Positive Developments Rolling into September

#TradeTalks: Positive Developments Rolling Into September – Especially from Tech

September is often a weak time for the market; however, over the course of the past month there have been a number of positive developments that should not go unnoticed. Historically, September has been the single worst-performing month for the S&P 500 Index (SPX), the Dow Jones Industrial Average (DJIA), and the Nasdaq Composite (NASD) (source: Stock Trader's Almanac 2018). The Almanac says, “September is when leaves and stocks tend to fall; on Wall Street, it’s the worst month of all.” So far, September 2019 has bucked that historical trend with the major US indices up more than 2% (through 9/9).

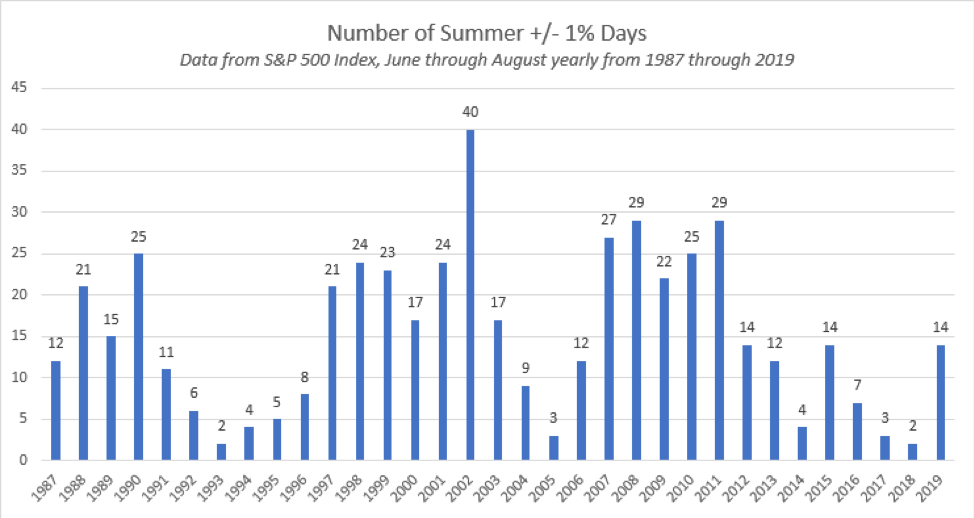

We enter the final four months of 2019 with a positive longer-term picture for US equities which remains the top-ranked asset class in our Dynamic Asset Level Investing (DALI) tool. As a matter of fact, US equities has now continually been the top-ranked asset class for a little over three years, a milestone it reached last month. This not to say the domestic equity market has been perfectly smooth and quiet for that entire time and it has been quite the opposite over the past few months. By some measures, 2019 was the most volatile summer for US equities since 2014, and prior to that 2011, as this summer produced more “volatile days” for the US equity market than any summer in the last five years. We defined “volatile days” as those which produced a move greater than +/- 1% for the S&P 500 and then tallied the number of such days for every summer going back to 1987.

Interestingly, it turns out that the S&P 500 had just one volatile day in July, which came on the last day of the month. However, volatility picked up quite a bit in August with the S&P 500 moving more than 1% on 11 out of 22 trading days during the month, which was the most volatile August since 2011 and brought the total number of volatile days during summer 2019 to 14.

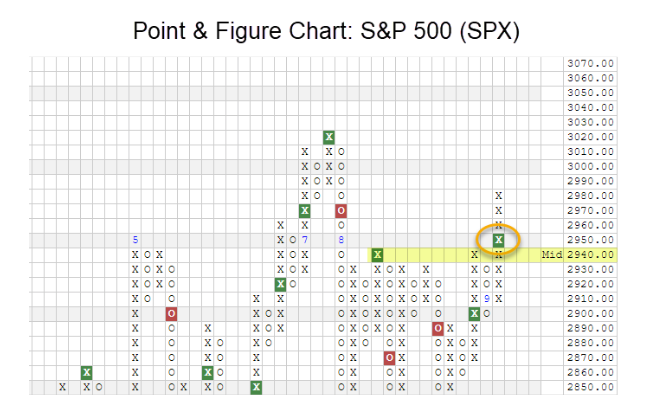

All of the back-and-forth action over the course of the past couple months has led to consolidation on the chart of the S&P 500, which recently culminated in an upside breakout at 2950.

The positive breakout for the S&P 500 can largely be attributed to the continued strength of the technology sector. The reason for this is twofold: Currently, the technology sector accounts for about 22% of the S&P 500’s market cap, the largest weighting of any individual sector, making technology the most important sector in terms of the overall performance of the Index. Technology has also been the best performing broad sector this year, with the Technology Select Sector SPDR Fund [XLK] up more than 30% this year (through 9/9). The Point & Figure chart of XLK also recently showed further positive development with an upside breakout of its own, completing a bullish triangle when it hit $81.

While the technology sector has been carrying the baton, the positive developments do not stop there. Recent market movement has also led to the Bullish Percent for the NYSE (BPNYSE) reversing back up into a column of Xs at 44%. The BPNYSE is a participation indicator, measuring the percentage of securities in the NYSE that are on a current Point & Figure buy signal. After reversing up in January to climb from a low of 16% to 58% in April, the BPNYSE reversed lower amid heightened volatility in May and more recently in August, dropping to 38%. The reversal up on Monday (9/9) leaves the chart in a column of Xs in mid-field position, indicating that we are back on "offense". This reversal follows the Bullish Percent for the Nasdaq-100 (BPNDX), the Bullish Percent for the S&P 500 (BPSPX), and the Bullish Percent for the S&P Midcap 400 (BPMID), which each reversed back up into Xs over the past two weeks.

MORE INFORMATION

- Visit www.nasdaq.com/dorsey-wright

- Click here to learn about our 8 Systematic Relatives Strength SMA/UMA strategies

- Click here for a free 30-day trial of the Nasdaq Dorsey Wright Research Platform, which includes a customized free demo.

Dorsey, Wright & Associates, LLC, a Nasdaq Company, is a registered investment advisory firm. Registration does not imply any level of skill or training.

Unless otherwise stated, the performance information included in this article does not include dividends or all potential transaction costs. Investors cannot invest directly in an index. Indexes have no fees. Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss.

Nothing contained within the article should be construed as an offer to sell or the solicitation of an offer to buy any security. This article does not attempt to examine all the facts and circumstances which may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this article. It is for the general information of and does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation (express or implied), investors should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice.

Dorsey Wright’s relative strength strategy is not a guarantee. There may be times when all assets are unfavorable and depreciate in value. Relative Strength is a measure of price momentum based on historical price activity. Relative Strength is not predictive and there is no assurance that forecasts based on relative strength can be relied upon to be successful or outperform any index, asset, or strategy.