Super Micro Computer‘s SMCI next-generation server platforms, storage offerings, and direct liquid cooling (DLC) racks are experiencing massive traction as enterprises and hyperscalers scale out, increasing AI deployments and improving time-to-market.

SMCI is capitalizing on this trend by being the first to ship next-generation AI systems, such as the NVIDIA B300 and GB300. SMCI has also expanded its Data Center offerings with the introduction of Data Center Building Block Solutions (DCBBS), which is a modular architecture designed for speedier deployment of AI data center buildouts.

SMCI has also introduced DLC-2, which lowers power and water consumption by up to 40%, operates at significantly reduced noise levels of approximately 50 decibels, and reduces the total cost of ownership by 20%.

Furthermore, SMCI has launched more than 30 new solutions optimized for the latest NVIDIA and AMD architectures. SMCI is well-positioned to benefit from strategic partnerships to build hyperscale AI campuses globally, along with the expectation that more than 30% of global new data center deployments will adopt liquid cooling solutions in the next 12 months.

On the execution front, SMCI is scaling its global manufacturing capacity to meet demand, with a third Silicon Valley campus underway, expansion in Taiwan and the Netherlands, and a new facility in Mexico. SMCI’s 2026 and 2027 revenues are expected to grow at 48% and 15%, respectively, per the Zacks Consensus Estimate.

How Competitors Fare Against SMCI

Super Micro Computer’s next-generation products face intense competition from Hewlett Packard Enterprise HPE and Dell Technologies DELL, which provide solutions like liquid cooling and advanced AI servers.

Hewlett Packard Enterprise entered the AI infrastructure space with a modular, performance-optimized data center solution that offers AI and high-performance computing features and supports its Private Cloud AI. This offers liquid-cooled HPC and AI servers through its HPE Cray and Apollo systems.

Dell offers liquid cooling architectures through its Apex and PowerEdge platforms. Dell has designed its AI server solutions to be custom and modular by adding both air and liquid cooling features with 24-hour rack deployment turnaround and end-to-end deployment services. These key differentiators make its server easy to deploy, hence encouraging smoother adoption.

SMCI’s Price Performance, Valuation and Estimates

Shares of SMCI have gained 50.4% year to date compared with the Zacks Computer- Storage Devices industry’s growth of 36.5%.

Image Source: Zacks Investment Research

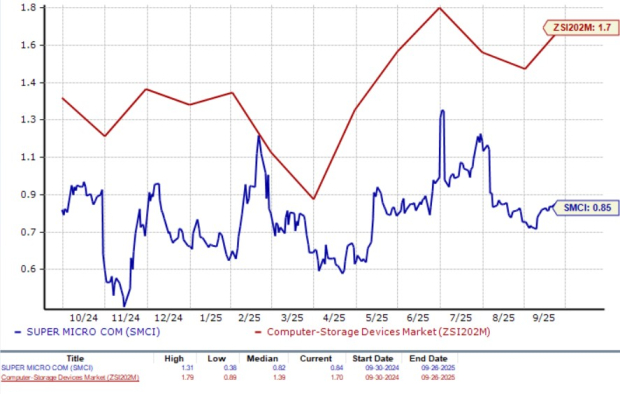

From a valuation standpoint, SMCI trades at a forward price-to-sales ratio of 0.85X, down from the industry’s average of 1.7X.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for SMCI’s fiscal 2025 earnings implies a year-over-year decline of 23%, while the same for fiscal 2026 indicates growth of 29%. The estimates for fiscal 2026 and 2027 have been revised downward in the past 60 days.

Image Source: Zacks Investment Research

SMCI currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.