Hershey Company Overview

Zacks Rank #5 (Strong Sell) stock Hershey (HSY), which is the largest chocolate manufacturer in North America and the global leader in chocolate and non-chocolate candy. Beyond chocolate, Hershey manufactures pantry items like baking ingredients, toppings and beverages, gum, and snack mixes. Though Hershey is the dominant player in the chocolate industry, growth has slowed, margins are shrinking, and a Trump administration appointee is a threat to the business.

Trump Taps RFK for HHS

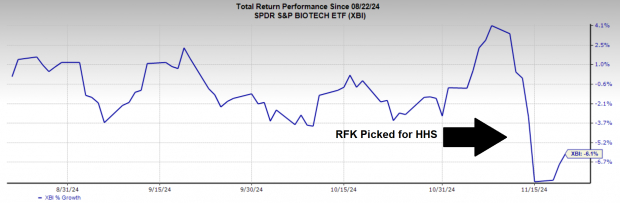

The overwhelming Republican victory in this year’s elections will have consequences far beyond politics. To understand how, investors need not look further than the SPDR S&P Biotech ETF (XBI) performance after President-elect Donald Trump announced that he would pick former presidential candidate Robert F. Kennedy Jr. to head the Department of Health and Human Services (HHS). Once the news broke that RFK would oversee HHS, XBI flushed nearly 12% in a single week.

Image Source: Zacks Investment Research

Kennedy, who is against biotech advertising on television and known for his controversial stance on vaccines, is seen as a threat to biotech companies. However, if you peel back the onion further, Kennedy could have an impact that stretches beyond biotech.

“Processed Foods are Poison”

While RFK has several controversial beliefs, one of his lesser controversial ideas is that processed foods harm Americans. The majority of Americans are obese due to fast food consumption in restaurants like McDonald’s (MCD). Meanwhile, RFK pointed out that recently that Kellanova (K), the Fruit Loop cereal maker formerly known as Kellog’s, uses several more harmful ingredients in its U.S. cereals compared to international cereals. If RFK gets his way, processed food giants like Hershey may be forced to use more expensive ingredients and change their recipes which would create a bearish headwind.

Market Environment: Value Stocks are Out of Favor

Currently, Wall Street investors are favoring risk-on areas of the market, such as Bitcoin, which is encroaching on $100,000 for the first time in its history. The relative price weakness in HSY shares is evidence that investors are in no rush to be in safe-haven stocks. Though the S&P 500 Index is up 26% year-to-date, HSY shares are down nearly 10%.

Image Source: Zacks Investment Research

High Cocoa Prices Hurt HSY

Cocoa, HSY’s most essential ingredient, has seen prices increase significantly, causing margin pressures for the company.

Image Source: FRED

Bottom Line

With safe haven value stocks out of favor, rising cocoa prices, shrinking margins, and a new HHS head, Hershey stock is an avoid.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>McDonald's Corporation (MCD) : Free Stock Analysis Report

Hershey Company (The) (HSY) : Free Stock Analysis Report

Kellanova (K) : Free Stock Analysis Report

SPDR S&P Biotech ETF (XBI): ETF Research Reports

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.