Plug Power, Inc. PLUG announced that it has clinched a deal for 25 megawatts (MW) of proton exchange membrane (PEM) electrolyzer systems from Castellón Green Hydrogen S.L., a joint venture between bp and Iberdrola. PLUG will leverage its solid expertise in the green hydrogen industry to offer its advanced PEM electrolyzer technology for carbon reduction targets.

Plug Power’s electrolyzers utilize PEM stack technology in a modular design, which offers a small footprint with potential for capacity expansion. The electrolyzer’s hydrogen output is capable of instant adjustment based on the electrical input, which makes it ideal for pairing with intermittent renewable resources.

Per the abovementioned deal, Plug Power will supply five of its 5 MW containerized PEM electrolyzers that will help lower the carbon footprint at bp’s Castellón refinery in Valencia, Spain. The electrolyzers will facilitate the production of green hydrogen, replacing part of the refinery’s gray hydrogen production.

This will likely help to mitigate 23,000 tons of carbon dioxide emissions per year at the hydrogen project jointly developed by bp and Iberdrola. The project, which will be developed in phases, has the potential to expand up to two GW of electrolysis capacity.

The company’s strong expertise in providing and installing PEM electrolyzer systems globally is underlined by its successful PEM electrolyzer deployment at the United States’ largest electrolytic liquid hydrogen production plant in Georgia. Also, it has a significant presence in Rochester, NY, with its Gigafactory being one of the biggest PEM manufacturing facilities in the country.

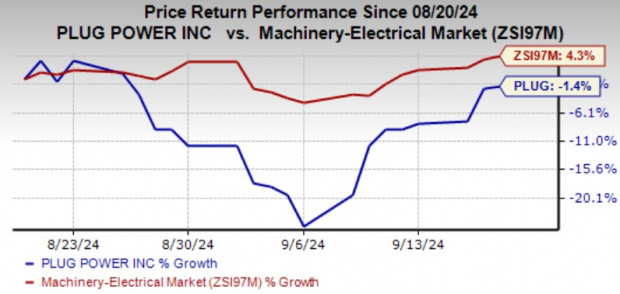

PLUG’s Zacks Rank & Price Performance

Plug Power, with a $1.8 billion market capitalization, currently carries a Zacks Rank #3 (Hold). Going by some estimates that state that the green hydrogen energy market is likely to grow to $30 billion by 2030, Plug Power offers solid long-term growth opportunities.

However, the company has been persistently suffering due to negative gross margins and cash outflows over the past several quarters. This is further evident from PLUG’s poor second-quarter 2024 results despite being a leading hydrogen energy stock.

That being said, PLUG remains focused on reducing cash burn, improving margins and boosting its balance sheet. In the second quarter, it reduced its net cash used in operations and capital expenditures by about 30% and aims to cut expenses further in the second half.

Image Source: Zacks Investment Research

In the past month, the PLUG stock has lost 1.4% against the industry’s 4.3% growth.

Stocks to Consider

We have highlighted three better-ranked stocks from the same space, namely Eaton Corporation plc ETN, Enersys ENS and Zurn Elkay Water Solutions Corporation ZWS, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Eaton delivered a trailing four-quarter average earnings surprise of 4.7%. In the past 60 days, the Zacks Consensus Estimate for 2024 earnings has increased 2%.

Enersys delivered a trailing four-quarter average earnings surprise of 1.5%. In the past 60 days, the consensus estimate for 2024 earnings has increased 2.3%.

Zurn Elkay delivered a trailing four-quarter average earnings surprise of 8.7%. In the past 60 days, the Zacks Consensus Estimate for 2024 earnings has increased 2.5%.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.7% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

Plug Power, Inc. (PLUG) : Free Stock Analysis Report

Enersys (ENS) : Free Stock Analysis Report

Zurn Elkay Water Solutions Cor (ZWS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.