Keurig Dr Pepper KDP is well-positioned from its continued brand strength, significant pricing, solid performance in its cold beverages and strong market share gains. This led to the solid first-quarter 2023 results, wherein the top line and bottom line surpassed the Zacks Consensus Estimate and grew year over year.

Factors to Note

Keurig Dr Pepper has been gaining traction in the Refreshment Beverage segment for quite some time now. The division reported a 12.7% increase in sales for the first quarter, gaining from higher net price realization of 12.5% and an increase in volume/mix of 0.2% year over year. The segment benefited from strong traction from recent innovation, most notably Dr Pepper Strawberries & Cream, effective in-market execution and its recently announced sales and distribution partnership for C4 Energy. The continuation of this trend may help the company's bottom line in the short term.

The company witnessed a strong in-market performance in the Liquid Refreshment Beverages category during the first quarter. Its retail dollar consumption grew 13.6%, with market share expansion above 88% of KDP's cold beverage portfolio. This mainly reflected strength in CSDs, seltzers, energy, apple juice, coconut waters and fruit drinks.

Also, strength in Dr Pepper, Canada Dry, A&W, Sunkist, Squirt and Crush CSDs, Polar seltzers, Vita Coco, C4 Energy, Mott's and Hawaiian Punch aided the results. In coffee, Keurig Dr Pepper’s manufactured shares were solid at 81%, driven by higher consumer mobility year over year.

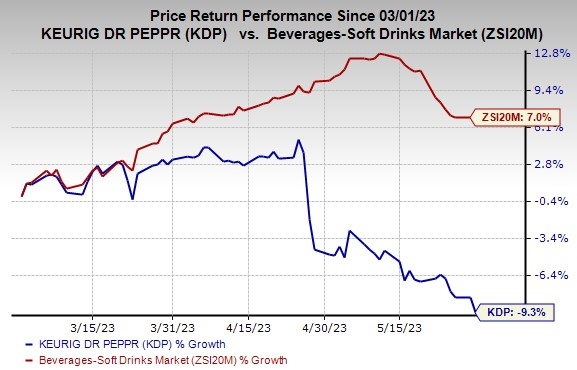

Image Source: Zacks Investment Research

Wrapping Up

This Zacks Rank #3 (Hold) company produced robust first-quarter 2023 results. Net sales of $3,353 million jumped 8.9% from the year-ago quarter and on a constant-currency basis. The upside was driven by net price realization growth of 9.9%. Adjusted earnings of 34 cents per share grew 3% year over year.

Driven by the robust quarterly results, management reaffirmed its view for 2023, which seems encouraging. The company expects sales growth of 5% and adjusted earnings increase of 6-7%.

However, Keurig Dr Pepper has been reeling under significant input cost inflation, rising transportation costs and supply-chain disruptions, which are likely to persist in the near term. These, along with the adverse impacts of higher marketing investment, acted as deterrents. Going ahead, management expects inflation to remain the greatest challenge.

Shares of the company have lost 9.3% in the past three months against the industry’s growth of 7%. The above-mentioned upsides are likely to help get KDP back on track in the near term.

Stocks to Consider

Some top-ranked stocks are Lamb Weston LW, Vital Farms VITL and General Mills GIS.

LW has an expected long-term earnings growth rate of 42.7% and a trailing four-quarter earnings surprise of 47.6%, on average. Lamb Weston currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for LW’s current financial year sales and earnings suggests growth of 29.6% and 116.8%, respectively, from the year-ago reported numbers.

Vital Farms, which provides pasture-raised products, currently carries a Zacks Rank #1. VITL has a trailing four-quarter earnings surprise of 120%, on average.

The Zacks Consensus Estimate for VITL’s current fiscal-year sales and earnings suggests an increase of 27.6% and 1,100%, respectively, from the year-ago reported number.

General Mills is a major designer, marketer and distributor of premium lifestyle products. It currently carries a Zacks Rank of 2 (Buy). GIS has a trailing four-quarter earnings surprise of 8.1%, on average.

The Zacks Consensus Estimate for GIS’ current financial year sales and earnings suggests growth of 6.3% and 7.4%, respectively, from the year-ago reported numbers.

Just Released: Free Report Reveals Little-Known Strategies to Help Profit from the $30 Trillion Metaverse Boom

It's undeniable. The metaverse is gaining steam every day. Just follow the money. Google. Microsoft. Adobe. Nike. Facebook even rebranded itself as Meta because Mark Zuckerberg believes the metaverse is the next iteration of the internet. The inevitable result? Many investors will get rich as the metaverse evolves. What do they know that you don't? They’re aware of the companies best poised to grow as the metaverse does. And in a new FREE report, Zacks is revealing those stocks to you. This week, you can download, The Metaverse - What is it? And How to Profit with These 5 Pioneering Stocks. It reveals specific stocks set to skyrocket as this emerging technology develops and expands. Don't miss your chance to access it for free with no obligation.

>>Show me how I could profit from the metaverse!General Mills, Inc. (GIS) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

Keurig Dr Pepper, Inc (KDP) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.