Tapestry, Inc. TPR reported first-quarter fiscal 2025 results, which exceeded the Zacks Consensus Estimate for revenues and earnings despite a challenging global economic and consumer environment. The top line declined while the bottom line increased year over year. Driven by the first quarter results, Tapestry raised its fiscal 2025 outlook.

Tapestry's first-quarter results reflected the company's brand strength and operational excellence that support its strategic growth initiatives. This performance highlighted the effective efforts, which successfully engaged consumers through innovative products, compelling experiences and strong storytelling.

The company is positioned for continued growth, supported by its distinctive brands, a flexible platform and solid cash flow. These factors provide Tapestry with both strategic and financial flexibility, enabling it to pursue accelerated organic growth and long-term value creation, particularly in fiscal 2025 and beyond.

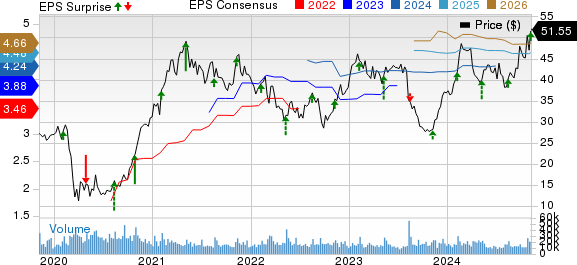

Tapestry, Inc. Price, Consensus and EPS Surprise

Tapestry, Inc. price-consensus-eps-surprise-chart | Tapestry, Inc. Quote

More on TPR’s Q1 Financial Results

Tapestry reported adjusted earnings of $1.02 per share for the first quarter, which surpassed the Zacks Consensus Estimate of 95 cents and increased from 93 cents delivered in the prior-year period.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Net sales reached $1,507.5 million, beating the consensus estimate of $1,474 million. However, the figure reflected a 0.4% year-over-year decline. The appreciation of the U.S. dollar caused a 40-basis point headwind in the quarter due to foreign exchange (FX) impacts.

In the first quarter, Tapestry acquired approximately 1.4 million new customers in North America, with growth across all of its brands. Notably, more than half of these new customers were Gen Z and Millennials, aligning with Tapestry’s strategy to attract younger consumers, demonstrating the success of its initiatives.

For the quarter, Coach's net sales were $1.17 billion, which was better than the Zacks Consensus Estimate of $1.14 billion. The figure increased 1% year over year.

Kate Spade’s sales were $283.2 million, came below the consensus estimate of $285.8 million, marking a 6.6% decline from the year-ago period.

Stuart Weitzman’s net sales totaled $53.7 million, which was better than the consensus estimate of $49.3 million. The figure marked 2.1% growth year over year.

Tapestry’s Q1 Revenue Insights by Region

Sales in North America declined 1% year over year to $948.2 million owing to a tough consumer environment. Sales in Greater China dropped 4% to $234.1 million.

In Japan, sales decreased 8% to $117.1 million, while revenues from Other Asian markets rose 11% to $86.8 million. European markets continued to show momentum, with a 27% increase in revenues to $94.3 million, thanks to robust spending from local consumers and tourists.

TPR’s Margins & Costs Details

The consolidated gross profit was $1.13 billion, up 3.4% from the year-ago period. Also, the gross margin increased 280 basis points to 75.3%. This was driven by a 180-basis point improvement in operations, a 60-basis point benefit from reduced freight expenses and favorable FX impacts.

The company reported an adjusted operating income of $285 million, up from $273 million in the year-ago period. Meanwhile, the adjusted operating margin increased 90 basis points to 18.9%.

Adjusted Selling, General & Administrative (SG&A) expenses totaled $850 million, up from $825 million in the year-ago period. As a percentage of net sales, this metric deleveraged 190 basis points to 56.4%.

Tapestry’s Q1 Store Update

As of the end of the quarter, Tapestry operated 325 Coach stores, 197 Kate Spade outlets and 34 Stuart Weitzman stores in North America. Internationally, the store count was 594, 178 and 60 for Coach, Kate Spade and Stuart Weitzman, respectively.

