Merck MRK announced that it has entered into an exclusive licensing deal with China-based privately-held biotech company LaNova Medicines for the latter’s PD-1xVEGF targeting bispecific antibody candidate, LM-299.

Per the terms of the deal, Merck will acquire the global rights to develop and market LM-299. In return, LaNova will receive an upfront cash payment of $588 million. In addition, Merck will have to pay up to $2.7 billion in milestone payments to LaNova.

The deal is expected to be closed by the end of this year, subject to the fulfillment of customary closing conditions, including regulatory approvals.

LaNova is evaluating LM-299 in an early-stage study in China, which is currently enrolling study participants. Merck intends to advance the clinical development of the drug “with speed and rigor for patients in need.”

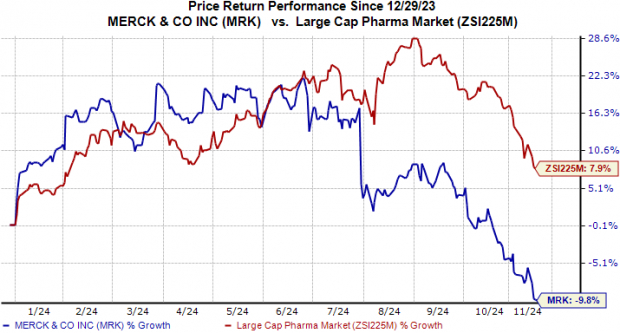

MRK Stock Performance

Year to date, Merck’s shares have lost 9.8% compared with the industry’s 7.9% decline.

Image Source: Zacks Investment Research

Therapies Rivaling Merck’s LM-299

Developing bispecific antibodies that target two proteins, namely PD-1 and VEGF, has been one of the lucrative areas in the treatment of cancer of late. Several smaller biotech companies like Summit Therapeutics SMMT, Instil Bio TIL and BioNTech BNTX are already engaged in developing their respective PD-1/VEGF-targeting antibody candidates, namely ivonescimab, SYN-2510 and BNT327.

Among these, Summit Therapeutics is ahead in terms of clinical development. It recently reported encouraging clinical data from a phase III study that showed that treatment with ivonescimab outperformed Merck’s Keytruda in certain patients with non-small cell lung cancer (NSCLC). Thestudy showed that the SMMT antibody reduced the risk of disease progression or death by nearly half compared with Keytruda.

The above results also make SMMT’s ivonescimab the first drug to achieve a statistically significant improvement compared to MRK’s Keytruda in a head-to-head set-up in a late-stage study in NSCLC indication. Keytruda is also the standard of care in NSCLC indication.

However, the BNTX and TIL candidates are in early or mid-stage development across multiple solid tumors. One of these candidates even carries an edge over ivonescimab. Instil Bio’s SYN-2510 has shown the potential to block both VEGF-A and VEGF-B compared with ivonescimab, which blocks only VEGF-A.

All these deals have one thing in common — all the companies have in-licensed their respective PD-1/VEGF drugs from Chinese biotechs. Summit acquired the exclusive license for ivonescimab from Akeso in 2022 while Instil Bio signed a deal with ImmuneOnco Biopharmaceuticals for SYN-2510 in August. While BioNTech signed a deal for BNT327 with Biotheus last year, BNTX offered to acquire its partner for $800 million this Tuesday.

Our Take

Though the deal seems encouraging, Merck still has a long way to go. The idea behind the LaNova deal is to diversify MRK’s revenue base, which has become highly dependent on Keytruda. In the first nine months of 2024, MRK generated nearly 45% of its total revenues from the drug’s sales. With concerns over Keytruda’s potential loss of exclusivity post-2028, the successful development and potential commercialization of an antibody like LM-299 could help Merck lower its dependence on a single product for growth.

The dual mechanism offered by LM-299 differentiates it from currently available therapies for solid tumors (including Keytruda), as there is a potentially higher expression of both PD-1 and VEGF in tumor tissues compared to the normal tissues in the body.

Merck & Co., Inc. Price

Merck & Co., Inc. price | Merck & Co., Inc. Quote

MRK’s Zacks Rank

Merck currently carries a Zacks Rank #3 (Hold).

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Summit Therapeutics PLC (SMMT) : Free Stock Analysis Report

Instil Bio, Inc. (TIL) : Free Stock Analysis Report

BioNTech SE Sponsored ADR (BNTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.