Ally Financial Overview

Zacks Rank #5 (Strong Sell) stock Ally Financial (ALLY) is a player in the online financial services sector that provides customers a range of banking and loan offerings. The company mainly focuses on auto loans, but its business extends to banking facilities, mortgages, investment options, and insurance coverage. ALLY is best known for providing top-notch service and cutting-edge technology solutions.

Deteriorating Credit Quality is a Headwind

The macroeconomic climate is a causing an issue for ALLY Financial, and the company anticipates that delinquencies will increase significantly (+7.4%) in the short term. Debt levels are reaching record highs in the United States, with the average consumer debt soaring to ~$37k.

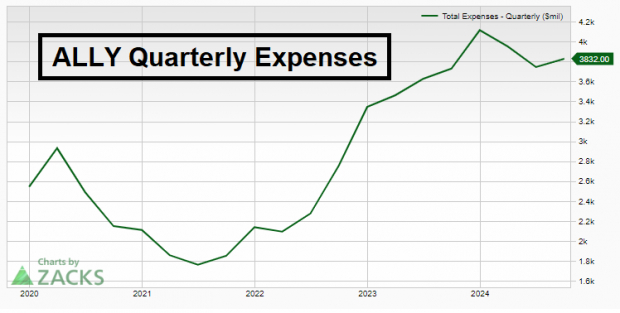

Operating Expenses are Increasing

Mounting operating expenses will likely hurt Ally’s bottom-line growth. Over the past five years, the company’s expenses have recorded a compound annual growth rate (CAGR) of nearly 10%, driven by higher compensation and benefit costs.

Image Source: Zacks Investment Research

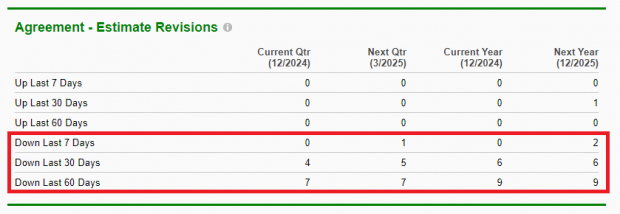

With several analysts tracked by Zacks revising earnings estimates lower for 2025, investors want to see costs dropping or at least staying relatively stagnant.

Image Source: Zacks Investment Research

With the company launching products and expanding into newer areas of operation, expenses are expected to remain elevated. Our estimate for total non-interest expenses reflects a CAGR of 2.4% by 2026.

Negative Earnings ESP Score

Zacks Earnings ESP (Expected Surprise Prediction) tracks the history of recent earnings revisions. A negative ESP score reveals the company has experienced negative recent analyst revisions. When a company has a negative ESP score and a Zacks Rank #3 or worse (like ALLY), it tends to miss earnings expectations and underperform its peers.

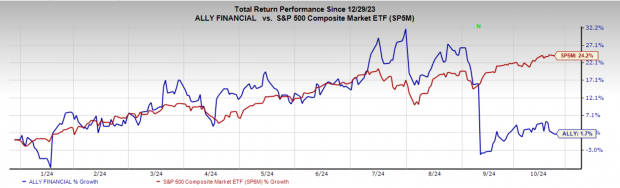

Relative Weakness

ALLY shares are exhibiting relative weakness compared to the S&P 500 Index. Year-to-date, the S&P has gained 24%, while ALLY shares have gained a futile 1.7%. Meanwhile, shares are carving out a classic bear flag chart pattern.

Image Source: Zacks Investment Research

Bottom Line

Increasing expenses and macro headwinds are reasons to avoid Ally Financial.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpAlly Financial Inc. (ALLY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.