As the world’s most valuable company, markets will pay close attention to results for Apple’s AAPL fiscal third quarter on Thursday, August 1.

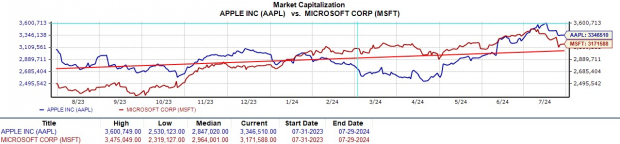

Edging Microsoft MSFT with a market cap of over $3.3 trillion, let’s see if it’s time to buy Apple’s stock as earnings approach.

Image Source: Zacks Investment Research

Apple’s Q3 Expectations

Ranging from games to subscriptions for movies and music, services revenue has helped sustain Apple’s robust top line. Along with its iconic app store, this includes Apple Pay and AppleCare with Q3 Services revenue expected to spike 13% to $23.99 billion.

However, Product revenue which is led by Apple’s flagship iPhone is expected to dip to $60.06 billion compared to $60.58 billion in the comparative quarter. Overall, Apple’s Q3 sales are still projected to rise 3% to $84.38 billion.

On the bottom line, Apple’s Q2 EPS is thought to have increased 6% to $1.34 versus $1.26 per share a year ago. Notably, Apple has surpassed bottom line expectations for five consecutive quarters posting an average earnings surprise of 4.14% in its last four quarterly reports.

Image Source: Zacks Investment Research

Apple Intelligence

Wall Street will be looking for updates on Apple’s plans to expand into generative AI which will concentrate on personal intelligence systems for the iPhone, iPad, and MacBook. Apple is also testing a ChatGPT-style generative AI tool called “ASK” for AppleCare Support along with upgrading its digital voice assistant Siri.

Apple has stated it believes in the transformative power and promise of AI and has the advantages to differentiate itself in the new era of tech. The company has worked closely with Taiwan Semiconductor TSM in this regard which provides the M3 chip for its MacBook Air. Apple deems the MacBook Air as the best consumer laptop for AI with breakthrough performance including a more powerful neural engine.

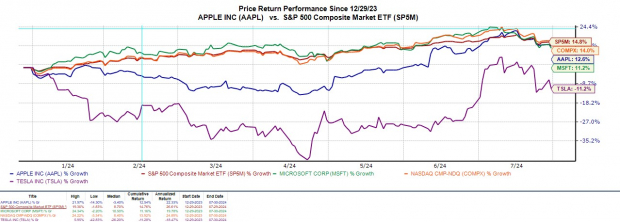

YTD Performance

Year to date, Apple’s stock is up a respectable +12% although this has slightly trailed the broader indexes and most of its "Magnificent Seven" peers outside of Microsoft and Tesla TSLA.

Image Source: Zacks Investment Research

Monitoring Apple’s Valuation

Checking out one of Apple’s key fundamental valuation metrics, AAPL currently commands a modest premium to the broader market at 33.1X forward earnings compared to the S&P 500’s 23X. It’s noteworthy that Apple trades below its decade-long high of 38.6X forward earnings but noticeably above the median of 18.1X.

Image Source: Zacks Investment Research

Takeaway

Ahead of its Q3 report, Apple’s stock lands a Zacks Rank #3 (Hold). Reaching or exceeding quarterly expectations may be crucial to more upside in Apple’s stock as its valuation does allude to the notion that there could be better buying opportunities ahead.

That said, Apple is a cash cow that has the resources to expand and potentially capitalize on artificial intelligence which could be very rewarding for long-term investors.

Check Out These Stocks Before They Report Earnings (Free Report)

A stock can jump +10-20% in a single day after a positive earnings surprise. What if you could get in early on those stocks? It could be the "holy grail" of stock picking for investors.

Zacks' new special report is designed to do exactly that. It reveals 5 promising stocks experts predict will crush earnings estimates and skyrocket in price.

Download Earnings Season Profit Secrets today, absolutely free.Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.