Transaction Reporting for Non-Investment Firms

Reporting for exchange members not subject to MiFIR

Full File Solution

The full file solution is used with INET/Genium INET for all markets/NDTS and is an XML file formatted according to ESMA guidelines. The file is submitted by the member to Nasdaq. Nasdaq validates the file and sends it to FSA.

Short Code Enrich

The short code enrichment solution is used with Genium INET, commodities. Short codes are submitted with each order or trade entry to supply additional information needed for the regulatory transaction reporting.

This solution is suited for members with mainly proprietary trading. If the company has significant post-trade processing, the full file submission solution will be a better fit.

Nasdaq MiFID II TRS

Investment firms trading on Nasdaq markets as well as non-members have access to support with their MiFID II transaction reporting.

Depending on the specific need and trading model, Nasdaq provides support with drafting TRS reports. Nasdaq can also transfer a customer-provided file or spreadsheet into a correctly formatted and validated XML report and return it to the customer or approved reporting mechanism (ARM) for further submission to the relevant FSA.

Similarly, feedback files from the FSA to the customer that are delivered to Nasdaq can be converted from complicated XML status reports to easily accessible and understandable data through the TRACK reporting system. TRACK offers customers the ability to easily correct and resend their reports.

Position Reporting

MiFID II-compliant position reporting for the commodities market

Nasdaq Commodities offers both FCA schema position and automated reporting.

REMIT Reporting

Efficient reporting of wholesale energy contracts to ACER and Equias

Order Record Keeping

MiFID II obligation to collect and maintain data

Approach to Collecting Client and Personal Data

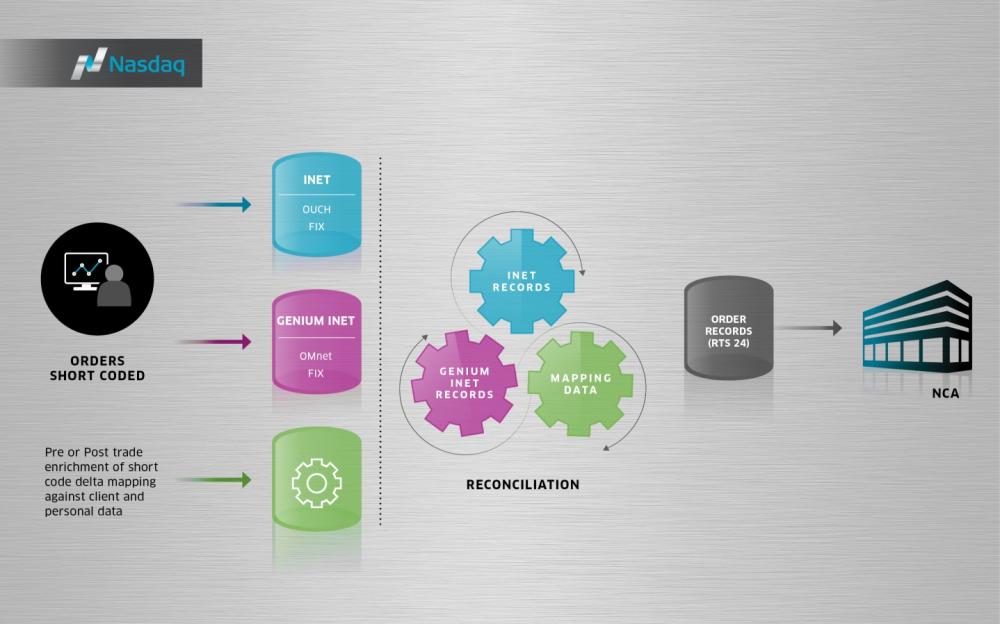

With regards to the mechanisms of record keeping of orders and transactions, Nasdaq took into consideration a number of factors, including regards for the sensitive nature of the data, consequences of the potential impact of additional data on latency and considerations for a solution synchronized with the industry. Nasdaq's approach can be described in the graphic.

Nasdaq implemented solutions for its equity (INET) and derivatives markets (Genium INET) where client and personal data is identified through short codes at order entry. Prior to order entry or at the latest by the end of the day, members need to supply information mapping each short code to an LEI, national ID or algorithm ID to allow Nasdaq to complete its order records in the format required by MiFIR. Members are expected to use persistent short codes to represent legal entities and physical persons over time, which means that only the delta mapping of short codes added during the day needs to be uploaded to Nasdaq on a daily basis.

Contact Exchange Services: +46 8 405 7700 or EMO@Nasdaq.com

Resource Center

-

- Nasdaq Guide Transaction Reporting Version 1.4 Open

- Nasdaq Commodities Position Reporting Open

- Nasdaq Member Portal Short Code Management CSV File Format Specification Open

- ESMA Guidelines for the Full File Solution Open

- TVTIC Manual Open

- Venue Product Codes and Definition of Spot Month Open

- Venue Product Codes List Open

- Standard FCA Schema Open

- Nasdaq Guide on Order Record Keeping v.2.3 - Valid from September 16, 2022 Open

- Short Code Administration in the Member Portal Open

- Nasdaq Member Portal Short Code Management API Open

- Member Portal SFTP Access Guide Open