Rigel Pharmaceuticals RIGL had an encouraging year in 2025. The company is yet to report its fourth-quarter and full-year 2025 results, but preliminary figures released last month point to another strong finish — driven primarily by the lead marketed drug Tavalisse. The two oncology assets, namely Gavreto and Rezlidhia, provide support to RIGL’s top-line momentum.

Based on the unaudited numbers, full-year 2025 product sales are expected to rise 60% year over year to $232 million, exceeding the prior $225-$230 million guidance. This outperformance reflects sustained demand for all marketed drugs.

Tavalisse remained the key driver of revenues for Rigel, generating $158.9 million during the full year, reflecting a 52% year-over-year increase and accounting for more than half of the company’s top line. This drug is approved to treat adults with low platelet counts due to chronic immune thrombocytopenia (ITP) who have had an insufficient response to prior treatment. Continued strong new patient demand supported the performance, reinforcing the drug’s position as the foundation of Rigel’s commercial portfolio.

The company’s two oncology assets added incremental momentum. The RET-gene targeting drug Gavreto contributed $42.1 million in quarterly sales, while the acute myeloid leukemia (AML) drug Rezlidhia added $31 million. Though smaller in scale compared to Tavalisse, these therapies are gradually expanding and diversifying Rigel’s revenue base.

Rigel projects 2026 net product sales of $255-$265 million, suggesting continued portfolio momentum. The company also expects to achieve positive net income for the full year while continuing to fund existing and new clinical development programs.

Competition in Target Markets

Rigel Pharmaceuticals faces stiff competition from Big Pharma in its target markets.

The company is currently riding on the success of Tavalisse, which faces stiff competition from Sanofi’s SNY novel BTK inhibitor Wayrilz that was approved for a similar indication in ITP last year. Though both the RIGL and SNY medications are built on different mechanisms, a successful launch of Wayrilz is likely to pose a significant threat to Tavalisse, given the resources available for a large drugmaker like Sanofi.

Gavreto competes in the RET fusion-positive non-small cell lung cancer (NSCLC) and advanced thyroid cancer markets against Eli Lilly’s LLY Retevmo, another RET inhibitor with an established presence.

RIGL’s Price Performance, Valuation and Estimates

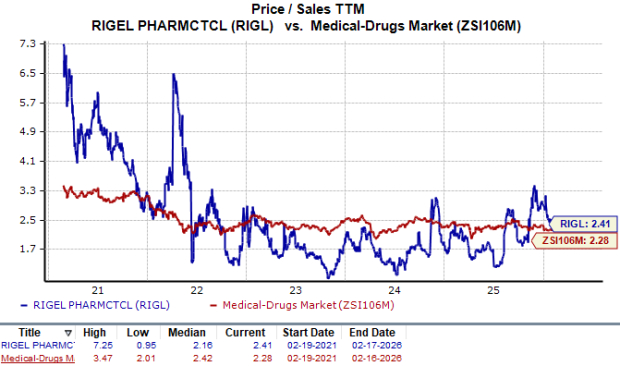

Shares of Rigel Pharmaceuticals have outperformed the industry in the past year, as seen in the chart below.

Image Source: Zacks Investment Research

From a valuation standpoint, RIGL is trading at a slight premium to the industry. Based on the price-to-sales (P/S) ratio, the stock trades at 2.41 times trailing 12-month sales, above the industry average of 2.28 times.

Image Source: Zacks Investment Research

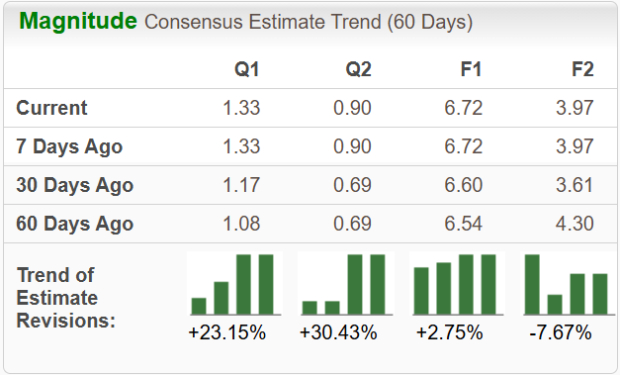

Estimates for Rigel Pharmaceuticals’ 2025 and 2026 EPS have increased during the past 30 days.

Image Source: Zacks Investment Research

Rigel Pharmaceuticals currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in the coming year. While not all picks can be winners, previous recommendations have soared +112%, +171%, +209% and +232%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Sanofi (SNY) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Rigel Pharmaceuticals, Inc. (RIGL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.