Second quarter results from the major automakers will be a highlight of this week’s earnings lineup with Tesla TSLA and General Motors GM set to report on Tuesday, July 23.

Plus, Q2 results from Ford Motor F are on tap Wednesday. That said, let’s see if it’s time to buy stock in these auto giants as earnings approach.

Tesla Q2 Expectations

Notably, Tesla‘s stock has been on a monstrous rally soaring over +20% in the last month. This comes as Tesla announced it delivered 443,956 EVs during Q2 which topped most analyst estimates although this was down from 466,140 deliveries in the prior year quarter.

Fueling the extended rally was increased deliveries from Chinese EV automakers such as Nio NIO and Li Auto LI with Tesla’s factory in Shanghai being critical to its production as well. However, Tesla’s Q2 EPS is expected at $0.62 compared to $0.91 a share in the comparative quarter. This is despite quarterly sales projected to rise to $25.13 billion versus $24.93 billion in Q2 2023.

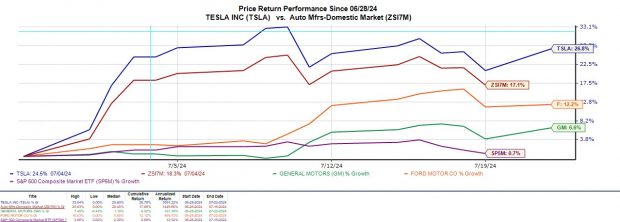

Image Source: Zacks Investment Research

Q2 Expectations for GM & Ford

As shown in Tesla’s price performance chart above, General Motors and Ford’s stock have also seen nice momentum leading up to their Q2 reports.

Both iconic automakers saw a hefty increase in elective vehicle sales with General Motors’ EV deliveries spiking 40% during Q2 to 21,930. As for Ford, its Q2 EV deliveries soared 61% year over year to 23,957.

More impressive, General Motors' Q2 EPS is projected to expand 38% to $2.64 on sales of $44.94 billion, a slight increase from $44.75 billion a year ago. Following a tougher-to-compete-against prior-year quarter, Ford’s Q2 EPS is expected to decline -14% to $0.62 with sales forecasted to dip -2% to $41.65 billion.

Valuation Comparisons

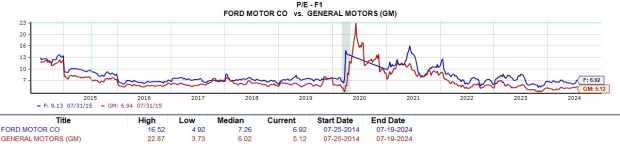

In terms of valuation, General Motors and Ford certainly stand out trading at just 5.1X and 6.9X forward earnings, respectively. It’s noteworthy that both GM and Ford have an “A” Zacks Style Scores grade for Value.

Image Source: Zacks Investment Research

Still commanding a noticeable premium to the broader market as an EV pioneer, Tesla’s stock trades at a 96.4X forward earning multiple which is below its two-year high of 141.2X but above its median of 76.3X during this period.

Image Source: Zacks Investment Research

Takeaway

Ahead of their Q2 reports, General Motors and Ford’s stock both sport a Zacks Rank #2 (Buy). Now looks like an opportunistic time to invest in General Motors and Ford considering their EV growth and cheap P/E valuations.

Meanwhile, Tesla’s stock lands a Zacks Rank #3 (Hold) after such an extensive rally over the last few months. To that point, longer-term investors may still be rewarded for holding Tesla’s stock but there could certainly be better buying opportunities ahead.

Free Report – 3 Stocks Sneaking Into Hydrogen Energy

Demand for clean hydrogen energy is projected to reach $500 billion by 2030 and grow 5-FOLD by 2050. No guarantees, but three companies are quietly getting the jump on their competition.

Zacks Investment Research is temporarily offering an urgent Special Report naming and explaining these emerging powerhouses primed to boom. Click below for Hydrogen Energy: 3 Industrial Giants to Ride the Next Renewable Energy Wave.

See Stocks Now >>Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

NIO Inc. (NIO) : Free Stock Analysis Report

Li Auto Inc. Sponsored ADR (LI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.