Palo Alto Networks PANW is showing robust growth in Secure Access Service Edge (SASE), its cloud-based network security offering. In the third quarter of fiscal 2025, SASE was its fastest-growing business, with the annual recurring revenue (ARR) up 36% from the year-ago quarter, which was more than twice the overall market’s growth.

A big part of that success is Prisma Access Browser, which made up one-third of all Prisma Access seats sold during the quarter. Since the acquisition of Talon 18 months ago, Palo Alto Networks has sold three million license seats, growing more than 10 times from last year. During the last quarterearnings call management stated that it has a healthy nine-figure sales pipeline for this product.

Palo Alto Networks now has approximately 6,000 SASE customers, up 22% year over year. Out of which 40% of new SASE customers were net new to the company during the third quarter. Management noted that many SASE deployments are large and complex, making them well-suited to PANW’s wide product portfolio and enterprise-focused expertise.

As artificial intelligence (AI) drives more applications and data into the cloud, Palo Alto Networks sees the browser becoming the new interface or runtime environment for work. Prisma Access Browser is designed to secure that environment, providing real-time visibility and native controls to protect sensitive data, no matter where the users are or what apps they access.

With AI changing how work is done, Prisma Access Browser could become a big part of Palo Alto Networks’ SASE strategy going forward.

How Competitors Fare Against PANW

Zscaler ZS and Fortinet FTNT are key rivals to Palo Alto Networks in the SASE space.

Zscaler is also expanding into browser-based security. Zscaler offers cloud-native secure access through its ZIA and ZPA platforms. In the third quarter of fiscal 2025, Zscaler saw continued demand from customers replacing legacy VPNs with its zero-trust architecture.

Fortinet is growing fast, driven by the rising adoption of its FortiSASE platform. During the first quarter of 2025, FTNT’s Unified SASE billings grew 18% year over year, accounting for 25% of its business. Fortinet stands out by delivering all core SASE capabilities within a single operating system. Fortinet also offers Sovereign SASE, a tailored solution for large enterprises and service providers that require full on-premises or in-country control of their data.

PANW’s Price Performance, Valuation and Estimates

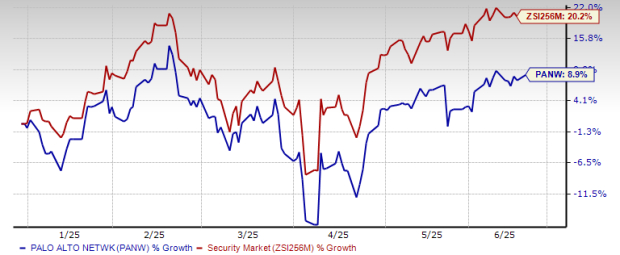

Shares of Palo Alto Networks have gained 8.9% year to date compared with the Security industry’s growth of 20.2%.

PANW YTD Price Return Performance

Image Source: Zacks Investment Research

From a valuation standpoint, Palo Alto Networks trades at a forward price-to-sales ratio of 12.69X, lower than the industry’s average of 14.52X.

PANW Forward 12-Month P/S Ratio

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for PANW’s fiscal 2025 and fiscal 2026 earnings implies year-over-year growth of 15.14% and 11.19%, respectively. The estimates for fiscal 2025 and fiscal 2026 have been revised upward in the past 30 days.

Image Source: Zacks Investment Research

Palo Alto Networks currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.5% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Fortinet, Inc. (FTNT) : Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

Zscaler, Inc. (ZS) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.