At the moment, the Zacks Leisure and Recreation Services Industry is in the top 7% out of 250 Zacks industries. Furthermore, a few Chinese ADRs (American Depository Receipts) are standing out among this top-rated industry in particular.

Starting to benefit from the holiday travel season, here’s a look at two of these leisure stocks that currently boast a Zacks Rank #1 (Strong Buy).

Atour Lifestyle Holdings - ATAT

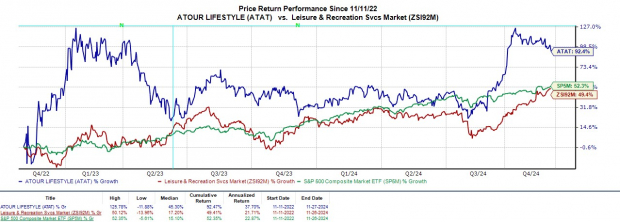

Operating the largest midscale hotel chain in China, Atour Lifestyle Holdings ATAT is worthy of investors' consideration. ATAT shares are attractive in terms of growth and momentum as Atour reported Q3 results last Tuesday with considerable expansion on its top and bottom lines.

Atour’s Q3 earnings of $0.39 a share increased 44% from EPS of $0.27 in the prior-year quarter. This came on Q3 sales of $270.55 million, a 52% increase from $177.37 million a year ago. Furthermore, Atour beat Q3 EPS and sales estimates by 2% respectively with ATAT being one of the hottest IPOs in recent years after going public at the end of 2022.

Image Source: Zacks Investment Research

Trip.com - TCOM

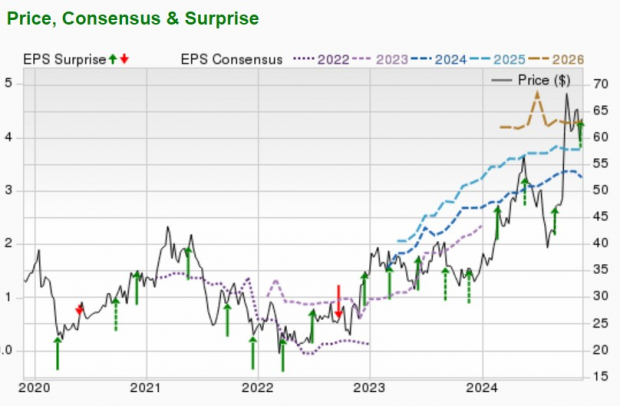

Based in Shanghai, Trip.com TCOM is another Chinese leisure and recreation services company whose stock could have more upside. Offering a one-stop booking service for travel-related packages, Trip.com impressively exceeded Q3 EPS expectations by 37% last Monday with earnings at $1.25 per share compared to Zacks estimates of $0.91.

Trip.com’s EPS spiked from $1.00 in the comparative quarter while Q3 sales of $2.26 billion rose 20% and exceeded estimates of $2.19 billion. TCOM has been a top-performing stock this year, soaring over +70% in 2024 with Trip.com now surpassing earnings expectations for nine consecutive quarters as shown in the EPS surprise chart below.

Image Source: Zacks Investment Research

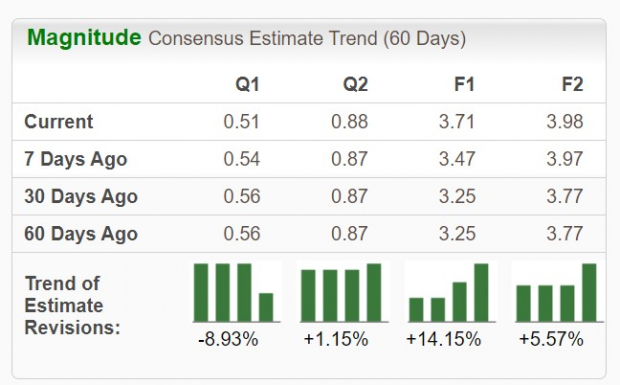

Seeing strong travel demand for the peak holiday season, earnings estimate revisions are noticeably higher for Trip.com over the last 60 days and are nicely up in the last week.

Image Source: Zacks Investment Research

Bottom Line

Like Trip.com, Atour Lifestyle Holdings is benefiting from a positive trend of earnings estimate revisions which suggests theirstellar priceperformances could continue. That said, it would be no surprise if these top leisure stocks keep soaring through the holiday season.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.1% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Trip.com Group Limited Sponsored ADR (TCOM) : Free Stock Analysis Report

Atour Lifestyle Holdings Limited Sponsored ADR (ATAT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.