Sterling Infrastructure, Inc. STRL continues to ride a powerful wave of demand from the data center-construction market, positioning itself as a key beneficiary of the growing investment in mission-critical infrastructure. The company’s strategic focus on large, complex projects spanning data centers, e-commerce distribution and manufacturing facilities has strengthened its role in building the essential backbone of the U.S. economy. With the sector showing no signs of slowing, Sterling appears well placed to sustain its momentum into 2026.

In the third quarter of 2025, Sterling reported an exceptional 125% year-over-year increase in data-center revenues, reflecting the accelerating need for large-scale and technically intensive site development projects. The company noted that project sizes and complexity continue to rise, driven by customer demand for mission-critical facilities and greater underground utility requirements. This shift toward larger, higher-margin projects has also contributed to expanding profitability within its E-Infrastructure Solutions segment.

The company’s backlog growth, fueled by signed and anticipated data center awards, offers strong visibility into 2026 and beyond. With customers planning multi-year capital deployments and new projects emerging across states like Texas, Sterling is deepening its geographic footprint to align with long-term client demand. Reflecting this momentum, the company raised its full-year 2025 guidance, underscoring confidence in sustained growth from data center activity.

While competitive bidding and permitting remain potential hurdles, the expanding project pipeline suggests that Sterling’s data-center growth could well extend into 2026, reinforcing its position as a core player in mission-critical infrastructure development.

Rising Demand for Data Centers Spurs Growth Opportunities

Sterling operates in a competitive landscape that includes major infrastructure and construction firms expanding into mission-critical and data center development. Quanta Services, Inc. PWR stands out as a significant competitor, with strong expertise in electrical infrastructure and large-scale utility projects. Quanta’s expanding role in data center and renewable energy site construction aligns closely with Sterling’s E-Infrastructure focus, creating overlap in customer base and project scope.

Another notable peer is EMCOR Group, Inc. EME, a leading provider of mechanical and electrical construction services. EMCOR’s data center capabilities and nationwide presence give it an edge in serving hyperscale clients and complex mission-critical facilities. While both Quanta and EMCOR benefit from robust demand trends, Sterling’s integrated approach—combining site development and electrical services through its CEC acquisition—offers a distinctive advantage. This synergy strengthens Sterling’s competitive positioning as data center investments continue to expand through 2026.

STRL’s Price Performance, Valuation and Estimates

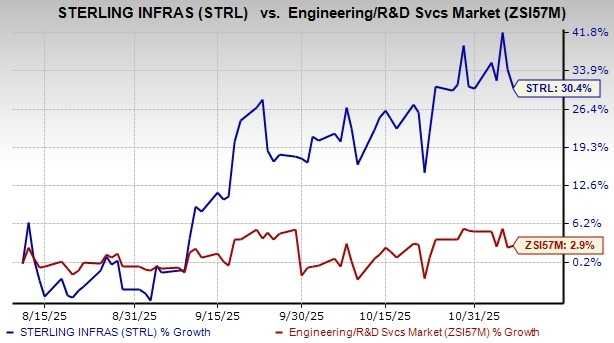

Shares of this Texas-based infrastructure services provider have surged 30.4% in the past three months, outperforming the Zacks Engineering - R and D Services industry’s growth of 2.9%.

Price Performance

Image Source: Zacks Investment Research

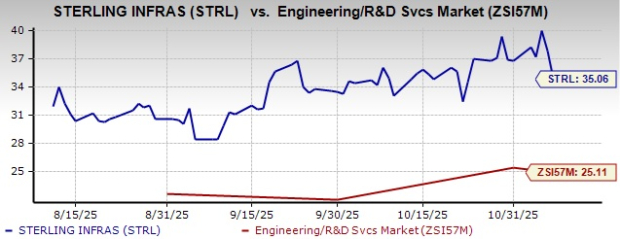

STRL stock is currently trading at a premium compared with its industry peers, with a forward 12-month price-to-earnings (P/E) ratio of 35.06, as shown in the chart below.

P/E (F12M)

Image Source: Zacks Investment Research

For 2025 and 2026, STRL’s earnings estimates have remained unchanged in the past 60 days at $9.57 and $10.98 per share, respectively. The revised estimated figures indicate 56.9% and 14.7% year-over-year growth, respectively.

Image Source: Zacks Investment Research

The company currently sports a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Quanta Services, Inc. (PWR) : Free Stock Analysis Report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.