As we head toward the final trading days of the year, you may be thinking more about holiday plans and gift lists than investing. And you might even consider that now isn't a very good time to buy stocks. After all, the three major indexes already have soared.

With a lighter flow of corporate news right now, isn't the potential for gains limited? The S&P 500 (SNPINDEX: ^GSPC), the Nasdaq, and the Dow Jones Industrial Average are heading for 26%, 29%, and 18% increases, respectively, this year.

Still, the positive elements that have driven this performance remain present, from excitement about the artificial intelligence (AI) boom to optimism about the beginnings of a lower-interest-rate environment. This could drive performance in the weeks to come and beyond.

Considering all of this, should you buy stocks before the new year? Let's dive in deeper -- and check out what history has to say, too.

Image source: Getty Images.

Roaring into a bull market

First let's talk about the stock market's performance this year. The S&P 500 roared into the new year by confirming its presence in a bull market and went on to hit multiple record highs. As mentioned, the two other benchmarks also climbed, and investors started to bet on new growth drivers for the market. AI development had picked up momentum, and companies with key roles in the industry -- such as chip designer Nvidia and networking leader Broadcom -- saw their shares skyrocket in recent years.

On top of this, investors focused on positive economic news, with the idea that potential interest-rate cuts would favor consumer spending and the ability of companies to borrow, invest, and grow. This fall, the Federal Reserve completed two rounds of rate cuts, confirming the debut of this new lower-rate environment. And the market expects a third rate cut before the end of the year, with the likelihood of one during the Dec. 18 Fed meeting, according to the CME FedWatch tool.

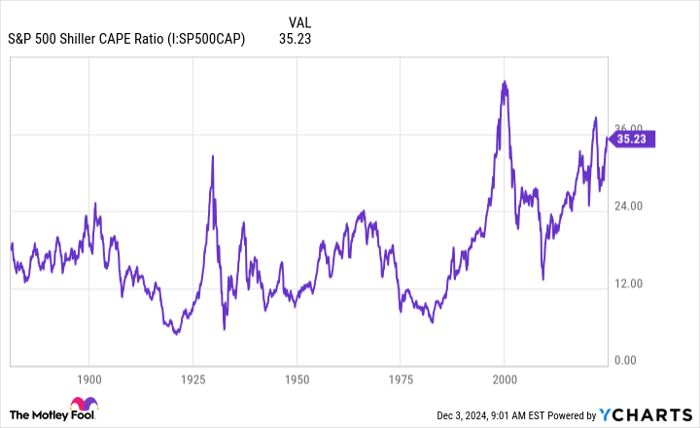

Meanwhile, the S&P 500's gains also have resulted in increases in stock valuations. The S&P 500 Shiller CAPE ratio has reached more than 35 -- a level only attained twice before since the S&P 500 launched as a 500-stock index back in the late 1950s.

The Shiller CAPE ratio is considered a solid measure of valuation since it's inflation-adjusted and looks at earnings per share and stock prices over a period of 10 years. All of this shows that the stock market, as a whole, is looking expensive today, compared with historic levels.

S&P 500 Shiller CAPE Ratio data by YCharts.

Investors may think that, considering this point, it's best not to rush into stocks before the new year.

The S&P 500 over the past 10 years

Let's look at what history has to say. Over the past 10 years, the S&P 500 has advanced in the last month of the year six times:

| Year | December percentage gain |

|---|---|

| 2023 | 4.4% |

| 2021 | 4.3% |

| 2020 | 3.7% |

| 2019 | 2.8% |

| 2017 | 1% |

| 2016 | 1.8% |

Data source YCharts. Chart by author.

The S&P 500 declined in December in 2022, 2018, 2015, and 2014 by a respective 5.9%, 9.1%, 1.7%, and 0.4%. It's important to note that the deeper dips happened in years that already had been difficult for markets.

For example, in 2018, the S&P 500 fell amid general economic concerns, including fear of a slowdown in China's economy. And runaway inflation, along with interest-rate increases, drove declines in the stock market in 2022.

If we remove those difficult years and look at the general trend, investors betting on the index, perhaps through an S&P 500 index fund, or those who chose just the right mix of stocks, benefited by buying stocks in early December.

Should you buy now?

Now let's get back to our question: Considering all of this, should you really buy stocks before the end of the year?

History shows us that December was more often a positive month than a negative one for stocks in recent times, supporting the idea of buying stocks now. That said, though it's interesting to refer to history, the market doesn't always follow historical trends and could surprise us. And the market does look particularly expensive right now.

But don't let this mix of pros and cons for investing right now get you down. The good news is that any time could be the right time to buy stocks, and this is for two reasons.

First, even in an expensive market, you'll find quality stocks that still trade at reasonable prices. And second, if you focus on investing for the long term, you don't have to worry about short-term market fluctuations. Short-term wins or losses won't have much impact on your returns over a period of years.

All of this means that now is a fantastic time to buy stocks if you find interesting opportunities. However, thanks to your long-term investment focus, you don't have to rush into it.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $359,445!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $45,374!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $484,143!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 2, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.