USA Rare Earth, Inc.’s USAR business subsidiary, Less Common Metals (‘LCM’), recently partnered with Solvay and Arnold Magnetic Technologies Corp. (Arnold) to provide a stable and premium-quality source of rare-earth materials. Arnold is a subsidiary of Westport, CT-based Compass Diversified (CODI).

Per the deal, LCM will offer Arnold rare-earth metals to produce advanced permanent magnets. This partnership is likely to boost the rare-earth supply chain across the US and Europe, helping the manufacturers and key industries to establish reliable access to these critical materials. A steady supply of rare earth materials will benefit several industries, including aerospace, automotive, defense and renewable energy. By creating a reliable supply chain across the US and Europe, this collaboration is expected to reduce dependence on China.

It is worth noting that USAR completed the acquisition of LCM in November 2025. LCM is a renowned producer of rare-earth metals and alloys, with expertise in samarium, samarium cobalt and neodymium praseodymium materials. It supplies strip cast alloys for magnet manufacturing companies and serves global customers across the defense and automotive sectors.

Notable Partnerships of USAR’s Peers

Among its major peers, MP Materials Corp. MP recently formed a joint venture with the U.S. Department of War and Saudi Arabia’s mining company (Maaden) to build a rare-earth refinery in Saudi Arabia. MP Materials will use its technical expertise to process rare-earth materials for the US, Saudi Arabia and allied manufacturing and defense industries. MP Materials’ joint venture will strengthen global supply chains, expand its refining capacity and support U.S.-Saudi economic ties.

In August 2025, USAR’s peer, Energy Fuels Inc. UUUU, signed an MOU with Vulcan Elements to supply rare earth oxides for U.S.-based magnet production. Per the deal, Energy Fuels will provide NdPr and Dy oxides to Vulcan from its White Mesa Mill in Utah for quality verification and future long-term supply. Energy Fuels is producing high-purity, ex-China rare earth oxides at a commercial scale, supporting a domestic rare earth magnet supply chain.

USAR’s Price Performance, Valuation and Estimates

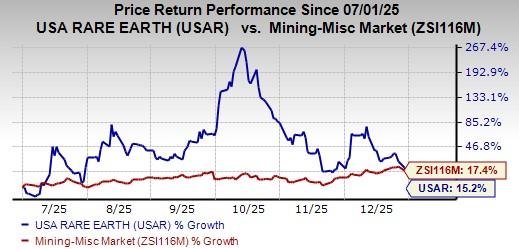

Shares of USAR have surged 15.2% in the past six months compared with the industry’s growth of 17.4%.

Image Source: Zacks Investment Research

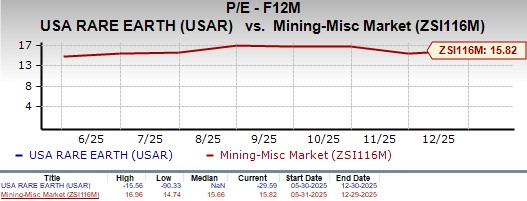

From a valuation standpoint, USAR is trading at a forward price-to-earnings ratio of negative 29.59X against the industry’s average of 15.82X. USA Rare Earth carries a Value Score of F.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for USAR’s 2025 earnings has remained steady over the past 30 days.

Image Source: Zacks Investment Research

The company currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Naming Top 10 Stocks for 2026

Want to be tipped off early to our 10 top picks for the entirety of 2026? History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2026. Don’t miss your chance to get in on these stocks when they’re released on January 5.

Be First to New Top 10 Stocks >>MP Materials Corp. (MP) : Free Stock Analysis Report

Energy Fuels Inc (UUUU) : Free Stock Analysis Report

USA Rare Earth Inc. (USAR) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.