TPR’s Financial Snapshot: Cash, Debt and Equity Overview

Tapestry ended the quarter with cash, cash equivalents and short-term investments of $7.31 billion, long-term debt of $7 billion and stockholders' equity of $2.98 billion.

Operating cash flow as of Sept. 28, 2024, amounted to $119.5 million, up from $75.3 million in the previous-year period. Free cash flow was $94 million, up from $54 million in the prior year. This included $30 million in capital expenditures and implementation costs related to cloud computing compared with $29 million in the previous year.

Image Source: Zacks Investment Research

Tapestry’s Guidance

Tapestry has raised its fiscal 2025 outlook, now expecting revenues of more than $6.75 billion, which represents growth of approximately 1% to 2% compared with the prior year on both a reported and constant currency basis. This is ahead of the previous guidance of $6.7 billion, which anticipated slight growth on a reported basis and around 1% growth on a constant currency basis.

Regionally, at constant currency, expectations include high-teens growth in Europe, where Tapestry has significant potential for further market penetration and mid-single-digit growth in other parts of Asia. Japan is forecasted to see a slight revenue decline, while North America is expected to be roughly stable to slightly higher than the prior year, reflecting ongoing support for a healthy business environment. In Greater China, revenues are expected to remain consistent with last year.

Operating margin is anticipated to expand by about 50 basis points from the prior year, driven by gross margin improvements tied to increases in both average unit retail and average unit cost. The impacts of freight and foreign exchange are expected to be minimal on gross margins for fiscal 2025.

SG&A expenses are expected to increase in line with revenue growth, with focused investments in high-impact growth areas, including enhanced marketing efforts. Corporate expenses are anticipated to see a slight decline from the prior-year figure as Tapestry continues to prioritize cost control while supporting brand growth.

Management guided fiscal 2025 earnings per share between $4.50 and $4.55, reflecting mid-single-digit growth compared with the previous year and an increase from the prior range of $4.45-$4.50. Free cash flow is forecasted to be around $1.1 billion, excluding deal-related costs.

Tapestry anticipates slight growth in constant currency sales in the first half of the year, with low single-digit growth planned for the latter half. In the second quarter specifically, sales are expected to rise 1% to 2% on both a reported and constant currency basis.

Operating margin expansion is expected across both halves of the year, initially driven by gross margin gains in the first half and SG&A leverage in the second half. This balanced approach is expected to result in mid-single-digit earnings per share (EPS) growth for both halves of the fiscal 2025, with the metric estimated to reach approximately $1.70 in the second quarter.

Shares of this Zacks Rank #3 (Hold) company have gained 34.8% in the past three months compared with the industry’s growth of 1%.

Key Picks

Some better-ranked stocks in the same space are The Gap, Inc. GAP, Nordstrom Inc. JWN and Abercrombie & Fitch Co. ANF.

The Gap is a premier international specialty retailer offering a diverse range of clothing, accessories and personal care products. It currently carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

The Zacks Consensus Estimate for The Gap’s fiscal 2024 earnings and sales indicates growth of 31.5% and 0.5%, respectively, from the year-ago actuals. GAP has a trailing four-quarter average earnings surprise of 142.8%.

Nordstrom is a leading fashion specialty retailer in the United States. The company offers an extensive selection of both branded and private-label merchandise. It currently has a Zacks Rank of 2.

The Zacks Consensus Estimate for Nordstrom’s fiscal 2024 sales indicates growth of 0.6% from the reported figure of fiscal 2023. JWN has a negative trailing four-quarter average earnings surprise of 17.8%.

Abercrombie is a specialty retailer of premium, high-quality casual apparel. It carries a Zacks Rank of 2 at present. ANF delivered a 16.8% earnings surprise in the last reported quarter.

The consensus estimate for Abercrombie’s fiscal 2025 earnings and sales indicates growth of 63.4% and 13%, respectively, from the fiscal 2024 actuals. ANF has a trailing four-quarter average earnings surprise of 28%.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Nordstrom, Inc. (JWN) : Free Stock Analysis Report

The Gap, Inc. (GAP) : Free Stock Analysis Report

Tapestry, Inc. (TPR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.