Per a Wall Street Journal report, International Business Machines Corporation IBM is aiming to boost its cloud and data-services offerings by acquiring Confluent, Inc. CFLT, a leading data-infrastructure company that specializes in real-time data streaming, for around $11 billion. IBM’s ability to handle real-time data streaming and data infrastructure will be enhanced significantly if the deal is successfully closed.

If the deal materializes, it will help IBM to modernize its streaming data, real-time processing, and cloud-native data services. IBM’s client base is likely to increase as it will offer both traditional enterprise services and real-time data.

IBM is investing heavily in making AI adoptable and scalable for enterprises by launching products like Watsonx, its core platform for enterprise AI. Watsonx helps businesses use powerful foundation models to boost productivity and scale AI safely.

IBM had earlier teamed up with SAP to bring generative AI into the retail and consumer-packaged-goods industries. The goal is to boost productivity and speed up digital transformation for retailers and distributors. Such opportune acquisitions are likely to translate into incremental revenues for the company and boost its market position.

How Are Competitors Faring?

IBM faces competition from Microsoft Corporation MSFT and Amazon.com, Inc. AMZN. Microsoft’s cloud business, Azure, continues to grow rapidly, making it stronger in cloud & AI infrastructure. Microsoft plans to make a huge investment in AI datacenters & infrastructure to expand AI-ready cloud infrastructure globally. Microsoft recently launched a version of Copilot tailored for small and medium-sized businesses to bring AI-powered productivity tools at a cheaper rate.

Amazon has added 3.8 gigawatts of power capacity over the past 12 months, making Amazon Web Services (“AWS”) a rapidly expanding infrastructure. Amazon is also making steady progress in its custom AI hardware through chips like Trainium to train AI models faster and cheaper. Amazon’s new CPUs, Graviton5, updated AI servers Trainium3 UltraServers, and new-generation AI models make it a highly competitive player in the AI world.

IBM’s Price Performance, Valuation & Estimates

IBM shares have gained 33.9% over the past year compared with the industry’s growth of 64.4%.

Image Source: Zacks Investment Research

From a valuation standpoint, IBM trades at a forward price-to-sales ratio of 4.1, below the industry.

Image Source: Zacks Investment Research

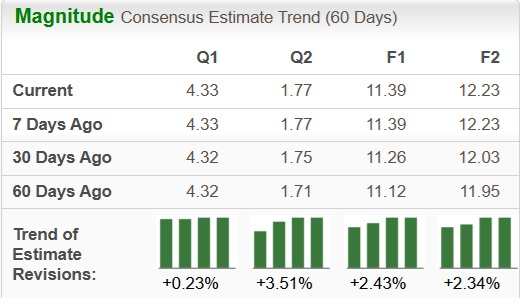

Earnings estimates for 2025 have increased 2.4% to $11.39 over the past 60 days, while the same for 2026 have also increased 2.3% to $12.23.

Image Source: Zacks Investment Research

IBM currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Naming Top 10 Stocks for 2026

Want to be tipped off early to our 10 top picks for the entirety of 2026? History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2026. Don’t miss your chance to get in on these stocks when they’re released on January 5.

Be First to New Top 10 Stocks >>Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

Confluent, Inc. (CFLT) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.