Visa Inc. V shares continued to decline following the Department of Justice (DOJ) filing an antitrust lawsuit. The quivers began after Bloomberg and The New York Times first hinted that a DOJ action was forthcoming. On Tuesday, the DOJ formally accused Visa of illegally dominating the debit card market. The stock, which had closed at $288.63 on Monday, dropped 6.6% to $269.63 by Wednesday, pushing it 8% below its 52-week high of $293.07.

Despite the recent slump, the dip could present a solid entry point for potential investors. Visa already had a favorable Zacks Rank #2 (Buy), and the price correction could enhance its value appeal. According to Morgan Stanley analyst James Faucette, the financial impact of the lawsuit is likely to be spread out over an extended period due to lengthy legal proceedings and possible appeals, mitigating immediate effects. Faucette highlighted that historically, market reactions to regulatory setbacks have created good buying opportunities, suggesting that the sell-off was an overreaction.

According to Reuters, KBW analyst Sanjay Sahrani highlighted that Visa’s U.S. debit revenues account for just around 10% of its total revenues. Hence, the overall impact of the lawsuit is expected to be limited on its revenue growth.

There is a bill in Congress, the Credit Card Competition Act, which also aims to boost competition in the payment processing space. Nevertheless, Visa’s long-term outlook remains strong, thanks to its market leadership and extensive global network, which are difficult for competitors to replicate. Its ability to navigate regulatory challenges while staying ahead through innovation and targeting underserved markets should support its continued dominance.

Even if competition intensifies due to the effects of the legal entanglements, Visa’s extensive customer base and robust infrastructure provide a firm foundation for future growth. Additionally, the company’s ongoing expansion into high-growth areas like digital payments, cryptocurrency and cybersecurity positions it well to capitalize on rising demand in these sectors. This strategic focus helps balance legal uncertainties with long-term opportunities.

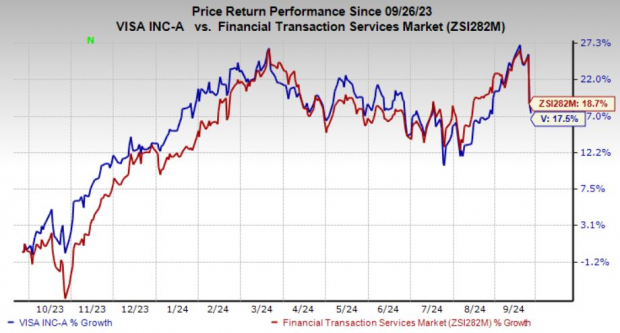

Visa’s Price Performance

Shares of Visa have gained 17.5% in the past year compared with the industry’s 18.7% growth.

Image Source: Zacks Investment Research

Other Key Picks

Investors can also look at other top-ranked stocks from the broader Business Services space, like Fidelity National Information Services, Inc. FIS, Remitly Global, Inc. RELY and Paysign, Inc. PAYS.While Fidelity National currently sports a Zacks Rank #1 (Strong Buy), Remitly Global and Paysign each carry a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Fidelity National’s current-year earnings indicates a 50.7% year-over-year increase. FIS beat earnings estimates in two of the trailing four quarters and missed twice. The consensus estimate for current-year revenues is pegged at $10.2 billion.

The Zacks Consensus Estimate for Remitly Global’s current-year earnings indicates a 53.9% year-over-year improvement. RELY beat earnings estimates in two of the trailing four quarters and missed twice, with the average surprise being 8%. The consensus estimate for current-year revenues implies 31.8% year-over-year growth.

The consensus estimate for Paysign’s current-year earnings indicates 75% year-over-year growth. The consensus estimate for PAYS’ current-year revenues is pegged at $58 million, implying 22.6% year-over-year growth.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>Visa Inc. (V) : Free Stock Analysis Report

Fidelity National Information Services, Inc. (FIS) : Free Stock Analysis Report

Remitly Global, Inc. (RELY) : Free Stock Analysis Report

Paysign, Inc. (PAYS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.