Markets continued to fall today as Friday’s jobs report showed the US labor force continued to cool while the unemployment rate rose to 4.3%, its highest peak since 2021.

Also extending this week’s selloff was underwhelming Q3 guidance from several big tech firms. However, the utility sector may be one to consider amid heightened market volatility and the potential resurgence of broader economic fears.

That said, here are three top utility stocks that have essential services and generous dividends to support investors.

Image Source: Federal Reserve Economic Data

American Electric Power AEP

We’ll start with American Electric Power which is one of the largest integrated utility providers in the US. AEP provides electricity, natural gas, and other commodities to over 5.6 million customers.

Along with its steady top and bottom line growth, AEP offers a 3.48% annual dividend yield and trades at a reasonable 18.1X forward earning multiple.

Image Source: Zacks Investment Research

Evergy EVRG

Operating on a smaller scale, Evergy is still worthy of investors' consideration as the largest electricity provider in Kansas and Missouri with more than 1.7 million customers.

Evergy’s increased probability is intriguing as earnings per share is expected to spike 8% this year with fiscal 2025 EPS projected to increase another 5% to $4.04. Plus, EVRG stands out in terms of valuation at 15.5X forward earnings which is a nice discount to the S&P 500’s 22.9X and slightly beneath the Zacks Utility-Electric Power Industry average of 15.9X.

More enticing, Evergy’s 4.3% annual dividend yield impressively tops its industry average of 3.43% and the S&P 500’s 1.28% average.

Image Source: Zacks Investment Research

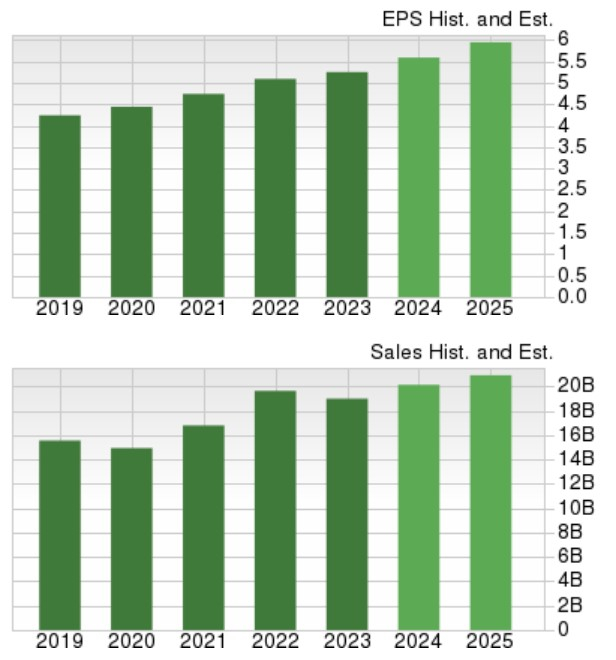

Exelon EXC

Last but not least is Exelon which provides power to over 10 million customers throughout the US with a few of its noteworthy subsidiaries being ComEd and Pepco.

Like American Electric Power, Exelon’s robust top line is steadily expanding with sales projections over $20 billion. Furthermore, as a leading utility company, Exelon’s valuation is very reasonable at 15.7X forward earnings with EPS expected to increase 2% in FY24 and projected to rise another 7% next year to $2.61 per share.

Exelon also trades at 1.7X sales compared to the Zacks Utility-Electric Power P/S ratio of 2.8X and the S&P 500’s 4.6X. The cherry on top is that Exelon's dividend is currently at 3.97%.

Image Source: Zacks Investment Research

Bottom Line

At the moment, these utility stocks all sport a Zacks Rank #2 (Buy). With utility stocks generally being less volatile due to their essential services now may be an ideal time to invest in American Electric Power, Evergy, and Exelon given their attractive valuations and generous dividends.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpExelon Corporation (EXC) : Free Stock Analysis Report

American Electric Power Company, Inc. (AEP) : Free Stock Analysis Report

Evergy Inc. (EVRG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.