Qualcomm Incorporated QCOM recently announced the launch of AI200 and AI250 chip-based AI accelerator cards and racks. The leading-edge AI inference optimized solutions for data centers are powered by Qualcomm’s NPU (Neural Processing Unit) technology. Both AI 200 and AI 250 solutions incorporate confidential computing that secures AI workloads, and their direct cooling feature ensures thermal efficiency.

Qualcomm AI250 brings a near-memory computing architecture that delivers 10x effective memory bandwidth while optimizing power consumption. AI200 is a rack-level inference solution optimized for large language models, multimodal model inference and other AI workloads at a lower total cost of ownership.

The AI ecosystem is evolving rapidly. The focus is shifting from training big AI models with a large amount of data to AI inference workloads, that is, actually using the AI models in real time for various tasks. Per a report from Grand View Research, the global AI inference market, which is estimated at $97.24 billion in 2024, is projected to witness a compound annual growth rate of 17.5% from 2025 to 2030. Qualcomm is expanding its portfolio offering to capitalize on this emerging market trend.

Qualcomm’s solutions’ high memory capacity, affordability, exceptional scale and flexibility for AI inference make them ideal for modern AI data center requirements. The newly introduced solution is already gaining solid market traction. HUMAIN, a global artificial intelligence company, has selected Qualcomm’s AI200 and AI250 solutions to deliver high-performance AI inference services in Saudi Arabia and worldwide.

How Are Competitors Faring?

Qualcomm faces competition from NVIDIA Corporation NVDA, Intel Corporation INTC and Advanced Micro Devices AMD. NVIDIA offers a comprehensive portfolio for AI inference infrastructure. The NVIDIA Blackwell, H200, L40S and NVIDIA RTX offers remarkable speed and efficiency in AI inference across cloud, workstations and data centers.

Intel is also expanding its product suite for the AI inference vertical. It recently launched a cutting-edge GPU chip, Crescent Island, optimized for AI inference workloads. Intel's GPU systems have successfully achieved MLPerf v5.1 benchmark requirements, the newest release of an industry-standard AI benchmarking suite.

AMD Instinct MI350 Series GPU, featuring powerful and power-efficient cores, has set a new benchmark in generative AI and high-performance computing in data centers. With NVIDIA’s dominance and AMD’s strong momentum, Intel faces a steep uphill battle in the AI inference domain.

QCOM’s Price Performance, Valuation and Estimates

Qualcomm shares have gained 9.3% over the past year compared with the industry’s growth of 62%.

Image Source: Zacks Investment Research

Going by the price/earnings ratio, the company's shares currently trade at 15.73 forward earnings, lower than 37.93 for the industry.

Image Source: Zacks Investment Research

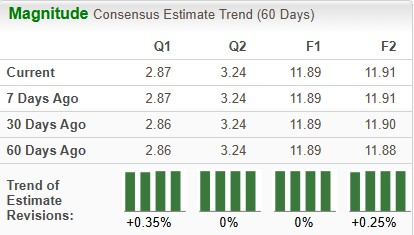

Earnings estimates for 2025 have remained unchanged over the past 60 days, while the same for 2026 have improved 0.25% to $11.91.

Image Source: Zacks Investment Research

Qualcomm stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Quantum Computing Stocks Set To Soar

Artificial intelligence has already reshaped the investment landscape, and its convergence with quantum computing could lead to the most significant wealth-building opportunities of our time.

Today, you have a chance to position your portfolio at the forefront of this technological revolution. In our urgent special report, Beyond AI: The Quantum Leap in Computing Power, you'll discover the little-known stocks we believe will win the quantum computing race and deliver massive gains to early investors.

Access the Report Free Now >>Intel Corporation (INTC) : Free Stock Analysis Report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.