Despite posting strong results for its fiscal third quarter on Wednesday, Disney’s DIS stock has dropped 5% since its Q3 report and is now 30% below its 52-week highs.

Recent market volatility may be playing a part in the post-earnings decline as there were some very positive signs for the iconic media and entertainment company, including its streaming unit turning its first profit.

Image Source: Zacks Investment Research

Disney’s Q3 Results

Disney stated its strong performance during Q3 was driven by its Entertainment segment, both at the box office and in direct-to-consumer (DTC). Earnings of $1.39 per share spiked 35% from EPS of $1.03 in the comparative quarter and impressively surpassed expectations of $1.20 a share.

This came on sales of $23.15 billion which rose 3% year over year and topped estimates of $22.91 billion by 1%.

Image Source: Zacks Investment Research

Steaming Profitability & Subscribers

Adding to the sharp increase on its bottom line, Disney said it was able to achieve profitability across its combined streaming businesses which include Disney Plus, Hulu, and ESPN+. Surprisingly, this came ahead of schedule as Disney’s previous guidance didn’t have its streaming services being profitable until Q4.

Notably, Disney+ Core subscribers increased by 1% during Q3 to 118 million and remains the second largest streaming service behind Netflix NFLX while being ahead of Paramount PARA and Warner Brothers Discovery WBD among other competitors.

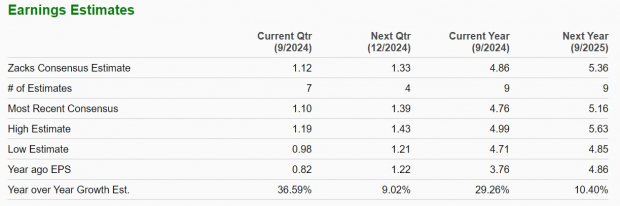

EPS Guidance

Raising its full-year EPS guidance, Disney now expects earnings to grow 30% in fiscal 2024 compared to previous targets of 25% growth. This is slightly above the current Zacks Consensus of $4.86 per share or 29% growth.

Image Source: Zacks Investment Research

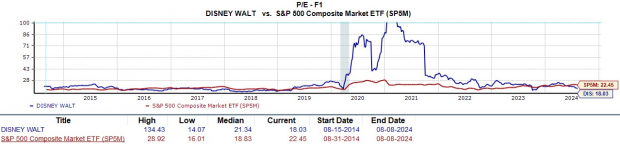

Monitoring Disney’s Valuation

Trading around $85, Disney’s stock trades at 18X forward earnings and at a noticeable discount to the S&P 500’s 22.4X and Netflix’s 33X. More intriguing, DIS trades well below its decade-long high of 134.4X forward earnings and at a 15% discount to the median of 21.3X.

Image Source: Zacks Investment Research

Takeaway

It’s certainly tempting to buy the post-earnings dip in Disney’s stock but for now, DIS lands a Zacks Rank #3 (Hold). There was a lot to like about Disney’s Q3 results and its valuation is enticing. However, it’s noteworthy that FY25 earnings estimate revisions have declined in the last week which could lead to more short-term resistance against a potential rebound although 10% EPS growth is still expected next year.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpThe Walt Disney Company (DIS) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Warner Bros. Discovery, Inc. (WBD) : Free Stock Analysis Report

Paramount Global (PARA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.