The Home Depot, Inc. HD faces a challenging fourth quarter in fiscal 2025 as year-over-year weather comparisons intensify. Management has acknowledged that third-quarter performance fell short of expectations due to the absence of storm activity, which typically supports demand in categories such as roofing, power generation and plywood. That same dynamic is unlikely to change in the final quarter, as Home Depot laps a prior-year period that benefited from extended storm-driven repair demand. This difficult comparison creates a structural headwind for revenues.

On its lastearnings call management highlighted that October was most impacted by the absence of storms in the third quarter, with comparable sales falling 1.5%. This signals that softness tied to weather effects could persist into the fourth quarter. While demand trends, excluding weather effects, remained relatively consistent with the second quarter, management emphasized that storm-adjusted demand has not improved, citing housing activity at nearly 40-year lows and ongoing consumer uncertainty.

While Home Depot does not plan around storm activity, it has historically benefited from weather-related repair demand. This year, that benefit was largely absent, resulting in a notable year-over-year drag. Management cautioned that fourth-quarter comparisons will be even more challenging than the third quarter, as rebuild activity that supported results last year is absent this time. Reflecting these pressures, Home Depot now expects fiscal 2025 comparable sales to be slightly positive, down from its prior forecast of 1% growth.

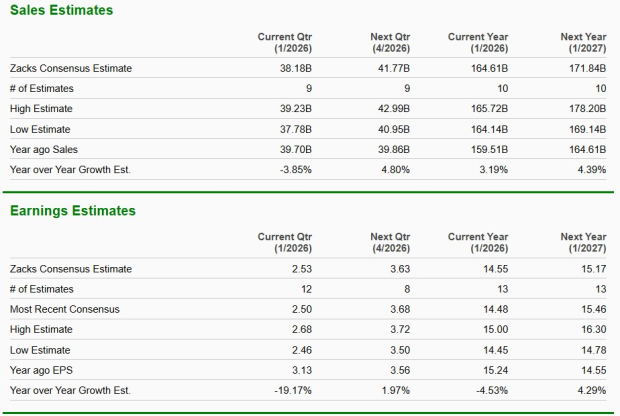

Home Depot cited continued fourth-quarter pressure from the lack of storm activity. As storm-sensitive categories face tougher comparisons, fourth-quarter performance may look weaker on the surface, even if underlying demand trends remain broadly stable. The Zacks Consensus Estimate for fourth-quarter revenues is currently pegged at $38.18 billion, calling for a decline of almost 4% from the year-ago period.

Are FND and LOW Seeing a Structural Demand Reset?

Floor & Decor Holdings, Inc. FND continues to face industry-wide softness, with third-quarter 2025 comparable store sales down 1.2% as transactions remain pressured. Despite better Pro engagement and category innovation, Floor & Decor repeatedly acknowledged that the hard-surface flooring market remains in a trough and that demand recovery is uncertain. This suggests Floor & Decor is navigating similar structural headwinds as Home Depot.

Lowe's Companies, Inc. LOW posted third-quarter fiscal 2025 comparable sales at 0.4% but also cited an anxious consumer and continued pressure on big-ticket discretionary spending. While Pro, appliances and online improved, Lowe's emphasized that affordability constraints and macro uncertainty remain barriers to any broad rebound. Overall, Lowe's also appears constrained by the same structural demand backdrop limiting large-project activity.

What the Latest Metrics Say About Home Depot

Home Depot shares have fallen 12.4% in the past year compared with the industry’s decline of 18.3%.

Image Source: Zacks Investment Research

From a valuation standpoint, Home Depot trades at a forward price-to-earnings ratio of 23.83, higher than the industry’s 21.58. HD carries a Value Score of F.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Home Depot’s current financial-year sales implies year-over-year growth of 3.2%, while the same for earnings per share suggests a decline of 4.5%.

Image Source: Zacks Investment Research

Home Depot currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Lowe's Companies, Inc. (LOW) : Free Stock Analysis Report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

Floor & Decor Holdings, Inc. (FND) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.