MultiPlan Corporation MPLN has partnered with the National Rural Health Association (NRHA) to improve healthcare services in rural communities. NRHA is a nonprofit organization focused on improving the health and well-being of rural Americans. Through advocacy, communications, education and research, NRHA addresses key rural health issues.

MultiPlan and NRHA, combining more than 40 years of expertise with innovative technology and data insights, are positioned to transform rural healthcare. This alliance will provide rural healthcare providers with innovative technology and actionable insights to enhance care quality, reduce costs and boost transparency. Despite nearly 20% of the U.S. population living in rural areas, only 10% of physicians practice there. MultiPlan's efforts aim to address this disparity by improving access to healthcare through innovative solutions and data-driven insights for rural providers.

Likely Trend of MPLN Stock Following the News

Following the news release, shares of MPLN lost 2.3% to $7.22 at yesterday’s closing. The recent partnership is expected to boost the company’s healthcare system for rural Americans.

Despite a decline in price movement, MultiPlan's recent partnership with NRHA is expected to foster positive sentiment by enhancing its commitment to affordability in healthcare. By focusing on identifying medical savings and leveraging advanced technology and data analytics, MultiPlan continues to deliver significant value to healthcare payors, employers, consumers and providers, reinforcing its role in improving the U.S. healthcare system.

Impact of MultiPlan & NRHA Partnership on Rural Healthcare

This partnership addresses key challenges faced by rural healthcare providers, such as staffing shortages, financial pressures and limited access to specialized services for patients in rural communities. By leveraging MultiPlan’s expertise in cost management and technology, along with NRHA's advocacy for sustainable healthcare systems and enhancing financial viability with tech-enabled solutions, the collaboration aims to transform rural healthcare by enhancing provider sustainability, increasing transparency and ensuring that high-quality care is more accessible to rural populations.

The introduction of a solution by MultiPlan, such as the CompleteVue, will further drive these goals. The goal of introducing CompleteVue to rural providers is to enhance rural health networks by reducing healthcare costs and improving access to high-quality care, ensuring it is both maintained and elevated.

More on NRHA’s Partnership for Rural Healthcare

NRHA expressed enthusiasm for the partnership with MultiPlan, aiming to create a robust and sustainable rural healthcare system that meets the needs of communities across the United States.

Market Prospects Favoring MPLN

Per a report in Research And Markets, the healthcare services marketsize is estimated to be $9 trillion in 2024. It is anticipated to reach $10.9 trillion by 2028 at a CAGR of 5%.

The robust growth is likely to be driven by several key factors, including the expansion of telehealth and digital health services, efforts to address healthcare workforce shortages, initiatives to advance health equity, the shift toward value-based care models and changes in reimbursement mechanisms. Major trends expected include increased integration of telemedicine, a focus on patient-centered care, promotion of preventive care and wellness, the rise of personalized medicine and continued healthcare consolidation efforts.

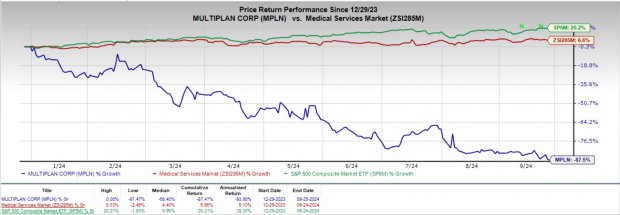

MPLN’s Stock Price Performance

Shares of MultiPlan have plunged 87.5% year to date against the industry’s 6.6% growth. The S&P 500 has risen 20.2% in the same time frame.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, MultiPlan carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Universal Health Services UHS, ATI Physical Therapy (ATIP) and Aveanna HealthcareAVAH. While Universal Health Services sports a Zacks Rank #1 (Strong Buy), ATI Physical Therapy and Aveanna Healthcarecarry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Universal Health Services has an estimated long-term growth rate of 19%. UHS’ earnings surpassed estimates in each of the trailing four quarters, with the average being 14.58%.

Universal Health Services has gained 41.1% compared with the industry's 34.8% growth year to date.

ATI Physical Therapy's earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 7.25%.

ATIP's shares have gained 5.5% year to date compared with the industry’s 18.6% growth.

Aveanna Healthcare's earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 47.5%.

AVAH's shares have surged 104.5% year to date compared with the industry’s15.7% growth.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>Universal Health Services, Inc. (UHS) : Free Stock Analysis Report

MultiPlan Corporation (MPLN) : Free Stock Analysis Report

Aveanna Healthcare Holdings Inc. (AVAH) : Free Stock Analysis Report

ATI Physical Therapy, Inc. (ATIP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.