Nokia Corporation NOK has announced a strategic partnership with Telecom Egypt to introduce 5G technology in the Middle-East country for the first time. This collaboration aims to significantly enhance the country's telecommunications infrastructure and accelerate its digital transformation journey.

Under this agreement, Nokia will deploy radio access network (RAN) equipment from its state-of-the-art 5G AirScale portfolio, comprising baseband units and its latest generation of Massive MIMO radios. This portfolio integrates Nokia’s energy-efficient ReefShark System-on-Chip technology to deliver faster speeds, lower latency and greater capacity that will likely help Telecom Egypt’s customers meet their growing demands. Nokia will also offer various professional services, encompassing deployment, integration and network optimization.

The rollout of 5G technology in Egypt promises to deliver a substantial improvement in connectivity capabilities, especially in densely populated areas of the country. This advancement will likely facilitate faster downloads, smoother streaming and enhanced network reliability, thereby driving innovation and operational efficiency across various sectors in Egypt.

The partnership between Nokia and Telecom Egypt marks a significant milestone in Nokia’s journey toward expanding its footprint in the Middle East region. Nokia currently has 319 commercial 5G deals with communications service providers globally.

The 5G portfolio is increasingly gaining traction among enterprise customers. Nokia’s expertise in mission-critical networks is well-established, with deployments of more than 2,600 leading enterprise customers in the transportation, energy, large enterprise, manufacturing, webscale and public sector segments worldwide.

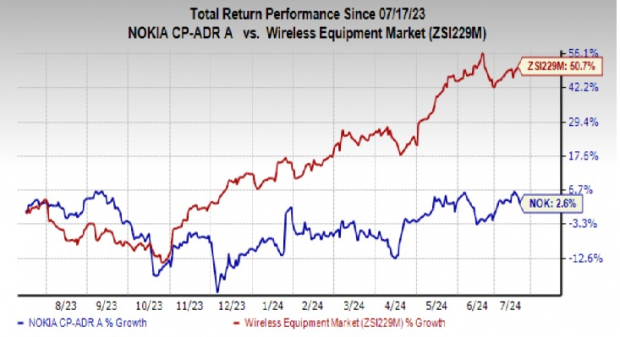

Shares of Nokia have gained 2.6% over the past year compared with the industry’s growth of 50.7%.

Image Source: Zacks Investment Research

Zacks Rank and Other Key Picks

Nokia currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader industry have been discussed below.

Ooma, Inc. OOMA offers cloud-based communications solutions, smart security and other connected services. The company’s smart software-as-a-service and unified-communications-as-a-service platforms serve as a hub for seamless communications and networking infrastructure applications. It currently sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

It delivered a trailing four-quarter average earnings surprise of 8.90%. In the last reported quarter, Ooma delivered an earnings surprise of 27.27%.

Telephone and Data Systems, Inc. TDS, sporting a Zacks Rank of 1, provides wireless products and services, cable and wireline broadband, TV and voice services to approximately 6 million customers in Chicago.

In the last reported quarter, TDS delivered an earnings surprise of 145.45%.

Motorola Solutions, Inc. MSI provides services and solutions to government segments and public safety programs, along with large enterprises and wireless infrastructure services. Currently, Motorola holds a Zacks Rank #2.

It delivered a trailing four-quarter average earnings surprise of 7.54% and has a long-term growth expectation of 9.47%. In the last reported quarter, Motorola delivered an earnings surprise of 11.51%.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>Nokia Corporation (NOK) : Free Stock Analysis Report

Telephone and Data Systems, Inc. (TDS) : Free Stock Analysis Report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

Ooma, Inc. (OOMA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.