earnings surprise of 41.14% in its last four quarterly reports.

Image Source: Zacks Investment Research

PDD’s Growth Trajectory

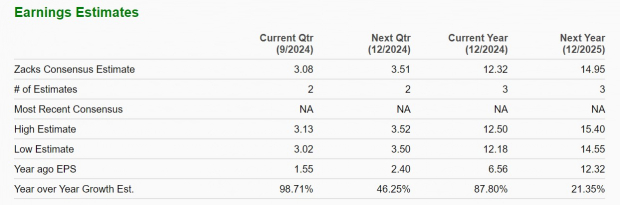

Based on Zacks estimates, PDD's total sales are currently forecasted to climb 62% in fiscal 2024 to $56.27 billion versus $34.64 billion last year. PDD’s top line is projected to expand another 27% in FY25 to $71.59 billion.

Annual earnings are expected to soar 87% this year to $12.32 per share compared to EPS of $6.56 in 2023. Plus, FY25 EPS is projected to increase another 21%. However, its noteworthy that earnings estimate revisions for FY24 and FY25 could start to decline following the reiteration of PDD’s lower profitability warning.

Image Source: Zacks Investment Research

Valuation Comparison

Trading at $95, PDD’s stock is at an 8.1X forward earnings multiple which is a significant discount to the S&P 500’s 23.7X. Furthermore, after the recent pullback, PDD now trades near Alibaba’s 9.4X but above JD.com’s 6.5X.

Image Source: Zacks Investment Research

Bottom Line

Following its Q2 report PDD Holdings stock lands a Zacks Rank #3 (Hold). While it may be tempting to buy the post-earnings drop in PDD’s stock the company is starting to share the same fate as many other Chinese e-commerce firms that appear to be undervalued but have been submerged in volatility due to broader economic fears.

PDD is certainly a viable long-term investment considering its expansive growth trajectory but there could still be better buying opportunities ahead.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>PDD Holdings Inc. Sponsored ADR (PDD) : Free Stock Analysis Report

JD.com, Inc. (JD) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.