GE Vernova Inc. GEV stock has skyrocketed since its April debut. Wall Street and investors have fallen in love with GEV because GE Vernova is a pure-play bet on the energy transition and technology giants like Microsoft going all-in on nuclear energy to fuel their AI expansion efforts.

See the Zacks Earnings Calendar to stay ahead of market-making news.

It might be time for investors to buy GEV stock and hold it for the long haul. GE Vernova is set to release its Q3 earnings results on October 23.

Nuclear and Energy Transition Stocks Will Power the Economy and the AI Boom

There are very good reasons that three of the top five performing S&P 500 stocks in 2024 are nuclear energy companies and broader electrification plays: Vistra, Constellation Energy, and GEV Vernova—all three of these stocks are currently held in the Zacks Alternative Energy Innovators service.

Wall Street realized a few years ago that the AI revolution required a ton of energy. Investors began to gravitate to nuclear and energy transition stocks that will power the economy and AI. Constellation Energy’s CEG deal with Microsoft (announced on September 20) cemented part of the nuclear bull case: nuclear energy will fuel the AI boom.

Nuclear energy and uranium stocks have soared since Constellation Energy signed a 20-year power purchase agreement with Microsoft MSFT. Amazon and many other tech giants are also racing to secure power agreements from nuclear energy and non-fossil fuel companies.

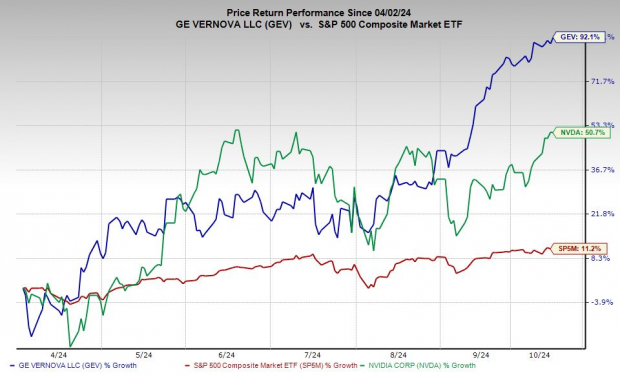

Image Source: Zacks Investment Research

Data centers could account for 10.9% of U.S. electricity demand by 2030 compared to 4.5% today, according to Citi analysts.

The U.S. power grid and energy ecosystem are in the early years of a multi-decade revamp and massive expansion to support the energy transition, electrification, reshoring, the AI revolution, and beyond.

Nuclear energy companies are poised to be the stars of the global energy transition.

Why Investors Should Buy GEV Stock as a Nuclear Energy and AI Play

GE Vernova went public in April after General Electric completed its separation into three companies: GE Aerospace (GE), GE HealthCare (GEHC), and GE Vernova.

GEV is “singularly focused on accelerating the energy transition,” according to CEO Scott Strazik. GE Vernova is a pure-play energy transition investment, spanning electrification, nuclear energy, and beyond.

GE Vernova reports via three business segments: Power, Wind, and Electrification. GE Vernova helps generate approximately 25% of the world’s electricity via its gas and wind turbines, leading-edge electrification technology, and more.

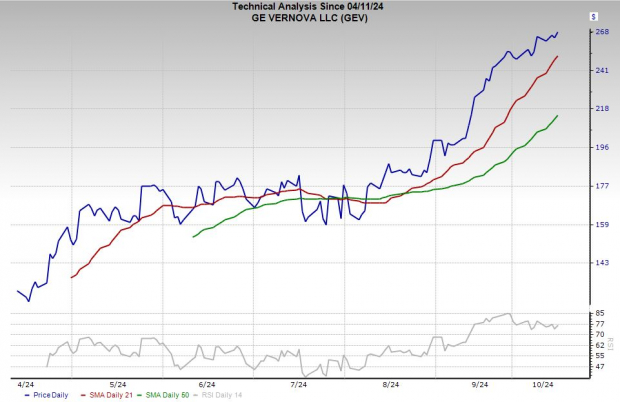

Image Source: Zacks Investment Research

GEV’s steam power segment provides nuclear turbine technologies and services for all reactor types. GEV’s Hitachi Nuclear Energy division is a leading provider of advanced nuclear reactors, fuel, and nuclear services GEV’s chief executive recently told the Wall Street Journal that “gigawatts upon gigawatts of nuclear capacity” are going to be added every year.

The U.S. Department of Energy selected GE Vernova earlier this month to help build out a key part of the next-gen nuclear and uranium industry.

GE Vernova, along with several other cutting-edge nuclear companies, will “compete for work to provide deconversion services and help secure domestic high-assay low-enriched uranium for advanced reactors to strengthen America’s leadership in nuclear energy.”

The current fleet of nuclear reactors runs on uranium fuel enriched up to 5%. HALEU (High-Assay Low-Enriched Uranium) is enriched between 5% and 20% and is required for the next-gen small modular reactors (SMRs).

Other Bullish Reasons to Buy GEV Stock

GEV’s Electrification backlog grew 35% YoY to $4.8 billion in Q2, with its Power unit up 30% to $5.0 billion, helping GE Vernova provide upbeat guidance. Wall Street also cheered reports that GEV plans to slash the size of its struggling offshore wind business as inflation and supply chain challenges plague the industry.

GEV is projected to grow sales by 5% in 2024 and 6% next year. GE Vernova is projected to roughly double its adjusted earnings in 2025 from our $3.19 FY24 estimate to $6.19 a share.

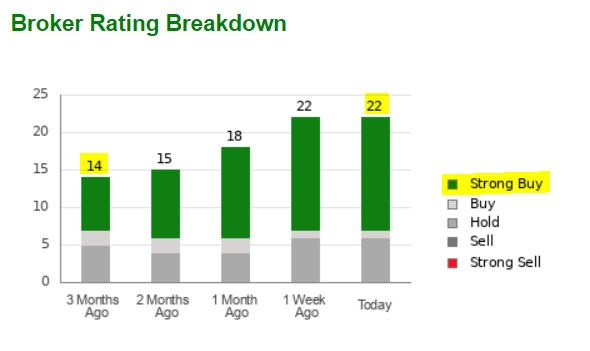

GE Vernova’s earnings outlook for FY25 and FY26 has surged. This backdrop has seen more Wall Street analysts start coverage of GEV stock. GEV has 22 brokerage recommendations at Zacks vs. 14 three months ago, with 70% coming in at “Strong Buys.”

Image Source: Zacks Investment Research

GE Vernova is the fifth-best performing S&P 500 stock in 2024, up 90% since its debut. GEV has outclimbed Nvidia and Vistra VST since early April, boosted by its 50% surge in the past three months.

GEV trades at fresh highs. GE Vernova stock might be a bit overheated. Any pre- or post-earnings release pullback to GE Vernova’s 21-day moving average (or 50-day) would mark a screaming buy opportunity. That said, long-term investors shouldn’t attempt to time stocks exactly.

GE Vernova is set to release its Q3 earnings results on October 23.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Constellation Energy Corporation (CEG) : Free Stock Analysis Report

Vistra Corp. (VST) : Free Stock Analysis Report

GE Vernova Inc. (GEV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.