TeraWulf’s WULF prospects are expected to benefit from its growing footprint in the high-performance computing (HPC) domain, thanks to its latest joint venture (JV) with Fluidstack, a premier AI cloud platform that builds and operates HPC clusters. The JV, in which WULF holds a majority of 51% share, will develop and deliver 168 MW of critical IT load at the Abernathy, TX, campus. The facility is expected to be delivered in the second half of 2026.

The 25-year JV promises roughly $9.5 billion in contracted revenues and TeraWulf’s contracted HPC platform now exceeds 510 MW of critical IT load. Under TeraWulf’s existing deal with Fluidstack, the former will deliver more than 360 MW of critical IT load at its Lake Mariner data center campus in Western New York. The Lake Mariner facility can expand up to 500 MW in the near term and up to 750 MW with targeted transmission upgrades. The existing deal represents roughly $6.7 billion in contracted revenues, with total contract revenues expected to hit $16 billion.

WULF’s growing HPC footprint is expected to drive top-line growth. As per the company’s preliminary third-quarter 2025 results, revenues are expected to be between $48 million and $52 million, representing roughly 84% year-over-year growth. WULF now expects adjusted EBITDA $15 million and $19 million.

WULF Faces Tough Competition

TeraWulf faces stiff competition from the likes of IREN Limited IREN and Applied Digital APLD in the bitcoin mining and HPC markets.

IREN Limited has doubled its AI cloud capacity to 23k GPUs through the purchase of an additional 12.4k GPUs for roughly $674 million. IREN now expects to achieve $500 million in AI Cloud annualized run-rate revenue (ARR) by the first quarter of fiscal 2026. IREN is on track to achieve $1.25 billion in annualized revenues, with roughly $1 billion coming from bitcoin mining, and $200-$250 million from AI Cloud (by December 2025).

Applied Digital is benefiting from robust demand for data center infrastructure and the growing focus on energy efficiency. Strong spending by hyperscalers, which is expected to be $500 billion in 2027, bodes well for APLD. Applied Digital’s Data Center Hosting business provides energized infrastructure services to crypto mining customers. The company currently operates sites in Jamestown and Ellendale, ND, with a total hosting capacity of approximately 286 megawatts (MWs).

WULF’s Share Price Performance, Valuation & Estimates

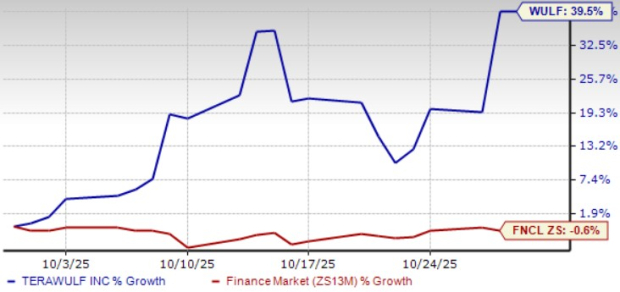

TeraWulf shares have appreciated 39.5% in the past month, outperforming the broader Zacks Finance sector’s decline of 0.6%.

WULF Stock’s Performance

Image Source: Zacks Investment Research

The WULF stock is trading at a premium, with a trailing 12-month price/book of 39.4X compared with the industry’s 4.28X. TeraWulf has a Value Score of F.

WULF Valuation

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for 2025 earnings is pegged at a loss of 36 per share, wider by 3 cents over the past seven days. The company reported a loss of 19 cents per share in 2024.

TeraWulf Inc. Price and Consensus

TeraWulf Inc. price-consensus-chart | TeraWulf Inc. Quote

TeraWulf currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market's next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don't build. It's just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>Applied Digital Corporation (APLD) : Free Stock Analysis Report

IREN Limited (IREN) : Free Stock Analysis Report

TeraWulf Inc. (WULF) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.