Nokia Corporation NOK recently announced that it has completed the acquisition of Rapid’s API technology assets for an undisclosed amount. Rapid’s industry-leading API technology includes the world's largest application programming interface (API) hub, which enables businesses to securely design, test and share APIs within their organization and with external associates. In addition, Rapid’s public API marketplace, boasting an extensive developer base worldwide, allows users to list and monetize their APIs while giving access to a wide array of third-party APIs.

Significance of Network APIs

Network APIs act as bridges through which developers can tap into different functionalities of the telecommunication network, such as location services, latency control, network slicing and bandwidth management. The process streamlines the application development process for developers and enables them to drive innovation without requiring any deep expertise in underlying network infrastructure.

For telecom operators who have heavily invested in building 4G and 5G infrastructure, network APIs allow them to sell the various network capabilities to businesses and developers and create new revenue streams. For instance, operators can sell real-time location data to businesses creating location-based services; it can also monetize the network’s low latency features for video streaming apps.

Will This Buyout Drive NOK Share Performance?

Nokia’s Network as Code platform, launched in 2023, is designed to make network capabilities easily accessible through APIs for developers. Since its introduction, the solution has witnessed healthy market traction from major enterprises worldwide, including Google Cloud, Telefonica, Telecom Argentina, DISH and more.

The integration of Rapid’s industry-leading API technology and R&D unit will strengthen NOK’s Network as Code platform, creating a robust API infrastructure. This advanced API ecosystem will enhance API lifecycle management, allowing operators to control API usage and exposure. It is likely to drive Nokia’s commercial expansion in the network API space.

The telecom industry is looking to unlock new avenues of monetization following massive 5G investments. By expanding the capabilities of its Network as a Code platform, Nokia is aiming to capitalize on these emerging market trends. This strategic buyout will accelerate network API-related product development and empower operators to derive a sustainable return against their 5G investment by engaging the broader global developer community.

NOK’s Stock Price Movement

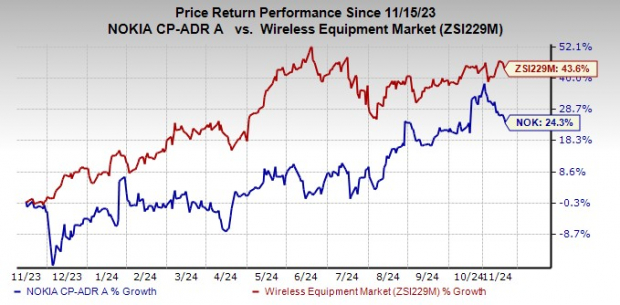

Shares of Nokia have gained 24.3% over the past year compared with the industry's growth of 43.6%.

Image Source: Zacks Investment Research

NOK’s Zacks Rank and Key Picks

Nokia currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same space are Arista Networks, Inc. ANET, Zillow Group, Inc. ZG and Workday Inc. WDAY.

Arista Networks carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the last reported quarter, it delivered an earnings surprise of 14.83%. It provides cloud networking solutions for data centers and cloud computing environments. The company offers 10/25/40/50/100-gigabit Ethernet switches and routers optimized for next-generation data center networks.

Zillow Group carries a Zacks Rank #2 at present. In the last reported quarter, it delivered an earnings surprise of 9.38%. ZG delivered an earnings surprise of 25.47%, on average, in the trailing four quarters.

The company is witnessing solid momentum in rental revenues, driven by growth in multi- and single-family listings, which is a positive factor. Solid growth in the Premier Agent business is driving growth in the Residential segment.

Workday carries a Zacks Rank of 2 at present. In the last reported quarter, it delivered an earnings surprise of 7.36%.

WDAY is a leading provider of enterprise-level software solutions for financial management and human resource domains. The company’s cloud-based platform combines finance and HR in a single system, making it easier for organizations to provide analytical insights and decision support.

Free: 5 Stocks to Buy As Infrastructure Spending Soars

Trillions of dollars in Federal funds have been earmarked to repair and upgrade America’s infrastructure. In addition to roads and bridges, this flood of cash will pour into AI data centers, renewable energy sources and more.

In, you’ll discover 5 surprising stocks positioned to profit the most from the spending spree that’s just getting started in this space.

Download How to Profit from the Trillion-Dollar Infrastructure Boom absolutely free today.Nokia Corporation (NOK) : Free Stock Analysis Report

Workday, Inc. (WDAY) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Zillow Group, Inc. (ZG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.