The Q3 earnings season looks to be positive, with earnings growth expected to be strong and again underpinned by a robust showing from the Tech sector.

Three notable companies – Progressive PGR, Nike NKE, and Domino’s Pizza DPZ – are all on the reporting docket in the upcoming weeks.

Let’s take a closer look at each.

Nike Looks to Bounce Back

Nike shares faced considerable pressure following the release of its latest quarterly results due to an inability to capture consumers’ wants. Still, the stock is heading into the release with nice momentum, with shares up 5% over the last month and perhaps reflecting a trend reversal after a disappointing start to the year.

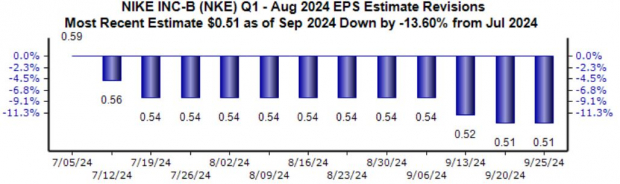

Analysts have been notably bearish for the upcoming print, with the $0.51 Zacks Consensus EPS estimate down nearly 14% since July and suggesting a 45% pullback year-over-year. Sales expectations have followed the same path, with NKE forecasted to see its sales fall nearly 3% from the year-ago period.

Image Source: Zacks Investment Research

The guidance and commentary here will be key for post-earnings reactions, which have largely been disappointing as of late. Nonetheless, the company remains focused on capturing consumers’ eyes again, and a reacceleration of sales growth would bode highly favorably for share performance from a near and long-term perspective.

PGR Maintains Share Momentum

Progressive shares have been rockstar performers in 2024, gaining nearly 60% on the back of robust quarterly results. The stock sports the highly-coveted Zacks Rank #1 (Strong Buy), and its earnings outlook for the quarter to be reported (shown below) is a big reason why.

The $3.22 Zacks Consensus EPS estimate suggests 54% EPS growth year-over-year, whereas expected sales of $18.9 billion reflects 20% growth from the year-ago period.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Can DPZ Get Its Mojo Back?

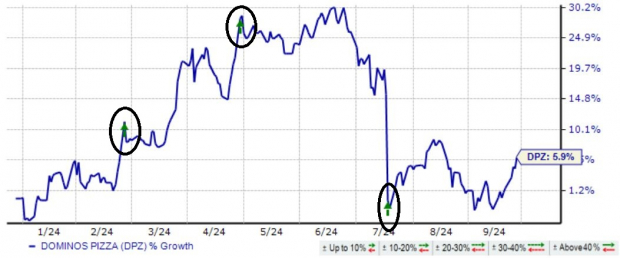

Like NKE, DPZ shares plunged following its latest set of quarterly results, perhaps a reflection of profit-taking after a big run. As shown below, the release broke a back-to-back streak of positive post-earnings reactions.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Earnings and revenue expectations have primarily remained stagnant over recent months, with the company expected to see a 12% decline in EPS alongside a 7% boost to quarterly sales. The sales boost paired with lower earnings reflects a profitability crunch, something to keep in mind.

Similar to NKE, DPZ’s results will give us a small glance into the current state of the consumer, which has shown signs of moderation as of late.

Bottom Line

The Q3 earnings cycle is just around the corner, with several notable companies – Progressive PGR, Nike NKE, and Domino’s Pizza DPZ – all on the reporting docket in the upcoming weeks.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

NIKE, Inc. (NKE) : Free Stock Analysis Report

Domino's Pizza Inc (DPZ) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.