Here's a quick recap of the crypto landscape for Friday (February 6) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ether and altcoins, along with a round-up of key cryptocurrencymarket news

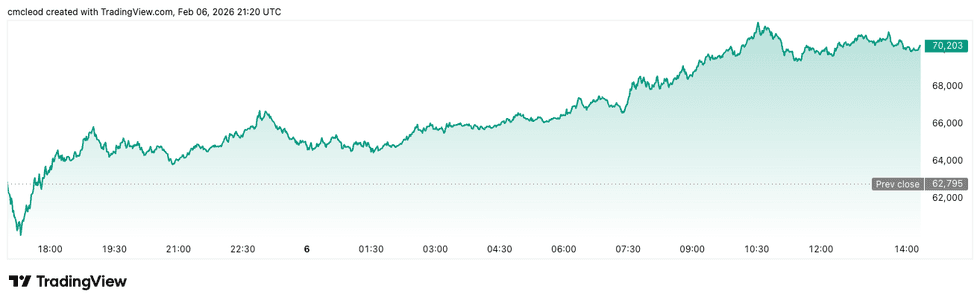

Bitcoin (BTC) was priced at US$70,178.66, up by 11.3 percent over 24 hours.

Chart via TradingView.

Bitcoin price performance, February 6, 2026.

Despite Friday's gains, Bitcoin has fallen over 14 percent this week to lows below US$62,000.

Antonio Di Giacomo, senior market analyst at XS.com, told the Investing News Network via email that the cryptocurrency's sharp price decline confirms a structural shift from a market dominated by speculation and leverage to one focused on capital preservation and adjustment across risk assets.

Bitcoin has stopped behaving as an alternative safe-haven asset and has realigned with the risk asset cycle. Its high correlation with traditional financial markets, including a broad selloff in technology stocks, precious metals and equities, suggests a scenario of systemic stress and scarce liquidity.

Downward pressure intensified after key technical levels were broken, causing nearly US$770 million in leveraged long positions to be liquidated in 24 hours, suggesting the market's "cleansing phase" is ongoing.

The decline was exacerbated by a strong US dollar and rising bond yields, which reduced the appeal of non-yielding assets like cryptocurrencies, prompting a rotation into defensive assets.

In the short term, price action will be limited and vulnerable to renewed selling pressure as long as restrictive financial conditions and a defensive tone prevail in global markets. Stabilization requires an improvement in global financial conditions and Bitcoin's ability to rebuild solid technical support.

Ether (ETH) was priced at US$2,052.03, up by 10 percent over the last 24 hours.

Altcoin price update

- XRP (XRP) was priced at US$1.46, up by 25.2 over 24 hours.

- Solana (SOL) was trading at US$87.37, up by 10.4 percent over 24 hours.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.