It’s a busy week ahead on Wall Street. Today, I will cover some of the most important economic and company-specific events for the week ahead.

Stay up-to-date with all quarterly releases:See Zacks Earnings Calendar.

Wednesday: Fed FOMC Minutes

Following the 50-bps rate cut, Wall Street investors will be anxious to tune into what the Fed Chair Jerome Powell and the Fed has to say about the path forward for monetary policy at the FOMC meeting Wednesday at 2:00 PM EST.

Thursday: AMD AI Event

Over the past few years, US equities have defied the odds and climbed the proverbial “Wall of Worry,” shaking off inflation fears, higher interest rates, and escalating wars in Europe and the Middle East. One of the significant drivers that has kept the market strong is the bullish spark that the artificial intelligence (AI) revolution has provided. Last week, OpenAI, which runs ChatGPT, the most popular large language model (LLM) “chatbot”, announced a successful fresh round of funding that values the start up at more than $150 billion. Meanwhile, the AI revolution has reverberated throughout the economy. For instance, nuclear-centric utility company Constellation Energy (CEG) soared after it inked a 20-year deal to provide nuclear power to Microsoft (MSFT) (the largest OpenAI investor).

However, no stock has benefitted more from the AI revolution than Nvidia (NVDA). Nvidia’s market cap has ballooned to more than $3 trillion as big tech companies rush to buildout their AI portfolios. Though Nvidia enjoys the lion’s share of the AI market, Advance Micro Devices (AMD) has a chance to shine this week when it presents its latest AI technology at its Advancing AI event Thursday. Though AMD only has a small share of the AI market, a Bank of America (BAC) analyst pointed out that even a 2-3% market share gain would be a massive catalyst. Meanwhile, Nvidia suffers from a demand problem, not a supply problem. Last week, NVDA CEO Jensen Huang updated investors on Blackwell, Nvidia’s most sophisticated and next generation chip, saying that demand for it is “insane.” If AMD is able to impress the Street with its new AI technology, the company may be able to take advantage of some of that demand.

Thursday: Initial jobless claims, consumer price index

Initial jobless claims and the latest CPI numbers will be released Thursday morning at 8:30 am EST.

Thursday: Tesla Robotaxi Event

Tesla’s (TSLA) most highly anticipated unveiling event will occur this Thursday at the Robotaxi event. Tesla’s visionary CEO Elon Musk has touted the Tesla Robotaxi as the next big bullish catalyst for the company. However, the Robotaxi timeline and the Robotaxi event itself have been pushed back several times in classic Musk fashion, leading to a sluggish stock price until recently. That said, if Tesla can meet or beat expectations, the stock should continue its recent uptrend.

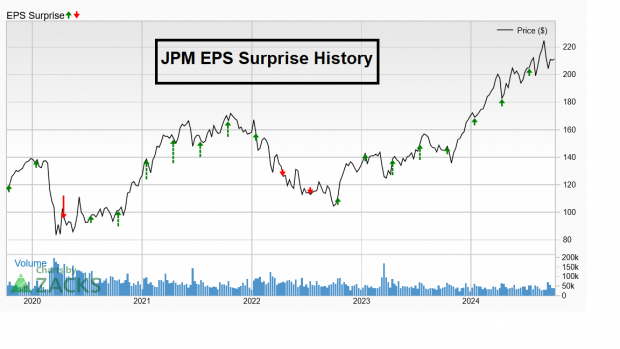

Friday: JP Morgan Earnings

JP Morgan (JPM) will kick off big bank earnings this Friday before the market open. JPM has beat Zacks Consensus Estimates for eight quarters in a row.

Image Source: Zacks Investment Research

Friday: US PPI Inflation, Consumer Sentiment

The US Producer Price Index (PPI) and the latest consumer sentiment numbers will round out the economic data for the week at 8:30 am and 10 am EST respectively.

Other Key Events to Watch:

Potential geopolitical escalations between Israel and Iran, options expiration end of week.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>Bank of America Corporation (BAC) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Constellation Energy Corporation (CEG) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.